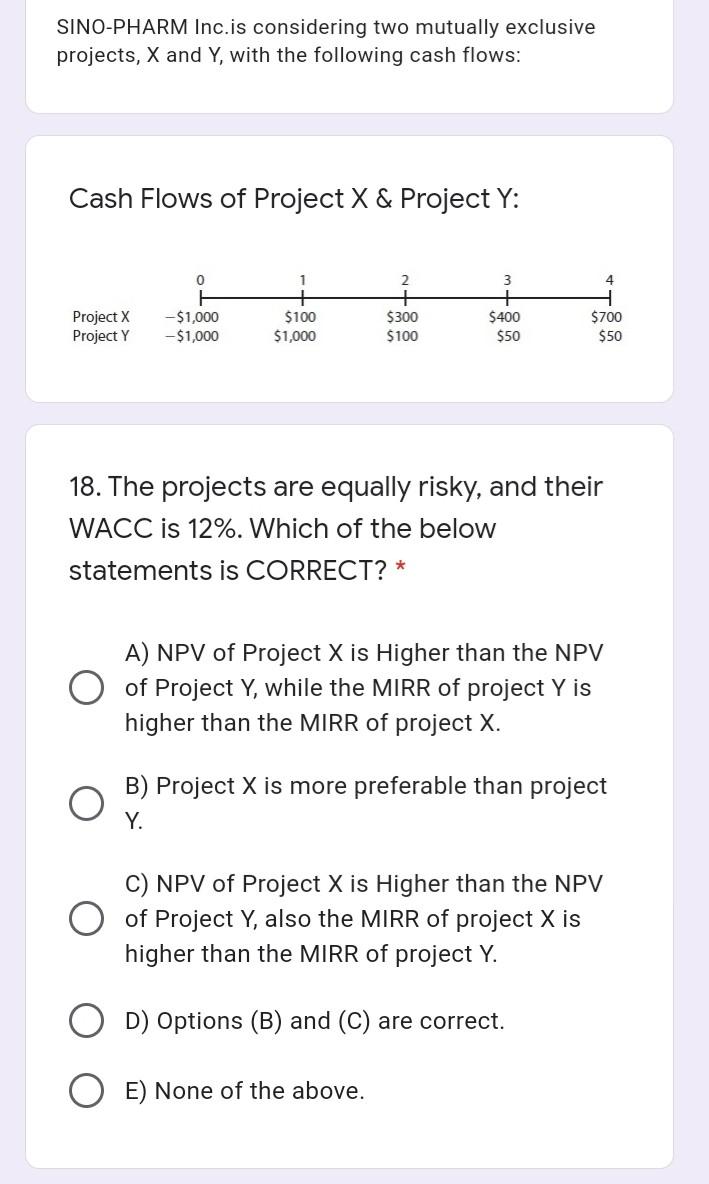

Question: SINO-PHARM Inc.is considering two mutually exclusive projects, X and Y, with the following cash flows: Cash Flows of Project X & Project Y: 0 1

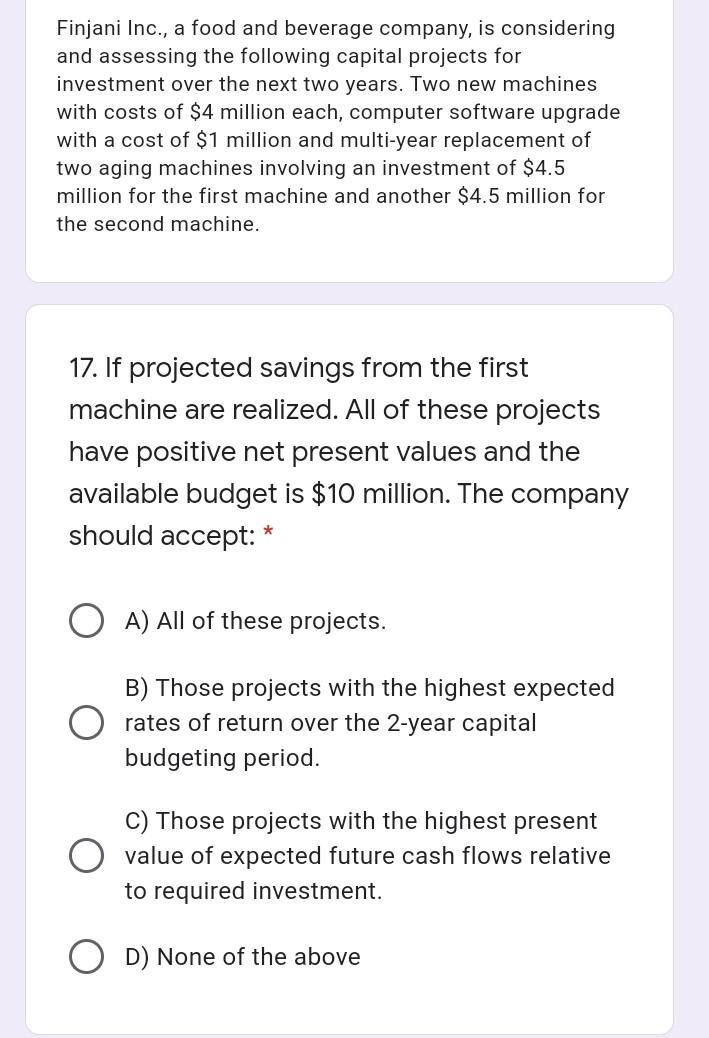

SINO-PHARM Inc.is considering two mutually exclusive projects, X and Y, with the following cash flows: Cash Flows of Project X & Project Y: 0 1 2. 3 4 Project X Project Y -$1,000 - $1,000 $100 $1,000 $300 $100 $400 $50 $700 $50 18. The projects are equally risky, and their WACC is 12%. Which of the below statements is CORRECT? * A) NPV of Project X is Higher than the NPV of Project Y, while the MIRR of project Y is higher than the MIRR of project X. B) Project X is more preferable than project Y. C) NPV of Project X is Higher than the NPV of Project Y, also the MIRR of project X is higher than the MIRR of project Y. D) Options (B) and (C) are correct. O E) None of the above. Finjani Inc., a food and beverage company, is considering and assessing the following capital projects for investment over the next two years. Two new machines with costs of $4 million each, computer software upgrade with a cost of $1 million and multi-year replacement of two aging machines involving an investment of $4.5 million for the first machine and another $4.5 million for the second machine. 17. If projected savings from the first machine are realized. All of these projects have positive net present values and the available budget is $10 million. The company should accept: * A) All of these projects. B) Those projects with the highest expected O rates of return over the 2-year capital budgeting period. C) Those projects with the highest present value of expected future cash flows relative to required investment. OD) None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts