Question: Situation. Two college buddies work for the same CPA firm after graduating college. Both have earned their CPA licenses. Both were assigned to the same

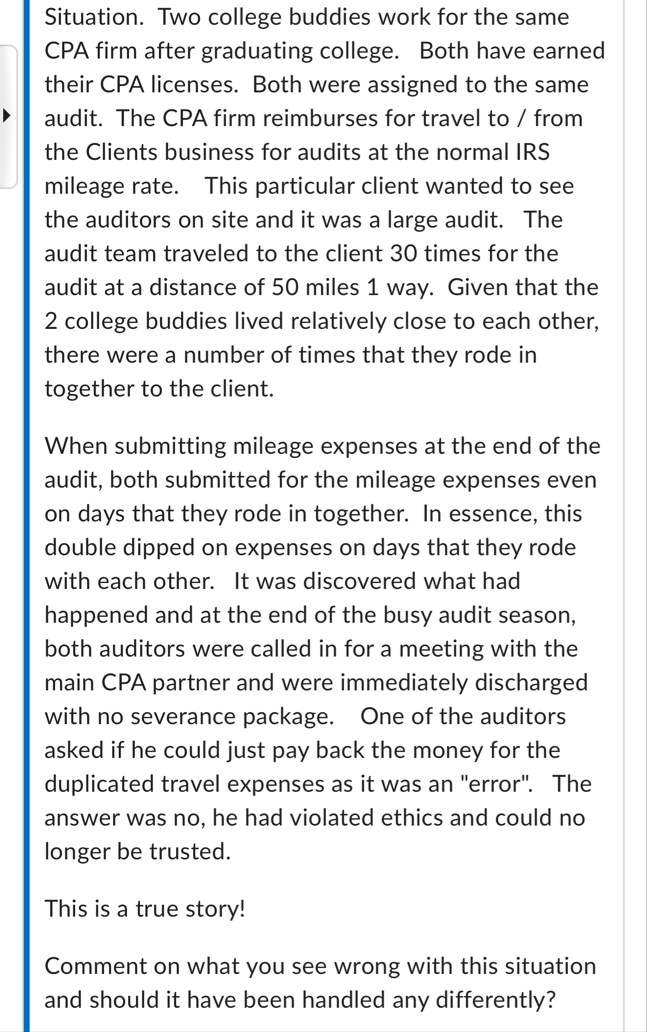

Situation. Two college buddies work for the same CPA firm after graduating college. Both have earned their CPA licenses. Both were assigned to the same audit. The CPA firm reimburses for travel to from the Clients business for audits at the normal IRS mileage rate. This particular client wanted to see the auditors on site and it was a large audit. The audit team traveled to the client times for the audit at a distance of miles way. Given that the college buddies lived relatively close to each other, there were a number of times that they rode in together to the client.

When submitting mileage expenses at the end of the audit, both submitted for the mileage expenses even on days that they rode in together. In essence, this double dipped on expenses on days that they rode with each other. It was discovered what had happened and at the end of the busy audit season, both auditors were called in for a meeting with the main CPA partner and were immediately discharged with no severance package. One of the auditors asked if he could just pay back the money for the duplicated travel expenses as it was an "error". The answer was no he had violated ethics and could no longer be trusted.

This is a true story!

Comment on what you see wrong with this situation and should it have been handled any differently?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock