Question: Sirca Technology Limited (STL) is considering a project that has an up-front cost of $3 million and is expected to produce a cash flow of

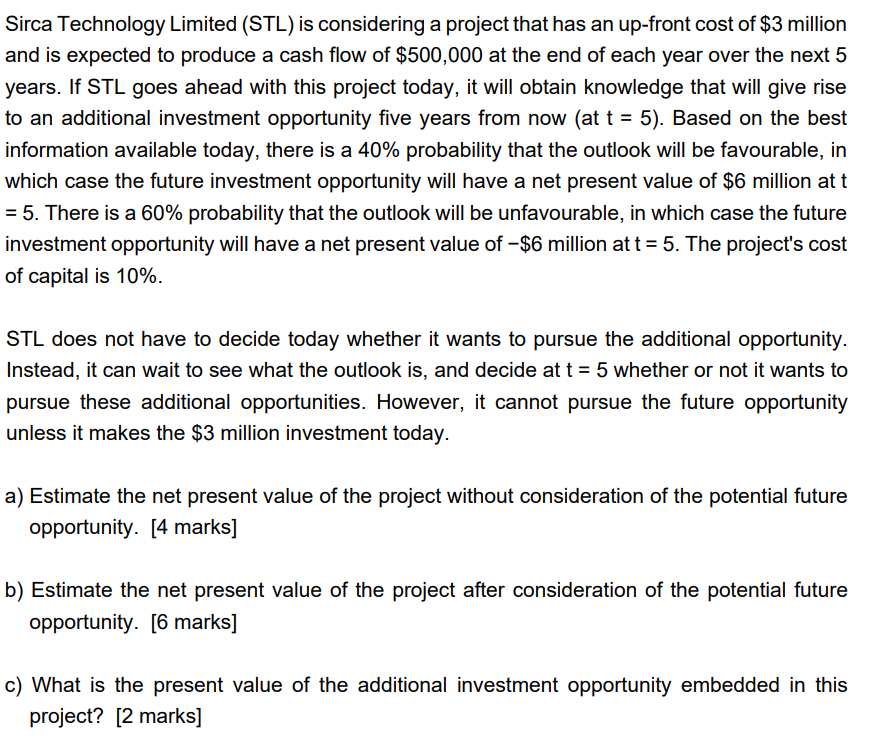

Sirca Technology Limited (STL) is considering a project that has an up-front cost of $3 million and is expected to produce a cash flow of $500,000 at the end of each year over the next 5 years. If STL goes ahead with this project today, it will obtain knowledge that will give rise to an additional investment opportunity five years from now (at t = 5). Based on the best information available today, there is a 40% probability that the outlook will be favourable, in which case the future investment opportunity will have a net present value of $6 million att = 5. There is a 60% probability that the outlook will be unfavourable, in which case the future investment opportunity will have a net present value of $6 million at t=5. The project's cost of capital is 10%. STL does not have to decide today whether it wants to pursue the additional opportunity. Instead, it can wait to see what the outlook is, and decide at t = 5 whether or not it wants to pursue these additional opportunities. However, it cannot pursue the future opportunity unless it makes the $3 million investment today. a) Estimate the net present value of the project without consideration of the potential future opportunity. [4 marks] b) Estimate the net present value of the project after consideration of the potential future opportunity. [6 marks] c) What is the present value of the additional investment opportunity embedded in this project? [2 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts