Question: Situation 3 . On January 1 , 2 0 2 1 , the company acquired machinery at a cost of ( $ 6

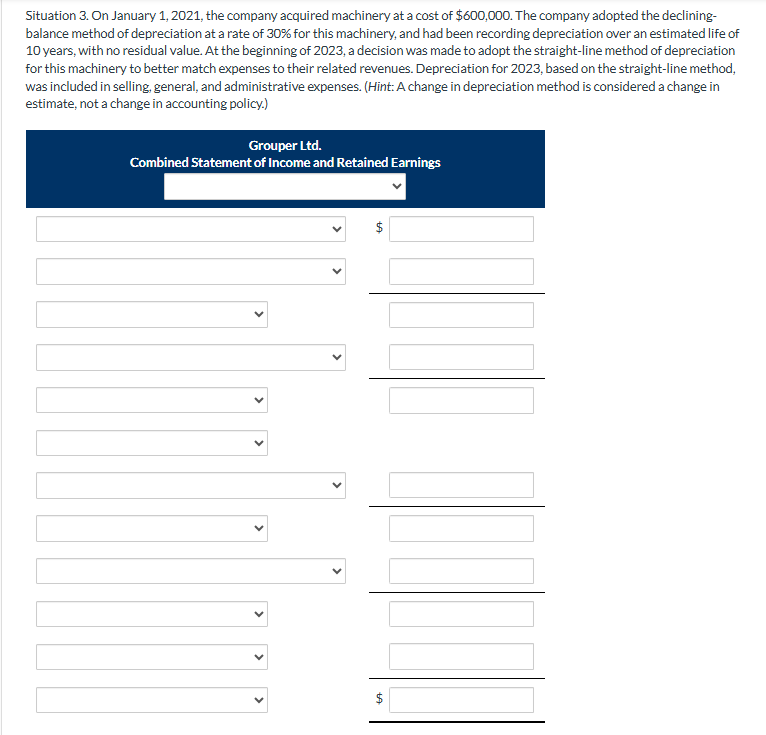

Situation On January the company acquired machinery at a cost of $ The company adopted the decliningbalance method of depreciation at a rate of for this machinery, and had been recording depreciation over an estimated life of years, with no residual value. At the beginning of a decision was made to adopt the straightline method of depreciation for this machinery to better match expenses to their related revenues. Depreciation for based on the straightline method, was included in selling, general, and administrative expenses. Hint: A change in depreciation method is considered a change in estimate, not a change in accounting policy. Grouper Ltd Combined Statement of Income and Retained Earnings $ square $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock