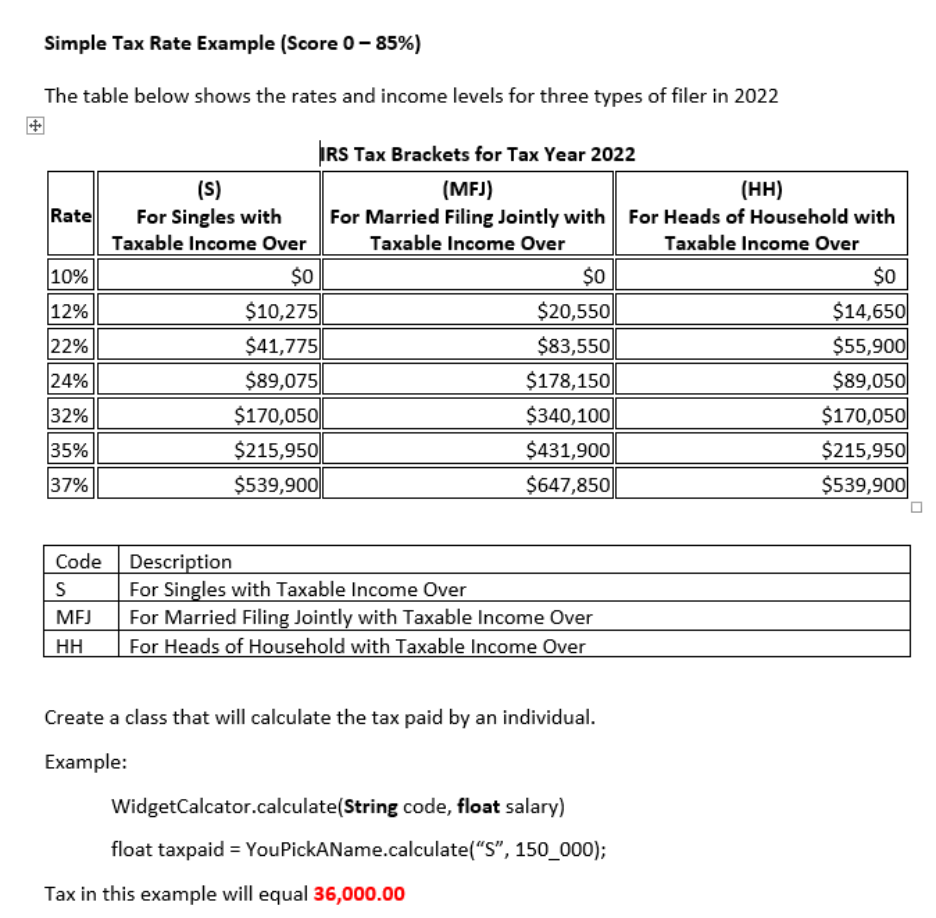

Question: Simple Tax Rate Example (Score 0-85%) The table below shows the rates and income levels for three types of filer in 2022 Create a class

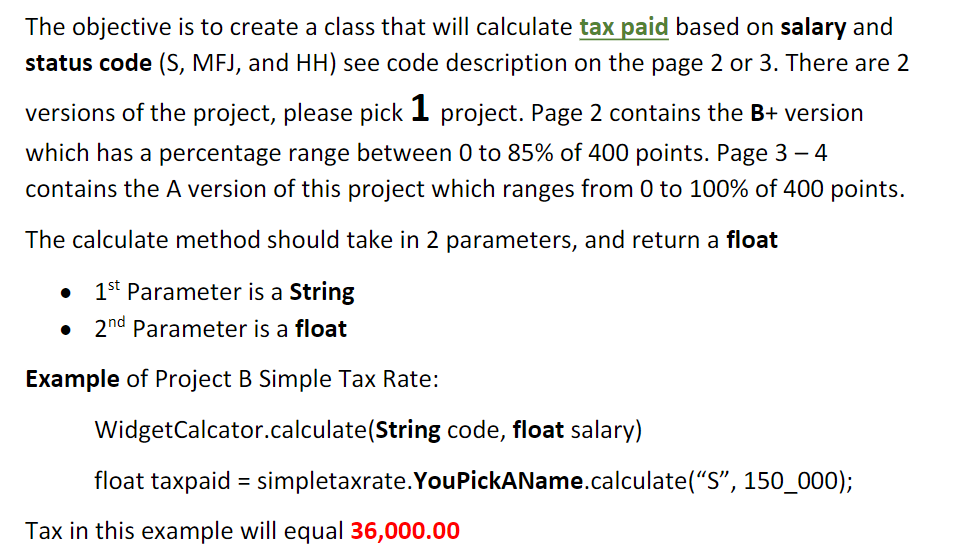

Simple Tax Rate Example (Score 0-85\%) The table below shows the rates and income levels for three types of filer in 2022 Create a class that will calculate the tax paid by an individual. Example: WidgetCalcator.calculate(String code, float salary) float taxpaid = YouPickAName.calculate (S,150_000); The objective is to create a class that will calculate tax paid based on salary and status code (S, MFJ, and HH ) see code description on the page 2 or 3 . There are 2 versions of the project, please pick 1 project. Page 2 contains the B+ version which has a percentage range between 0 to 85% of 400 points. Page 34 contains the A version of this project which ranges from 0 to 100% of 400 points. The calculate method should take in 2 parameters, and return a float - 1st Parameter is a String - 2nd Parameter is a float Example of Project B Simple Tax Rate: WidgetCalcator.calculate(String code, float salary) float taxpaid = simpletaxrate.YouPickAName.calculate( "S", 150_000); Tax in this example will equal 36,000.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts