Question: Since this is a whole question, please try to answer everything. If not please answer part E and F Consider the four bonds in the

Since this is a whole question, please try to answer everything. If not please answer part E and F

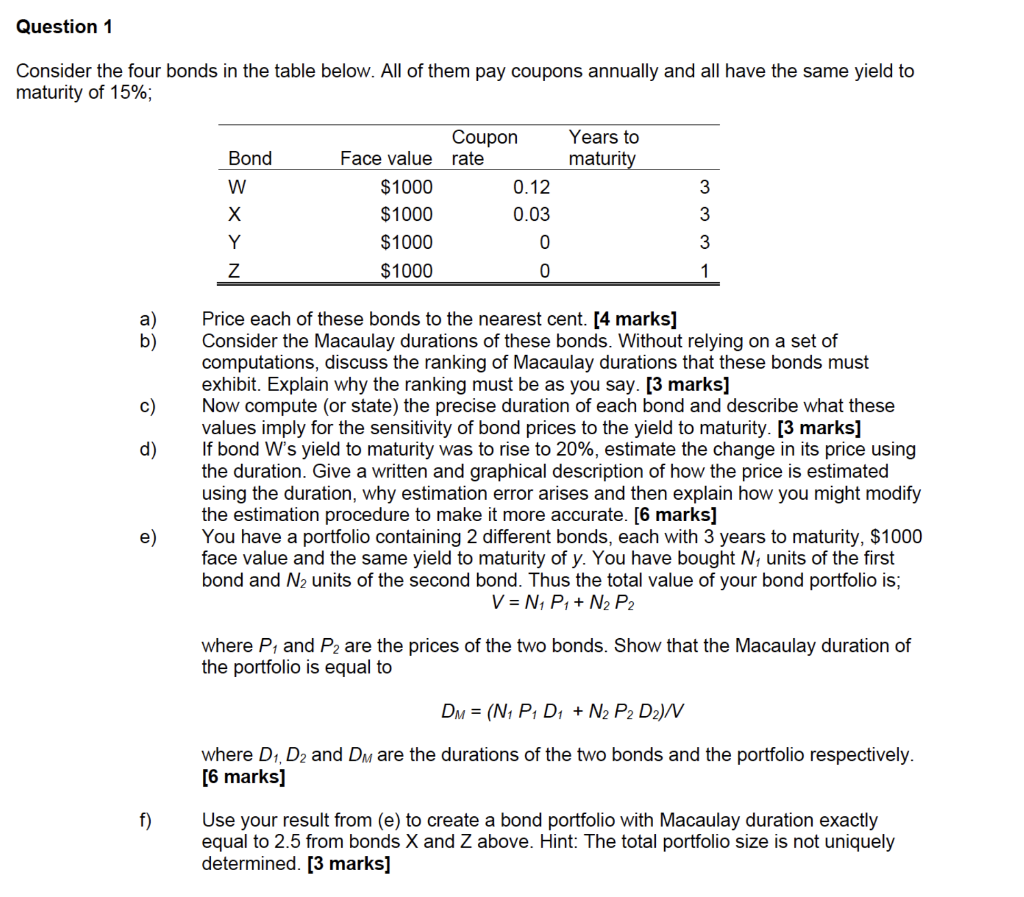

Consider the four bonds in the table below. All of them pay coupons annually and all have the same yield to maturity of 15%; a) Price each of these bonds to the nearest cent. [4 marks] b) Consider the Macaulay durations of these bonds. Without relying on a set of computations, discuss the ranking of Macaulay durations that these bonds must exhibit. Explain why the ranking must be as you say. [3 marks] c) Now compute (or state) the precise duration of each bond and describe what these values imply for the sensitivity of bond prices to the yield to maturity. [3 marks] d) If bond W's yield to maturity was to rise to 20%, estimate the change in its price using the duration. Give a written and graphical description of how the price is estimated using the duration, why estimation error arises and then explain how you might modify the estimation procedure to make it more accurate. [6 marks] e) You have a portfolio containing 2 different bonds, each with 3 years to maturity, $1000 face value and the same yield to maturity of y. You have bought N1 units of the first bond and N2 units of the second bond. Thus the total value of your bond portfolio is; V=N1P1+N2P2 where P1 and P2 are the prices of the two bonds. Show that the Macaulay duration of the portfolio is equal to DM=(N1P1D1+N2P2D2)N where D1,D2 and DM are the durations of the two bonds and the portfolio respectively. [6 marks] f) Use your result from (e) to create a bond portfolio with Macaulay duration exactly equal to 2.5 from bonds X and Z above. Hint: The total portfolio size is not uniquely determined. [3 marks] Consider the four bonds in the table below. All of them pay coupons annually and all have the same yield to maturity of 15%; a) Price each of these bonds to the nearest cent. [4 marks] b) Consider the Macaulay durations of these bonds. Without relying on a set of computations, discuss the ranking of Macaulay durations that these bonds must exhibit. Explain why the ranking must be as you say. [3 marks] c) Now compute (or state) the precise duration of each bond and describe what these values imply for the sensitivity of bond prices to the yield to maturity. [3 marks] d) If bond W's yield to maturity was to rise to 20%, estimate the change in its price using the duration. Give a written and graphical description of how the price is estimated using the duration, why estimation error arises and then explain how you might modify the estimation procedure to make it more accurate. [6 marks] e) You have a portfolio containing 2 different bonds, each with 3 years to maturity, $1000 face value and the same yield to maturity of y. You have bought N1 units of the first bond and N2 units of the second bond. Thus the total value of your bond portfolio is; V=N1P1+N2P2 where P1 and P2 are the prices of the two bonds. Show that the Macaulay duration of the portfolio is equal to DM=(N1P1D1+N2P2D2)N where D1,D2 and DM are the durations of the two bonds and the portfolio respectively. [6 marks] f) Use your result from (e) to create a bond portfolio with Macaulay duration exactly equal to 2.5 from bonds X and Z above. Hint: The total portfolio size is not uniquely determined. [3 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts