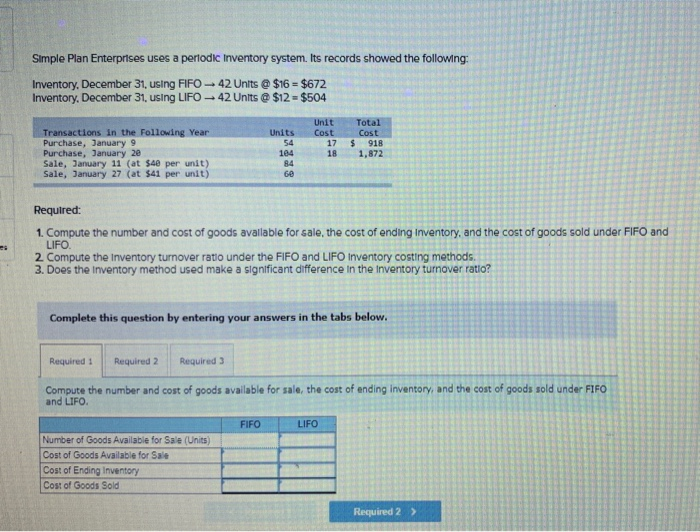

Question: Simple Plan Enterprises uses a periodic inventory system. Its records show the following: Inventory, December 31, using FIFO > 42 Units @ $16 = $672

Simple Plan Enterprises uses a periodic Inventory system. Its records showed the following: Inventory, December 31, using FIFO - 42 Units @ $16 = $672 Inventory, December 31, using LIFO - 42 Units @ $12 = $504 Transactions in the following Year Purchase, January 9 Purchase, January 20 Sale, January 11 (at $4e per unit) Sale, January 27 (at $41 per unit) Units 54 104 84 60 Unit Cost 17 18 Total Cost $ 918 1,872 and Required: 1. Compute the number and cost of goods available for sale, the cost of ending Inventory, and the cost of goods sold under FIF LIFO. 2 Compute the inventory turnover ratio under the FIFO and LIFO inventory costing methods. 3. Does the inventory method used make a significant difference in the Inventory turnover ratio? Complete this question by entering your answers in the tabs below. Required: Required 2 Required 3 Compute the number and cost of goods available for sale, the cost of ending inventory, and the cost of goods sold under FIFO and LIFO. FIFO LIFO Number of Goods Available for Sale (Units) Cost of Goods Available for Sale Cost of Ending Inventory Cost of Goods Sold Required 2 >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts