Question: Simran Tea Sanctuary (STS) is a local cafe chain in Vancouver, British Columbia, founded by Victor and Lucie Stone. STS's reputation was built around the

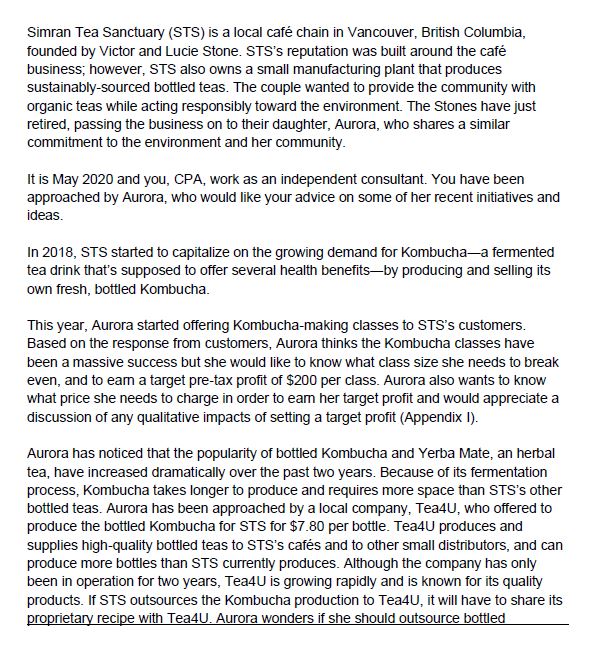

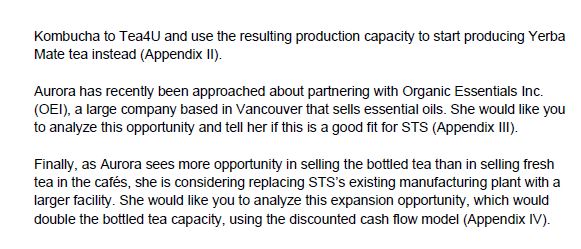

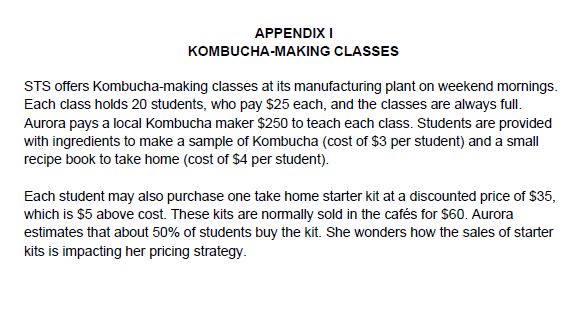

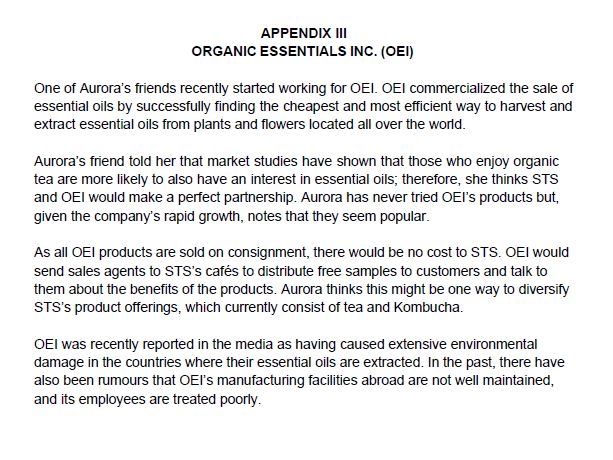

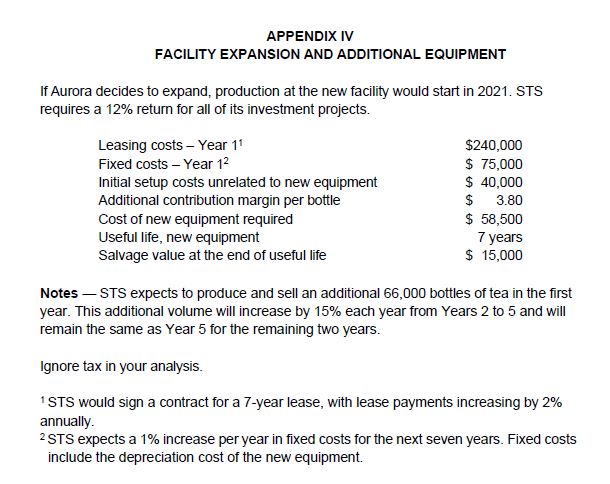

Simran Tea Sanctuary (STS) is a local cafe chain in Vancouver, British Columbia, founded by Victor and Lucie Stone. STS's reputation was built around the cafe business; however, STS also owns a small manufacturing plant that produces sustainably-sourced bottled teas. The couple wanted to provide the community with organic teas while acting responsibly toward the environment. The Stones have just retired, passing the business on to their daughter, Aurora, who shares a similar commitment to the environment and her community. It is May 2020 and you, CPA, work as an independent consultant. You have been approached by Aurora, who would like your advice on some of her recent initiatives and ideas. In 2018, STS started to capitalize on the growing demand for Kombucha-a fermented tea drink that's supposed to offer several health benefits-by producing and selling its own fresh, bottled Kombucha. This year, Aurora started offering Kombucha-making classes to STS's customers. Based on the response from customers, Aurora thinks the Kombucha classes have been a massive success but she would like to know what class size she needs to break even, and to earn a target pre-tax profit of $200 per class. Aurora also wants to know what price she needs to charge in order to earn her target profit and would appreciate a discussion of any qualitative impacts of setting a target profit (Appendix I). Aurora has noticed that the popularity of bottled Kombucha and Yerba Mate, an herbal tea, have increased dramatically over the past two years. Because of its fermentation process, Kombucha takes longer to produce and requires more space than STS's other bottled teas. Aurora has been approached by a local company, Tea4U, who offered to produce the bottled Kombucha for STS for $7.80 per bottle. Tea4U produces and supplies high-quality bottled teas to STS's cafes and to other small distributors, and can produce more bottles than STS currently produces. Although the company has only been in operation for two years, Tea4U is growing rapidly and is known for its quality products. If STS outsources the Kombucha production to Tea4U, it will have to share its proprietary recipe with Tea4U. Aurora wonders if she should outsource bottledKombucha to TeadLI and use the resulting production capacity to start producing Yerba Mate tea instead (Appendix II}. Aurora has recently been approached about partnering with Drganic Essentials Inc. (OElt, a large company based in Vancouver that sells essential oils. She would lilte you to analyze this opportunity and teii her if this is a good t for em {Appendix III}. Finally, as Aurora sees more opportunity in selling the botlled tea than in selling fresh tea in the cafes, she is considering replacing STS's existing manufacturing plant with a larger facility. She would lilte you to analyze this expansion opportunity, which would double the bottled tea capacity, using the discounted cash ow model (Appendix l'y']. APPENDIX I KOMBUCHA-MAKING CLASSES STS offers Kombucha-making classes at its manufacturing plant on weekend mornings. Each class holds 20 students, who pay $25 each, and the classes are always full. Aurora pays a local Kombucha maker $250 to teach each class. Students are provided with ingredients to make a sample of Kombucha (cost of $3 per student) and a small recipe book to take home (cost of $4 per student) Each student may also purchase one take home starter kit at a discounted price of $35, which is $5 above cost. These kits are normally sold in the cafes for $60. Aurora estimates that about 50% of students buy the kit. She wonders how the sales of starter kits is impacting her pricing strategy.\fAPPENDIX ||| ORGANIC ESSENTIALS INC. [DEI] One of Aurora's fn'ends recently started working for DE. DE commercialized the sale of essential oils by successfully nding the cheapest and most efcient way to harvest and extract essential oils from plants and flowers located all over the world. Aurora's friend told her that market studies have shown that these who enjoy organic tea are more likely to also have an interest in essential oils; therefore she thinks 3T8 and [El would make a perfect partnership. Aurora has never tried GEt's products but given the company's rapid growth, notes that they seem popular. As all OEI products are sold on consignment, there would be no cost to STS. DEI would send sales agents to STS's cafes to distribute free samples to customers and talk to them about the benets of the products. Aurora thinks this might be one way to diversify STS's product offerings, which currently consist of tea and kombucha. OEI was recently reported in the media as having caused extensive environmental damage in the countries where their essential oils are extracted. in the past, there have also been rumours that lDEl's manufactun'ng facilities abroad are not well maintained, and its employees are treated poorly. APPENDIX I'v" FAIIIILIT'lIr EXPANSION AND ADDITIONAL EQUIPMENT If Aurora decides to expand, production at the new facility would start in 2D21. STE requires a 12% return for all of its investment projects. Leasing costs Year 11 $24011!) Fixed costs Year 12 $ Elf-DUE] Initial setup costs unrelated to new equipment $ dtltlti Additional contnoution margin per bottle $ 3.30 lCost of new equipment required $ 58,500 Useful life, new equipment Tl years Salvage value at the end of useful life $ 151130 Notes STE expects to produce and sell an additional ss,ooo bottles of tea in the rst year. This additional volume will increase by 15% each year from Years 2 to 5 and will remain the same as \"fear 5 for the remaining hvo years. Ignore tax in your analysis. 'STS would sign a contract for a ?year lease, with lease payments increasing by 2% annually. 2 STS expects a 1% increase per year in xed costs for the next seven years. Fixed costs include the depreciation cost of the new equipment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts