Question: Simple MCQs from the Intermediate Financial Management course. Please solve it ASAP!!! QUESTION 2 A bond/warrant package is priced to sell at a face value

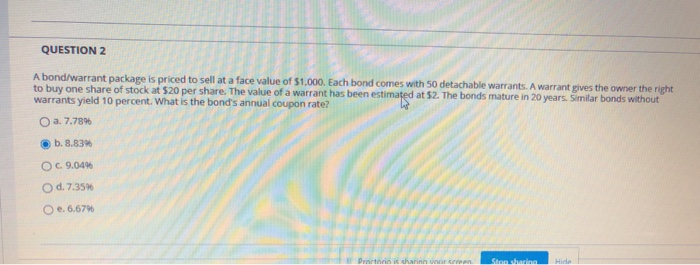

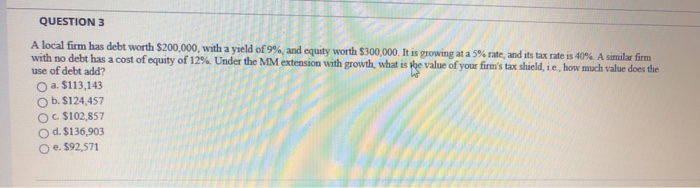

QUESTION 2 A bond/warrant package is priced to sell at a face value of $1,000. Each bond comes with 50 detachable warrants. A warrant gives the owner the right to buy one share of stock at $20 per share. The value of a warrant has been estimated at 52. The bonds mature in 20 years. Similar bonds without warrants yield 10 percent. What is the bond's annual coupon rate? O a. 7.78% b. 8.83% O c. 9.049 O d. 7.35% O e. 6.67% | | | | | Ston sbation Hirde QUESTION 3 A local firm has debt worth $200,000, with a yield of 9%, and equity worth $300,000. It is growing at a 5% rate, and its tax rate is 40%. A similar firm with no debt has a cost of equity of 12%. Under the MM extension with growth, what is the value of your firm's tax shield, i.e. how much value does the use of debt add? O a. $113,143 b. $124,457 O c $102,857 d. $136.903 O e. $92,571

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts