Question: Since the bad debt expense is based off the estimation provided at the start of the year, why does the September 29th write off not

Since the bad debt expense is based off the estimation provided at the start of the year, why does the September 29th write off not have an impact on the Bad Debt expense? This is a question in response to the answer to the question shown below.

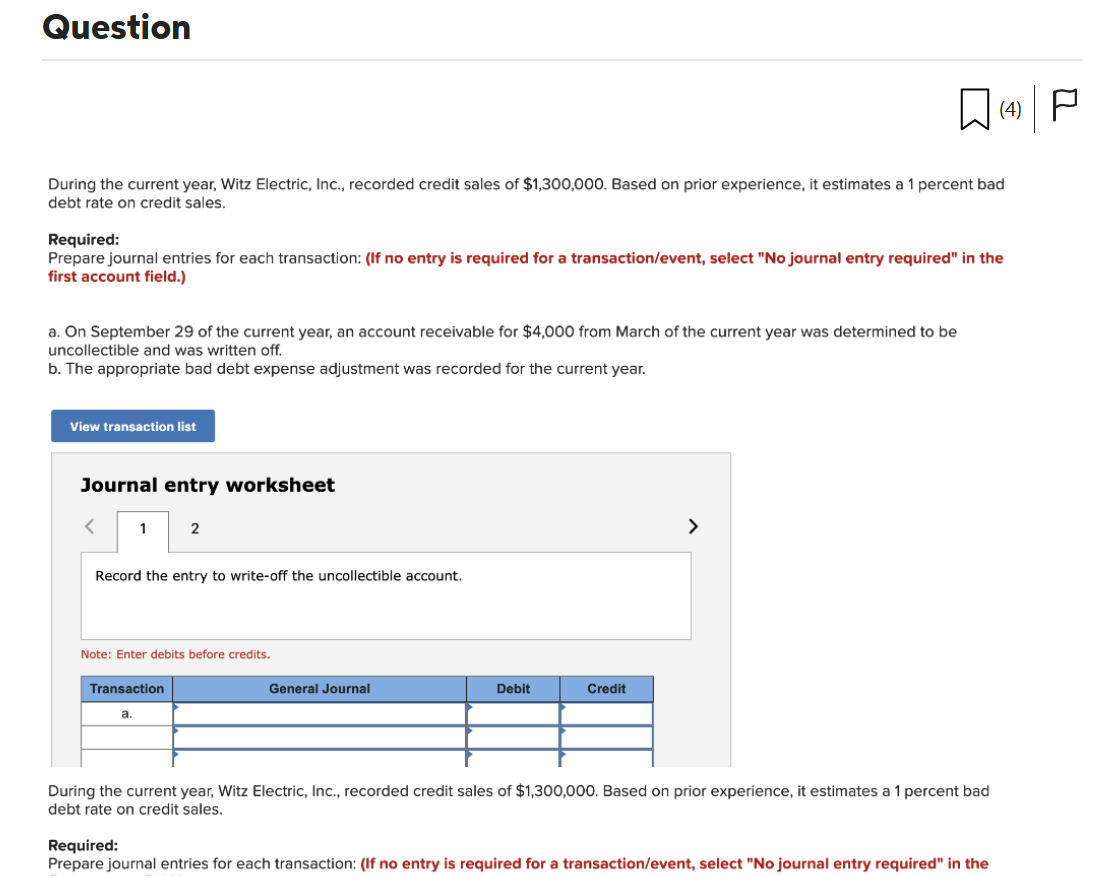

During the current year, Witz Electric, Inc., recorded credit sales of $1,300,000. Based on prior experience, it estimates a 1 percent bad debt rate on credit sales. Required: Prepare journal entries for each transaction: (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) a. On September 29 of the current year, an account receivable for $4,000 from March of the current year was determined to be uncollectible and was written off. b. The appropriate bad debt expense adjustment was recorded for the current year. During the current year, Witz Electric, Inc., recorded credit sales of $1,300,000. Based on prior experience, it estimates a 1 percent bad debt rate on credit sales. Required: Prepare journal entries for each transaction: (If no entry is required for a transaction/event, select "No journal entry required" in the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts