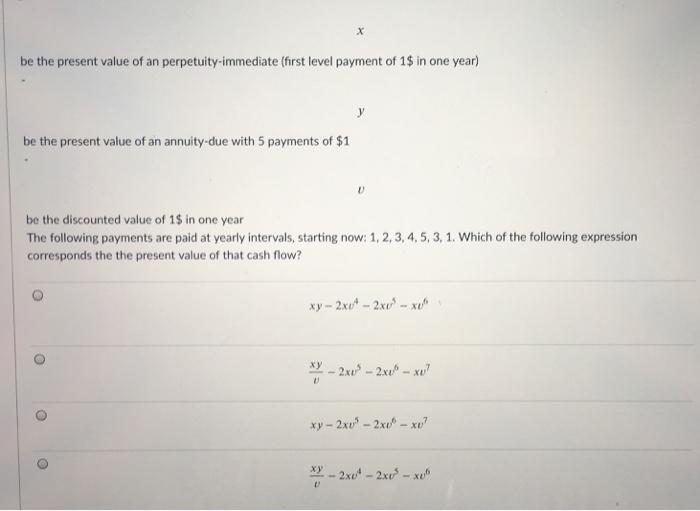

Question: single answer questions, please give answer only thx! be the present value of an perpetuity-immediate (first level payment of 1$ in one year) y be

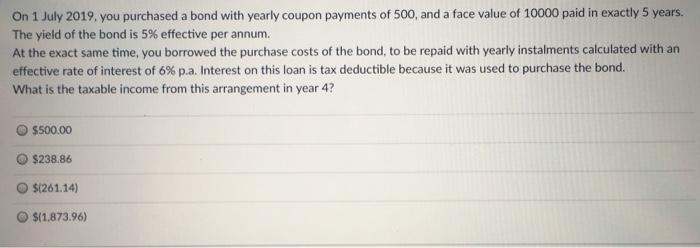

be the present value of an perpetuity-immediate (first level payment of 1$ in one year) y be the present value of an annuity-due with 5 payments of $1 1 be the discounted value of 1$ in one year The following payments are paid at yearly intervals, starting now: 1, 2, 3, 4, 5, 3, 1. Which of the following expression corresponds the the present value of that cash flow? xy - 2x4 - 2x09 - X o 2. xx- 2x1 - x07 o xy - 2x0 - 2x - xo? o * 2x0" - 2x0 - x On 1 July 2019. you purchased a bond with yearly coupon payments of 500, and a face value of 10000 paid in exactly 5 years. The yield of the bond is 5% effective per annum. At the exact same time, you borrowed the purchase costs of the bond, to be repaid with yearly instalments calculated with an effective rate of interest of 6% p.a. Interest on this loan is tax deductible because it was used to purchase the bond. What is the taxable income from this arrangement in year 4? $500.00 $238.86 $(261.14) $(1.873.96)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts