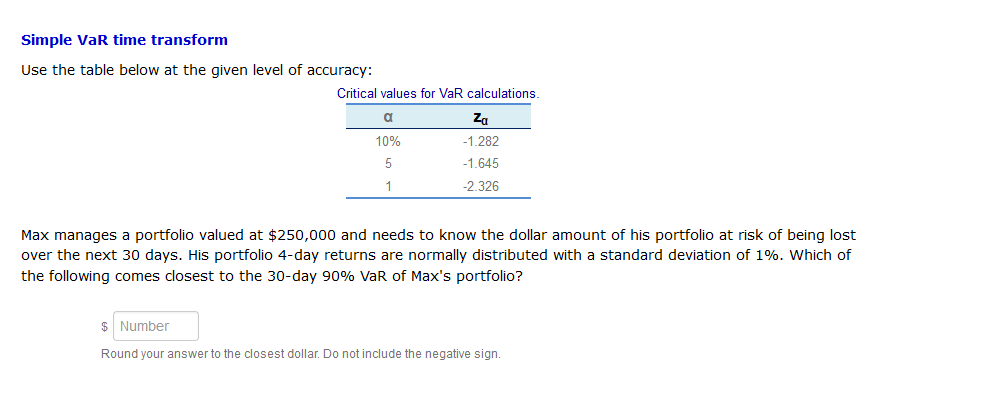

Question: Simple VaR time transform Use the table below at the given level of accuracy: Critical values for VaR calculations. Max manages a portfolio valued at

Simple VaR time transform Use the table below at the given level of accuracy: Critical values for VaR calculations. Max manages a portfolio valued at $250,000 and needs to know the dollar amount of his portfolio at risk of being lost over the next 30 days. His portfolio 4-day returns are normally distributed with a standard deviation of 1%. Which of the following comes closest to the 30 -day 90% VaR of Max's portfolio? $ Round your answer to the closest dollar. Do not include the negative sign

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts