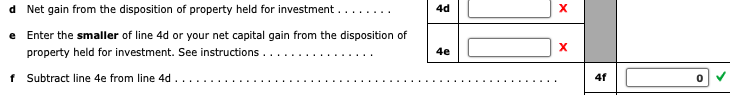

Question: Since 4f is 0, 4d = 4e. What is the net gain from the disposition of property held for investment? Helen Derby borrowed $150,000 to

Since 4f is 0, 4d = 4e. What is the net gain from the disposition of property held for investment?

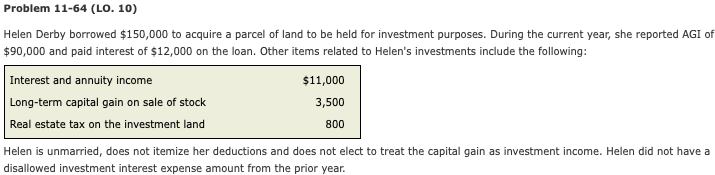

Helen Derby borrowed $150,000 to acquire a parcel of land to be held for investment purposes. During the current year, she reported AGI of $90,000 and paid interest of $12,000 on the loan. Other items related to Helen's investments include the following: Helen is unmarried, does not itemize her deductions and does not elect to treat the capital gain as investment income. Helen did not have a disallowed investment interest expense amount from the prior year. d Net gain from the disposition of property held for investment e Enter the smaller of line 4d or your net capital gain from the disposition of property held for investment. See instructions f Subtract line 4 e from line 4d. Helen Derby borrowed $150,000 to acquire a parcel of land to be held for investment purposes. During the current year, she reported AGI of $90,000 and paid interest of $12,000 on the loan. Other items related to Helen's investments include the following: Helen is unmarried, does not itemize her deductions and does not elect to treat the capital gain as investment income. Helen did not have a disallowed investment interest expense amount from the prior year. d Net gain from the disposition of property held for investment e Enter the smaller of line 4d or your net capital gain from the disposition of property held for investment. See instructions f Subtract line 4 e from line 4d

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts