Question: Since the SUTA rates changes are made at the end of each year, the available 2019 rates were used for FUTA and SUTA. Note: For

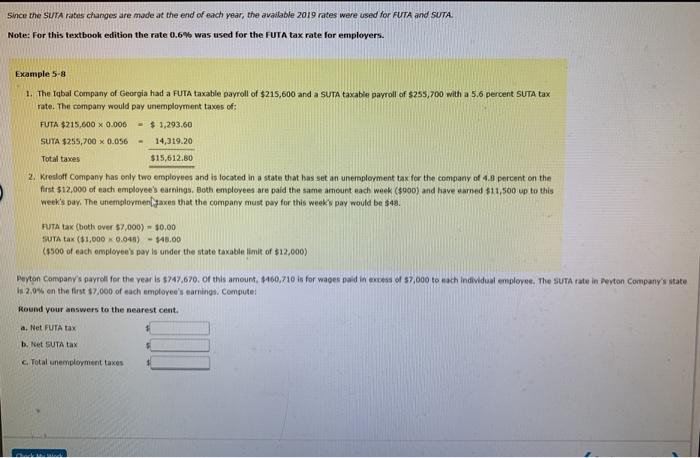

Since the SUTA rates changes are made at the end of each year, the available 2019 rates were used for FUTA and SUTA. Note: For this textbook edition the rate 0.6% was used for the FUTA tax rate for employers. Example 5-8 -- 1. The Tabal Company of Georgia had a FUTA taxable payroll of $215,600 and a SUTA taxable payroll of $255,700 with a 5.6 percent SUTA tax rate. The company would pay unemployment taxes of: FUTA $215,600 X 0.006 - $ 1,293.60 SUTA $255,700 x 0.056 14,319.20 Total taxes $15,612.50 2. Kresloff Company has only two employees and is located in a state that has set an unemployment tax for the company of 4.8 percent on the first $12,000 of each employee's earnings. Both employees are paid the same amount each week ($900) and have earned $11,500 up to this week's pay. The unemploymensaxes that the company must pay for this week's pay would be $48. FUTA (both over $7,000) 10,00 SUTA tax ($1,000 0.045) - 18.00 ($500 of each employee's pay is under the state taxable limit of $12,000) Peyton Companye payroll for the vear is $747.670. of this amount, 8100,710 in for waes paid in excess of $7,000 to each individual employee, The SUTA rate in Perton Company's state is 2.0% on the first $7,000 of each employee's caming Compute: Round your answers to the nearest cent. a. Net FUTA tax b. Net SUTA tax Total unemployment taxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts