Question: Sinopia completed a corporate restructuring transaction with Cyan on May 3 1 of the current year. Cyan distributed 3 0 % of Sinopia's stock to

Sinopia completed a corporate restructuring transaction with Cyan on May of the current year. Cyan distributed of Sinopia's stock to its shareholders in exchange for all of their stock in Cyan. At the completion of the reorganization, Cyan's assets were worth $ its liabilities were $ and it held an NOL carryover of $ The applicable Federal longterm taxexempt rate is and Sinopia is in the Federal income tax bracket. Sinopia earns a aftertax rate of return.

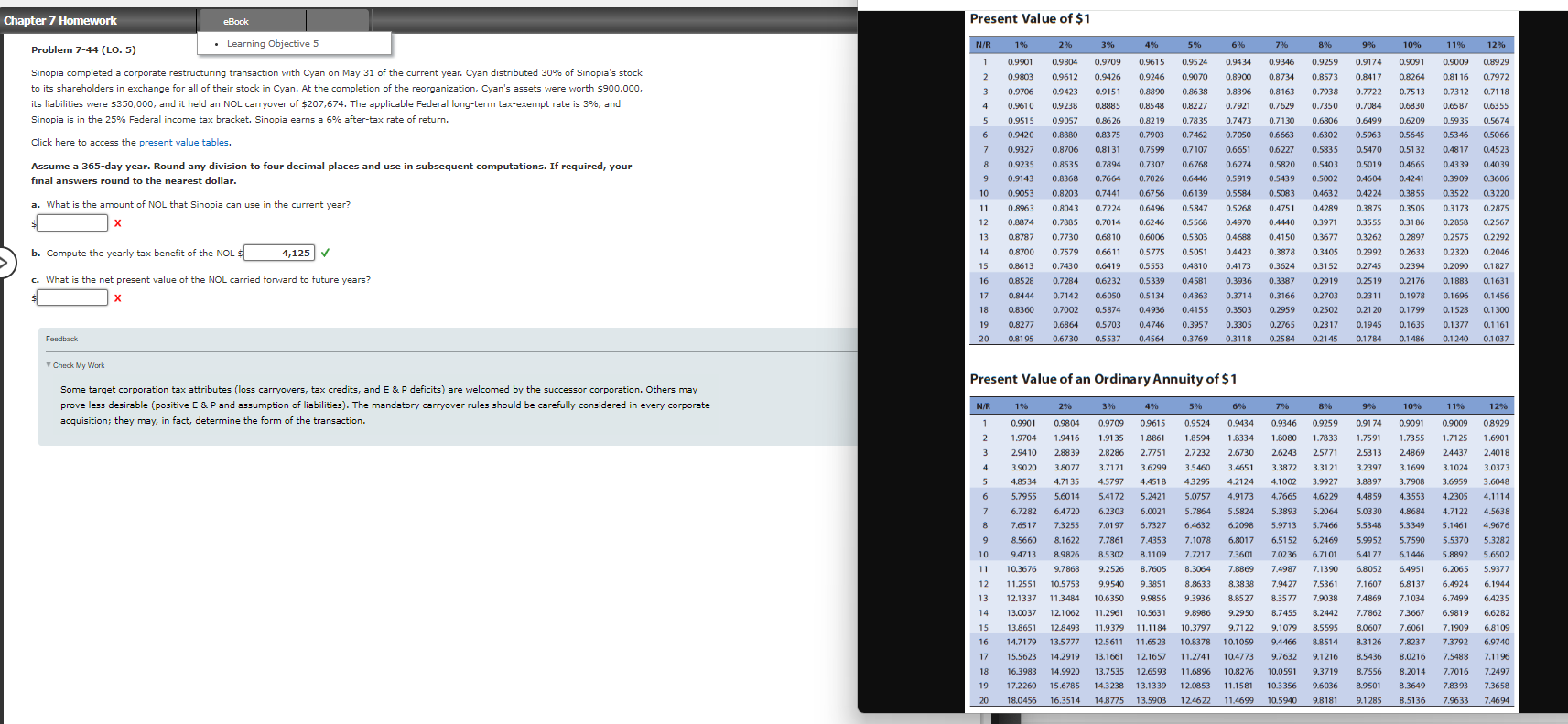

Click here to access the present value tables.

Assume a day year. Round any division to four decimal places and use in subsequent computations. If required, your final answers round to the nearest dollar.

a What is the amount of NOL that Sinopia can use in the current year?

$fill in the blank

b Compute the yearly tax benefit of the NOL $fill in the blank

c What is the net present value of the NOL carried forward to future years?

$fill in the blank

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock