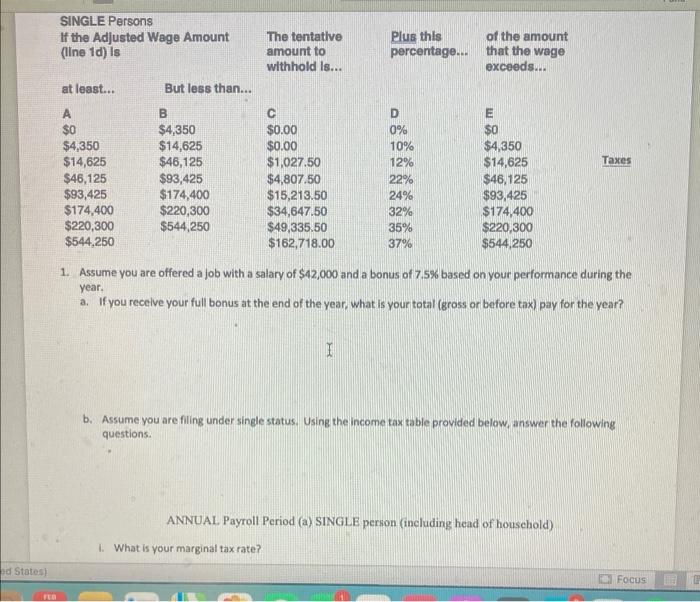

Question: SINGLE Persons If the Adjusted Wage Amount (line 1d) Is The tentative amount to withhold Is... Plus this percentage... of the amount that the wage

SINGLE Persons If the Adjusted Wage Amount (line 1d) Is The tentative amount to withhold Is... Plus this percentage... of the amount that the wage exceeds... at least... But less than... Taxes A $0 $4,350 $14,625 $46,125 $93,425 $174.400 $220,300 $544.250 B $4,350 $14,625 $46,125 $93,425 $174,400 $220,300 $544,250 $0.00 $0.00 $1,027.50 $4,807.50 $15,213.50 $34,647.50 $49,335,50 $162,718.00 D 0% 10% 12% 22% 24% 32% 35% 37% E $0 $4,350 $14,625 $46,125 $93,425 $174,400 $220,300 $544,250 1. Assume you are offered a job with a salary of $42,000 and a bonus of 7.5% based on your performance during the year. a. If you receive your full bonus at the end of the year, what is your total (gross or before tax) pay for the year? I b. Assume you are filing under single status. Using the income tax table provided below, answer the following questions. ANNUAL Payroll Period (a) SINGLE person (including head of household) 1. What is your marginal tax rate? ed States) Focus C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts