Question: Simple multiple choice finance, please answer! thank you! create and income statement and a balance sheet. Assume that the income tax rate for Peter's cookies

Simple multiple choice finance, please answer! thank you!

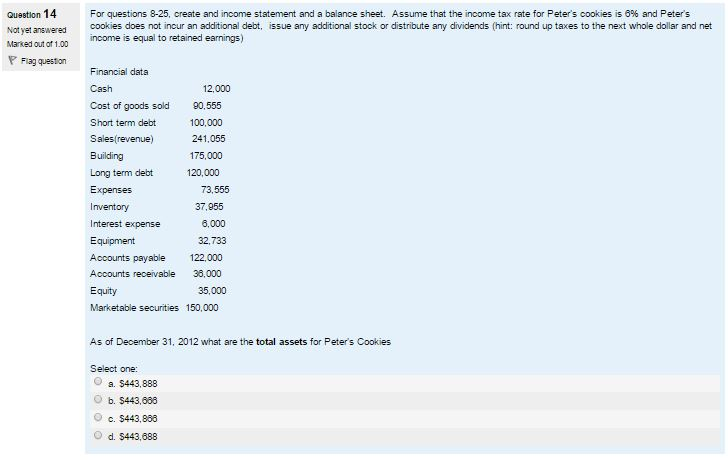

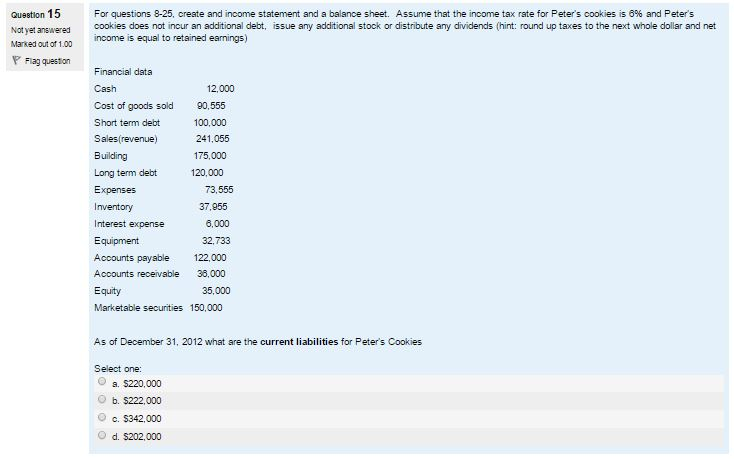

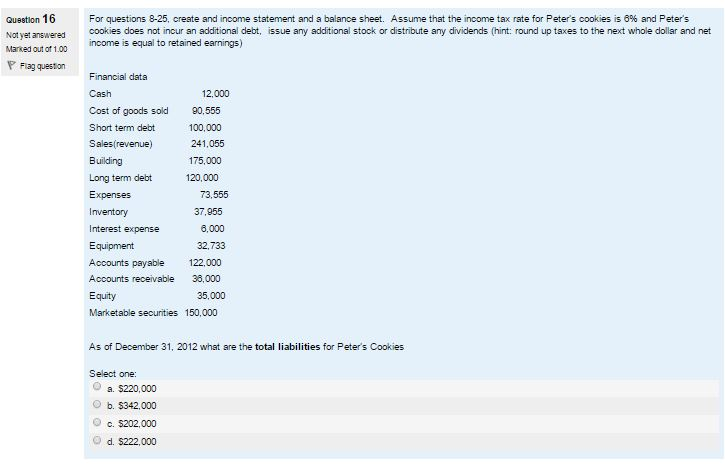

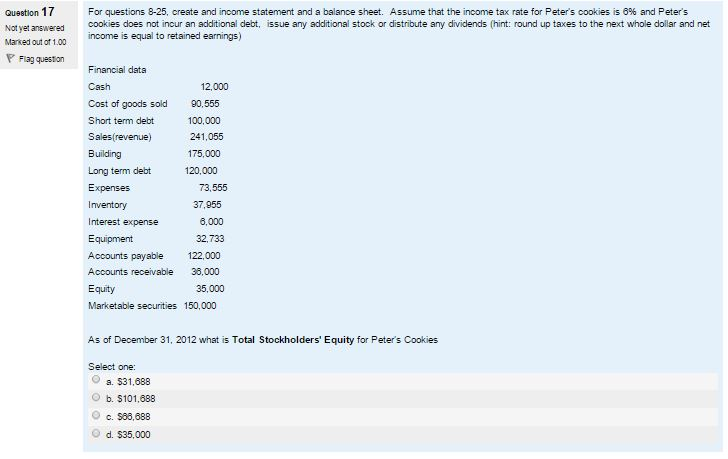

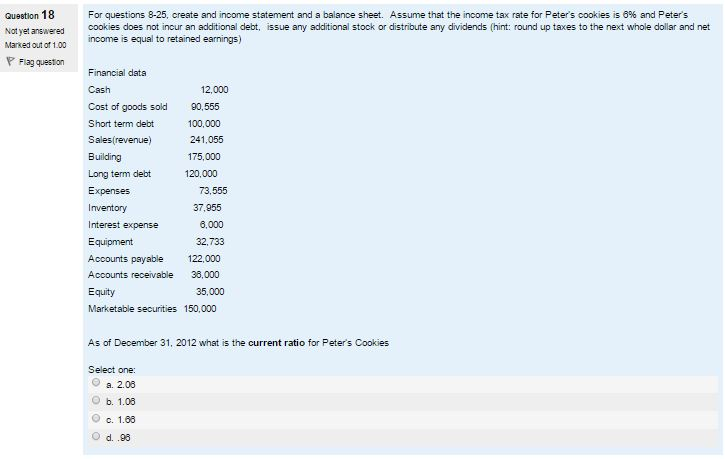

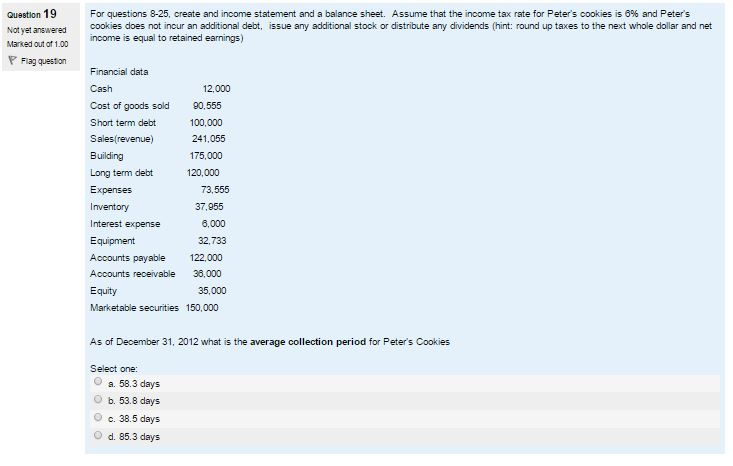

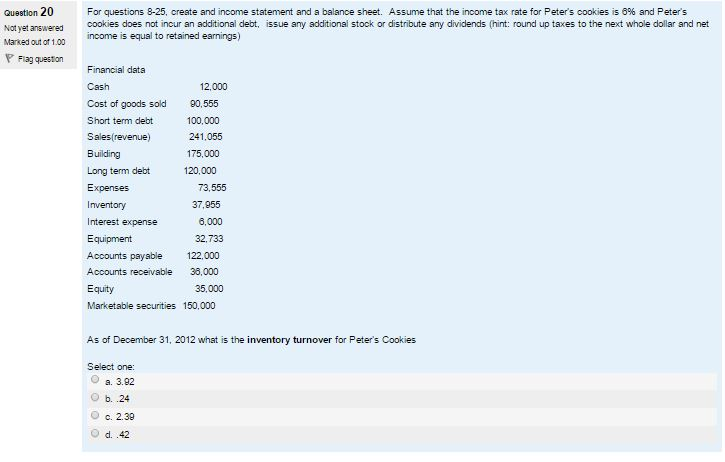

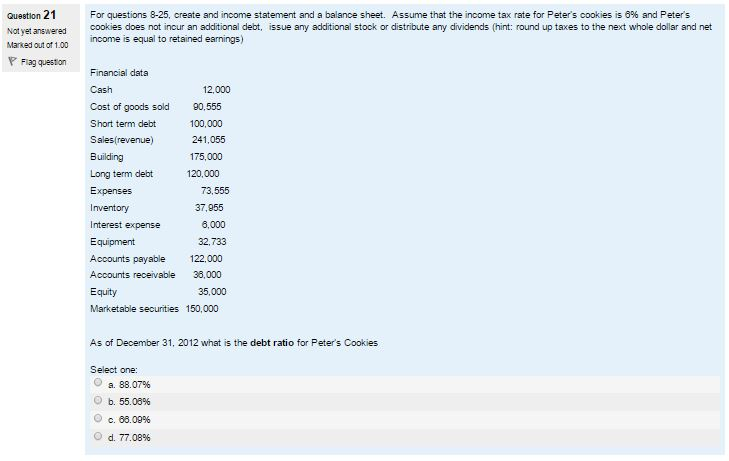

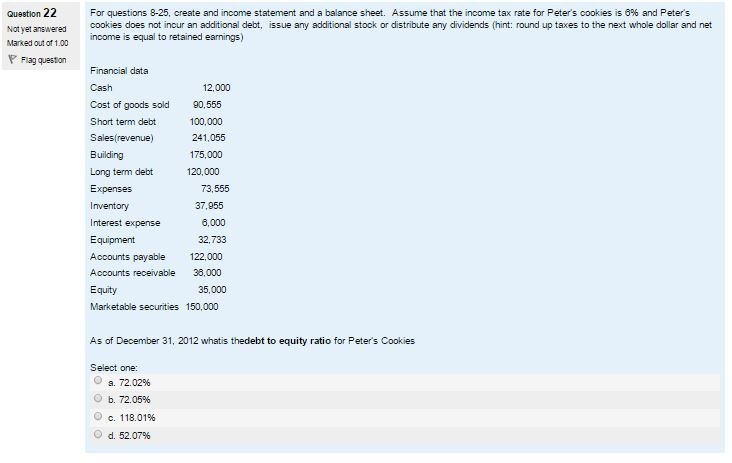

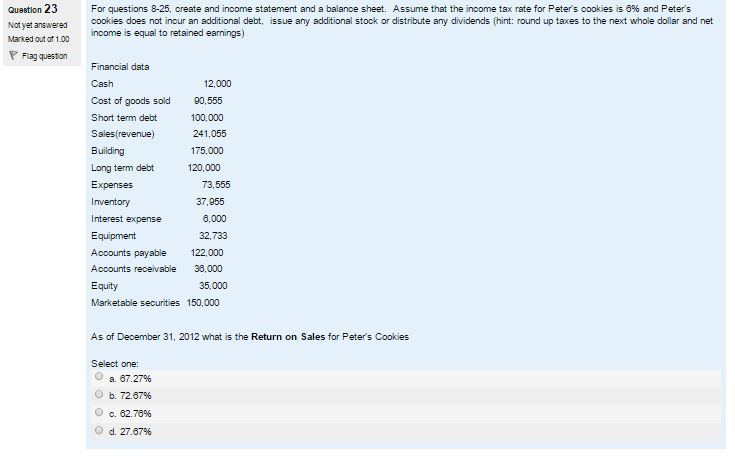

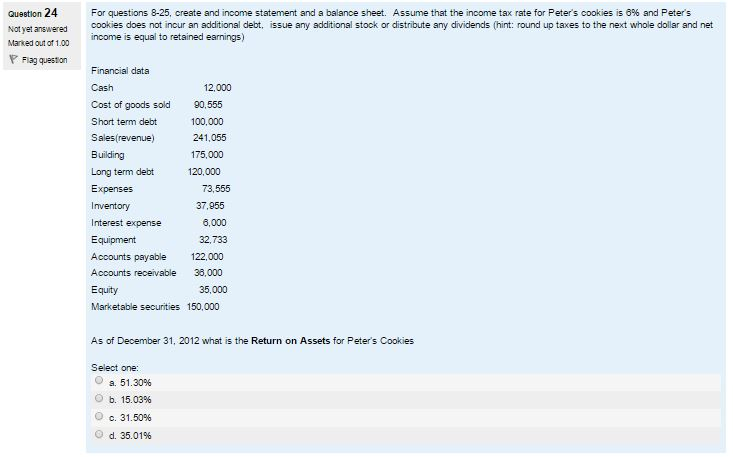

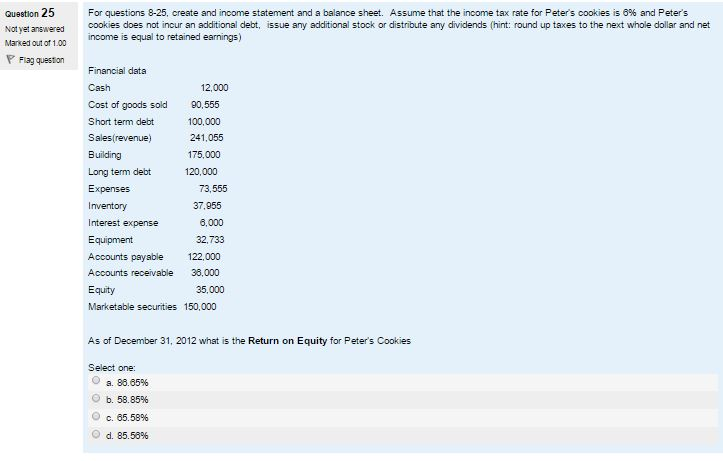

create and income statement and a balance sheet. Assume that the income tax rate for Peter's cookies is 9% and Peter s cookies does not incur an additional debt, issue any additional stock or distribute any dividends As of December 31, 2012 what are the total assets for Pete's Cookies create and income statement and a balance sheet. Assume that the income tax rate for Peter's cookies is 6% and Peter s cookies does not incur an additional debt, issue any additional stock or distribute any dividends As of December 31, 2012 what are the current liabilities for Peter's Cookies create and income statement and a balance sheet. Assume that the income tax rate for Peter's cookies is 6% and Peter's cookies does not incur an additional debt, issue any additional stock or distribute any dividends As of December 31, 2012 what are the total liabilities for Peter s Cookies create and income statement and a balance sheet. Assume that the income tax rate for Peter's cookies is 6% and Peter's cookies does not incur an additional debt, issue any additional stock or distribute any dividends As of December 31, 2012 what is Total Stockholders' Equity for Peter's Cookies create and income statement and a balance sheet. Assume that the income tax rate for Peter's cookies is 6% and Peter's cookies does not incur an additional debt, issue any additional stock or distribute any dividends As of December 31, 2012 what is the current ratio for Peter's Cookies create and income statement and a balance sheet. Assume that the income tax rate for Peter's cookies is 9% and Peter s cookies does not incur an additional debt, issue any additional stock or distribute any dividends As of December 31, 2012 what is the average collection period for Peter's Cookies

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts