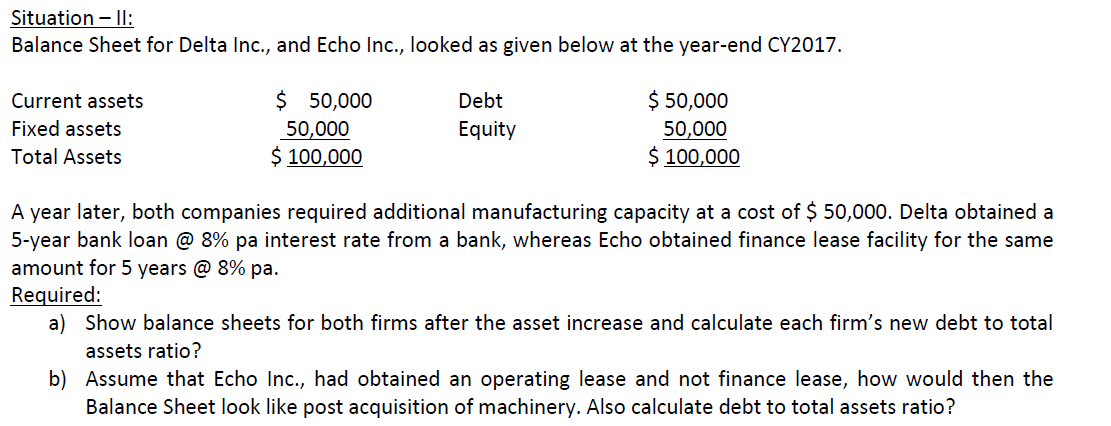

Question: Situation - II: Balance Sheet for Delta Inc., and Echo Inc., looked as given below at the year-end CY2017. Current assets Fixed assets Total Assets

Situation - II: Balance Sheet for Delta Inc., and Echo Inc., looked as given below at the year-end CY2017. Current assets Fixed assets Total Assets $ 50,000 50,000 $ 100,000 Debt Equity $ 50,000 50,000 $ 100,000 A year later, both companies required additional manufacturing capacity at a cost of $ 50,000. Delta obtained a 5-year bank loan @ 8% pa interest rate from a bank, whereas Echo obtained finance lease facility for the same amount for 5 years @ 8% pa. Required: a) Show balance sheets for both firms after the asset increase and calculate each firm's new debt to total assets ratio? b) Assume that Echo Inc., had obtained an operating lease and not finance lease, how would then the Balance Sheet look like post acquisition of machinery. Also calculate debt to total assets ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts