Question: Situation 1: Net income under the Absorption Method should be $459,000. Situation 4: Net income under the Variable Method should be $459,000. Show work please

- Situation 1: Net income under the Absorption Method should be $459,000.

- Situation 4: Net income under the Variable Method should be $459,000.

- Show work please

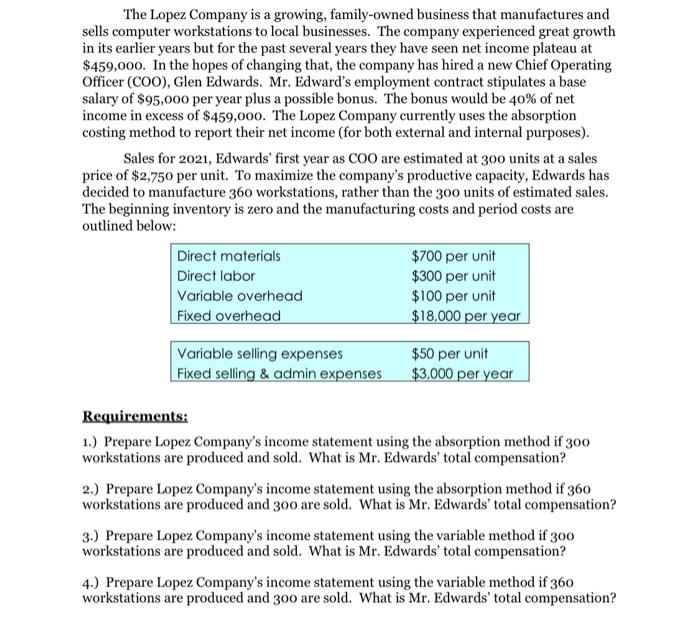

The Lopez Company is a growing, family-owned business that manufactures and sells computer workstations to local businesses. The company experienced great growth in its earlier years but for the past several years they have seen net income plateau at $450,000. In the hopes of changing that, the company has hired a new Chief Operating Officer (COO), Glen Edwards. Mr. Edward's employment contract stipulates a base salary of $95,000 per year plus a possible bonus. The bonus would be 40% of net income in excess of $459,000. The Lopez Company currently uses the absorption costing method to report their net income (for both external and internal purposes). Sales for 2021, Edwards' first year as COO are estimated at 300 units at a sales price of $2,750 per unit. To maximize the company's productive capacity, Edwards has decided to manufacture 360 workstations, rather than the 300 units of estimated sales. The beginning inventory is zero and the manufacturing costs and period costs are outlined below: Direct materials $700 per unit Direct labor $300 per unit Variable overhead $100 per unit Fixed overhead $18,000 per year Variable selling expenses Fixed selling & admin expenses $50 per unit $3,000 per year Requirements: 1.) Prepare Lopez Company's income statement using the absorption method if 300 workstations are produced and sold. What is Mr. Edwards' total compensation? 2.) Prepare Lopez Company's income statement using the absorption method if 360 workstations are produced and 300 are sold. What is Mr. Edwards' total compensation? 3.) Prepare Lopez Company's income statement using the variable method if 300 workstations are produced and sold. What is Mr. Edwards' total compensation? 4.) Prepare Lopez Company's income statement using the variable method if 360 workstations are produced and 300 are sold. What is Mr. Edwards' total compensation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts