Question: Since monetary policy changes through the fed funds rate occur with a lag, policymakers are usually more concerned with adjusting policy according to changes in

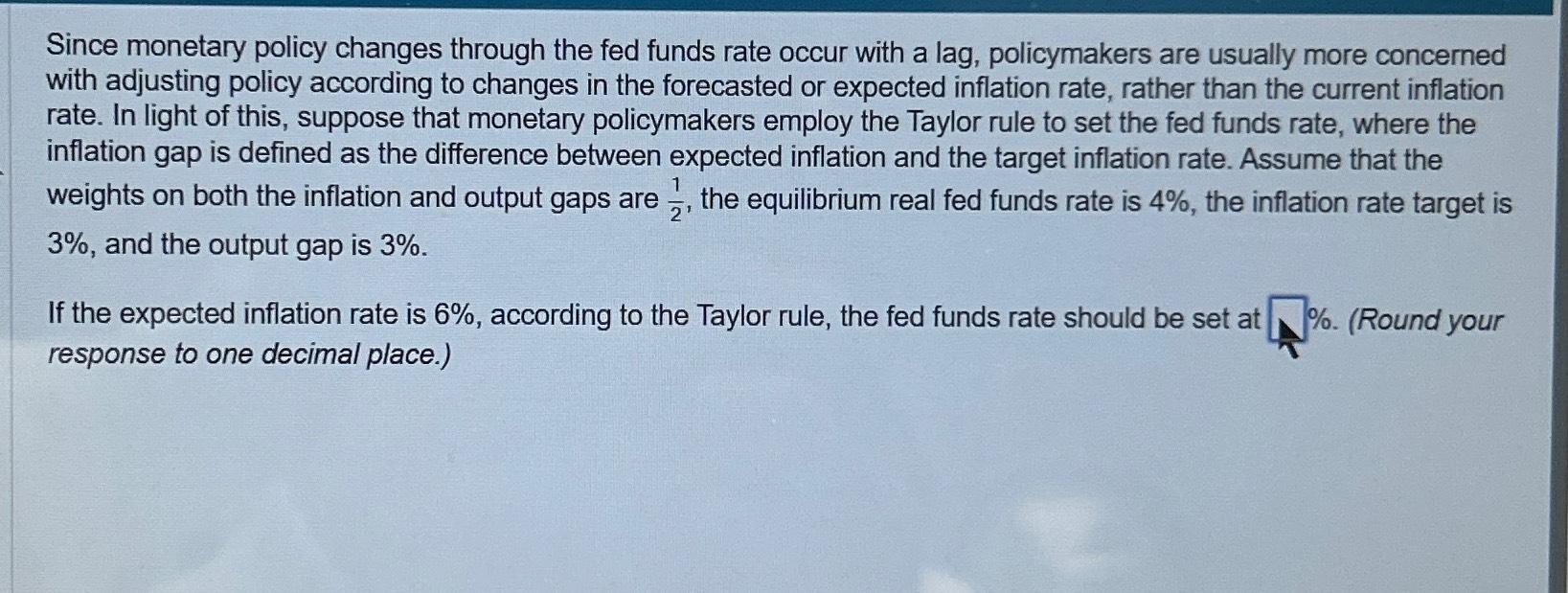

Since monetary policy changes through the fed funds rate occur with a lag, policymakers are usually more concerned with adjusting policy according to changes in the forecasted or expected inflation rate, rather than the current inflation rate. In light of this, suppose that monetary policymakers employ the Taylor rule to set the fed funds rate, where the inflation gap is defined as the difference between expected inflation and the target inflation rate. Assume that the weights on both the inflation and output gaps are the equilibrium real fed funds rate is the inflation rate target is and the output gap is

If the expected inflation rate is according to the Taylor rule, the fed funds rate should be set at Round your response to one decimal place.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock