Question: simple loans fixed-payment loans coupon bonds present value yield-to-maturity current yield nominal and real interest rates rate of return capital gairn interest-rate and reinvestment risk

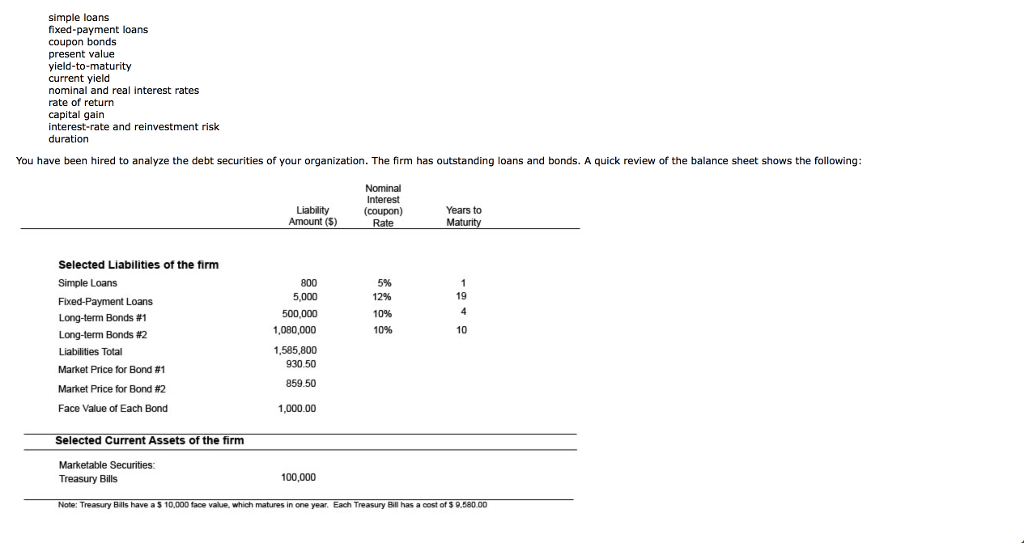

simple loans fixed-payment loans coupon bonds present value yield-to-maturity current yield nominal and real interest rates rate of return capital gairn interest-rate and reinvestment risk duration You have been hired to analyze the debt securities of your organization. The firm has outstanding loans and bonds. A quick review of the balance sheet shows the following Nominal ity (coupon) Years to Maturity Amount (S)Rate Selected Liabilities of the firm Simple Loans Fixed-Payment Loans Long-term Bonds #1 Long-term Bonds #2 Liabilities Total Market Price for Bond #1 Market Price for Bond #2 Face Value of Each Bond 5,000 500,000 ,080,000 1,585,800 930 50 859.50 10% 1,000.00 Selected Current Assets of the firm Marketable Securities: Treasury Bills 100,000 Note: Treasury Bils have a S 10,000 tace value. which matures in one year Bill has a cost of $ 9 580.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts