Question: Singh Development Co. is deciding whether to proceed with Project X. The after-tax cost would be $11 million in Year 0 . There is a

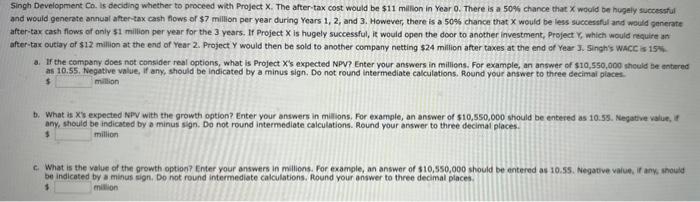

Singh Development Co. is deciding whether to proceed with Project X. The after-tax cost would be $11 million in Year 0 . There is a 50% chance that X would be hugely successfui and would generate annual after-tax cash flows of $7 million per year during Years 1, 2, and 3 . However, there is a 50% chance that x would be less successful ard would generate after-tax cash flows of anly $1 million per year for the 3 years, If Project X is hugely successful, it would open the door to another investment, Project Y, which iwould require an a. Ir the company does not consider real options, what is Project X's expected NPV? Enter your answers in millions. For example, an answer of $10,550,000 sheuld ise antiered as 10.55. Negative value, if any, should be indicated by a minus sign, Do not round intermediate calculations, Round your answer to three decimai piaces. 5 milion b. What is X/s expected NPV with the growth option? Enter your answers in millions, For example, an answer of $10,550,000 should be entered as 10.53 . Negative value, 4 anv. should be indicated by o minus sign. Do not round intermediate calculations. Round your answer to three decimal places. 3 million c. What is the value of the growth option? Enter your answers in millions. For example, an answer of 310,550,000 should be entered as 10.55. Negative vaiue, if ank ahould be indicated by a minus sign. Do not round intermediate calculations. Round your onswer to three decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts