Question: single mistake 5 dislikes. by trnot method When we discussed this case in the introduction, we learned that the initial estimates of equip ment life

single mistake 5 dislikes.

by trnot method

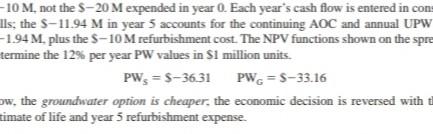

When we discussed this case in the introduction, we learned that the initial estimates of equip ment life were 10 years for both options of UPW (ultrapure water)-seawater and groundwater. As you might guess, a little research indicates that seawater is more corrosive and the equipment life is shorter 5 years rather than 10. However, it is expected that, instead of complete replace ment, a total refurbishment of the equipment for $10 M after 5 years will extend the life through the anticipated 10th year of service. With all other estimates remaining the same, it is important to determine if this 50% reduction in expected usable life and the refurbishment expense may alter the decision to go with the seawater option, as determined in Example 5.2. For a complete analysis, consider both a 10-year and a 5-year option for the expected use of the equipment, regardless of the source of UPW. -10 M, not the 5-20 M expended in year 0. Each year's cash flow is entered in con Ils: the S-11.94 M in year 5 accounts for the continuing AOC and annual UPW -1.94 M plus the S-10 M refurbishment cost. The NPV functions shown on the spre termine the 12% per year PW values in S1 million units. PW, = $-3631 PW=S-33.16 ow, the groundwater option is cheaper, the economic decision is reversed with simate of life and year 5 refurbishment expense. When we discussed this case in the introduction, we learned that the initial estimates of equip ment life were 10 years for both options of UPW (ultrapure water)-seawater and groundwater. As you might guess, a little research indicates that seawater is more corrosive and the equipment life is shorter 5 years rather than 10. However, it is expected that, instead of complete replace ment, a total refurbishment of the equipment for $10 M after 5 years will extend the life through the anticipated 10th year of service. With all other estimates remaining the same, it is important to determine if this 50% reduction in expected usable life and the refurbishment expense may alter the decision to go with the seawater option, as determined in Example 5.2. For a complete analysis, consider both a 10-year and a 5-year option for the expected use of the equipment, regardless of the source of UPW. -10 M, not the 5-20 M expended in year 0. Each year's cash flow is entered in con Ils: the S-11.94 M in year 5 accounts for the continuing AOC and annual UPW -1.94 M plus the S-10 M refurbishment cost. The NPV functions shown on the spre termine the 12% per year PW values in S1 million units. PW, = $-3631 PW=S-33.16 ow, the groundwater option is cheaper, the economic decision is reversed with simate of life and year 5 refurbishment expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts