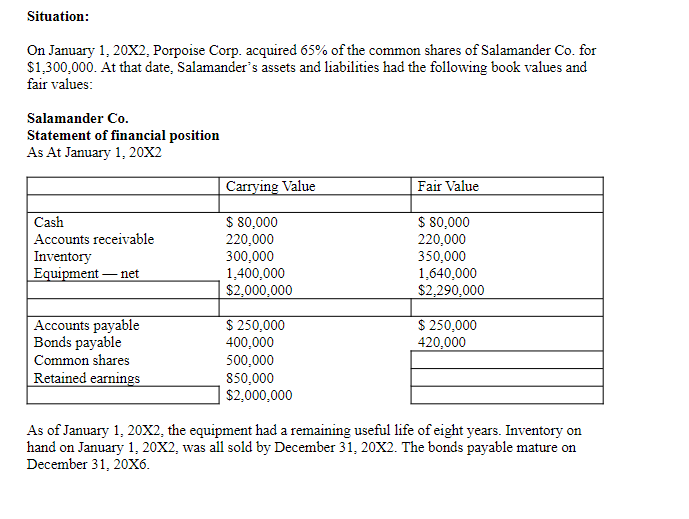

Question: Situation: On January 1 , 2 0 X 2 , Porpoise Corp. acquired 6 5 % of the common shares of Salamander Co . for

Situation:

On January X Porpoise Corp. acquired of the common shares of Salamander Co for

$ At that date, Salamander's assets and liabilities had the following book values and

fair values:

Salamander Co

Statement of financial position

As At January X

As of January X the equipment had a remaining useful life of eight years. Inventory on

hand on January X was all sold by December X The bonds payable mature on

December X

Porpoise uses the cost method to account for its investment in Salamander. The companies' statements of financial position at December X and statements of comprehensive income for the year ended December X are as follows:

Statements of financial position

As at December X

tablePorpoiseSalamanderCash$ $ Accounts receivable,InventoryEquipment net,Investment in Salamander$$Accounts payable$$Bonds payable,Common sharesRetained earnings,$$

Statement of Comprehensive Income

For the year ended December X

tablePorpoiseSalamanderSales$$Cost of goods sold,Gross profitSelling and administrative,expensesDepreciation expense,Interest expenseIncome before income taxes,Income taxesNet income and,$$comprehensive income Additional information:

During X and X Salamander sold inventory to Porpoise with a gross profit as follows:

During X Porpoise sold inventory to Salamander with a gross profit as follows: Intercompany sales downstream sale of $

Goods remaining in Salamander's inventory at December $

Management has determined that Salamander is a cashgenerating unit CGU Porpoise tests its investment in Salamander each year for impairment and allocates the loss, if any, first to goodwill. Goodwill was impaired by $ and $ for fiscal years X and X respectively.

On July X Salamander sold Porpoise equipment with a net book value of $ for a cash consideration of $ The equipment originally cost Salamander $ It had a remaining useful life of six years at the date of the intercompany sale. Assume that the loss is not an impairment loss.

Neither company paid dividends in X The income tax rate has remained at for both companies since X Ignore future income taxes on the purchase price discrepancy.

Porpoise uses the FVE method to value the noncontrolling interest at the acquisition date. Required:

a i Prepare a schedule showing the calculation of goodwill at Salamander's acquisition date.

ii Prepare an acquisition differential amortization and impairment AD schedule for the period from January X to December X

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock