Question: Sinclair Pharmaceuticals, a small drug company, will experience extremely high growth over the next few years and will reinvest all of its earnings in

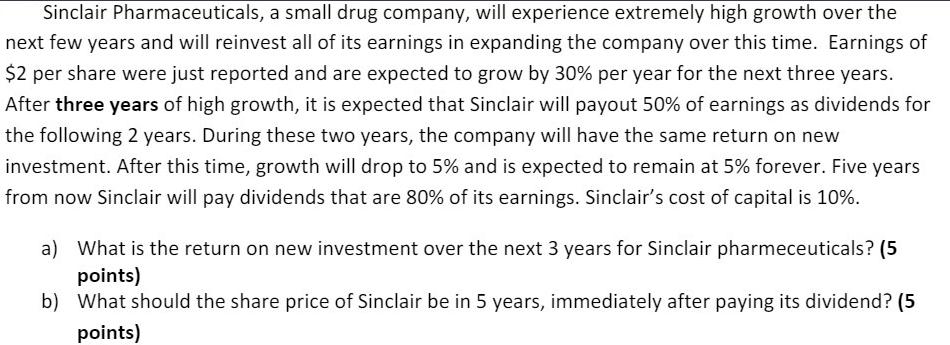

Sinclair Pharmaceuticals, a small drug company, will experience extremely high growth over the next few years and will reinvest all of its earnings in expanding the company over this time. Earnings of $2 per share were just reported and are expected to grow by 30% per year for the next three years. After three years of high growth, it is expected that Sinclair will payout 50% of earnings as dividends for the following 2 years. During these two years, the company will have the same return on new investment. After this time, growth will drop to 5% and is expected to remain at 5% forever. Five years from now Sinclair will pay dividends that are 80% of its earnings. Sinclair's cost of capital is 10%. a) What is the return on new investment over the next 3 years for Sinclair pharmeceuticals? (5 points) b) What should the share price of Sinclair be in 5 years, immediately after paying its dividend? (5 points)

Step by Step Solution

3.44 Rating (160 Votes )

There are 3 Steps involved in it

a To calculate the return on new investment over the next 3 years we need to determine the earnings ... View full answer

Get step-by-step solutions from verified subject matter experts