Question: SIMPLE INTEREST - practice problems 1) On July 10, 2005, Wendy Chapman borrowed $12,000 from her Aunt Nelda. If Wendy agreed to pay a 9%

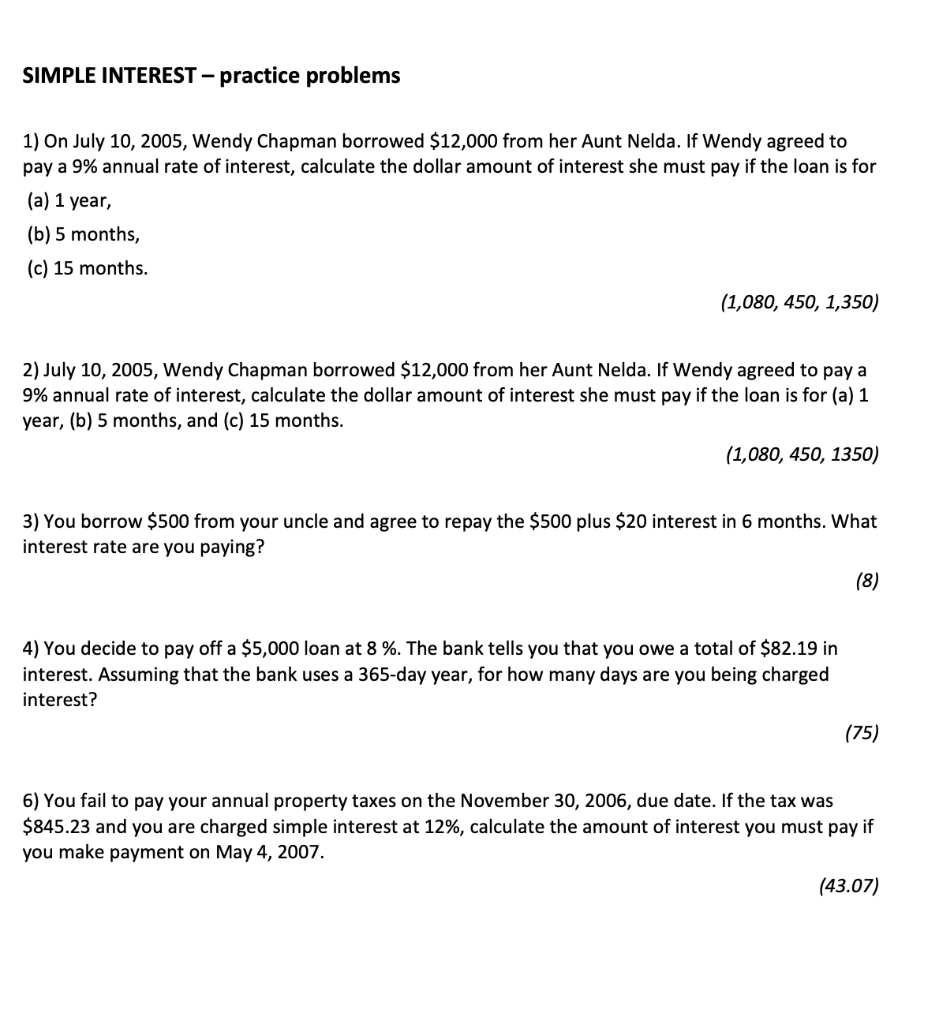

SIMPLE INTEREST - practice problems 1) On July 10, 2005, Wendy Chapman borrowed $12,000 from her Aunt Nelda. If Wendy agreed to pay a 9% annual rate of interest, calculate the dollar amount of interest she must pay if the loan is for (a) 1 year, (b) 5 months, (c) 15 months. (1,080, 450, 1,350) 2) July 10, 2005, Wendy Chapman borrowed $12,000 from her Aunt Nelda. If Wendy agreed to pay a 9% annual rate of interest, calculate the dollar amount of interest she must pay if the loan is for (a) 1 year, (b) 5 months, and (c) 15 months. (1,080, 450, 1350) 3) You borrow $500 from your uncle and agree to repay the $500 plus $20 interest in 6 months. What interest rate are you paying? (8) 4) You decide to pay off a $5,000 loan at 8 %. The bank tells you that you owe a total of $82.19 in interest. Assuming that the bank uses a 365-day year, for how many days are you being charged interest? (75) 6) You fail to pay your annual property taxes on the November 30, 2006, due date. If the tax was $845.23 and you are charged simple interest at 12%, calculate the amount of interest you must pay if you make payment on May 4, 2007. (43.07)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts