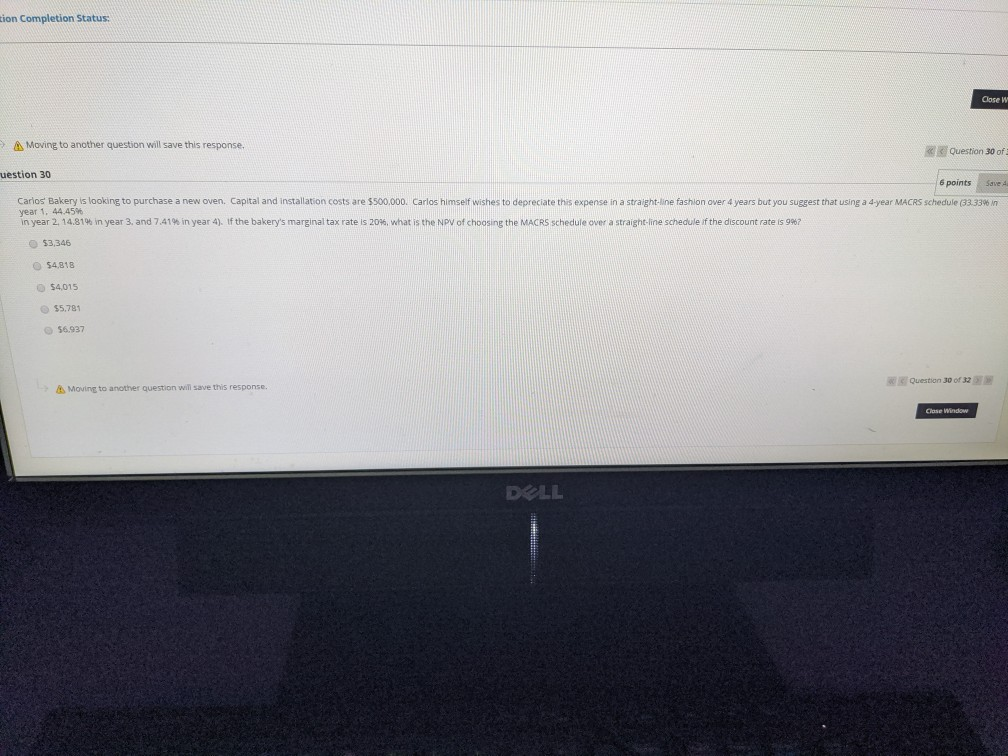

Question: sion Completion Status Close Moving to another question will save this response. Question 30 of uestion 30 Carlos Bakery is looking to purchase a new

sion Completion Status Close Moving to another question will save this response. Question 30 of uestion 30 Carlos Bakery is looking to purchase a new oven. Capital and installation costs are $500.000. Carlos himself wishes to depreciate this expense in a straight-line fashion over 4 years but you suggest that using a year 1. 44.45% in year 2. 14.816 in year 3. and 7.414 in year 4). If the bakery's marginal tax rate is 20%, what is the NPV of choosing the MACRS schedule over a straight-line schedule if the discount rate is 987 53,346 6 points Save year MACRS schedule 33.33% 54.818 54,015 $5.781 56.937 Moving to another question will save this response. Question 30 of 32 Ce Window DELL

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts