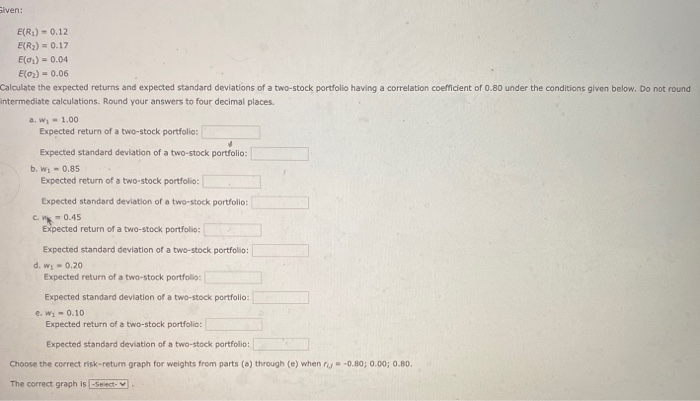

Question: Siven: E(R) - 0.12 E(R2) = 0.17 E(0) = 0.04 E(0) - 0.06 Calculate the expected returns and expected standard deviations of a two-stock portfolio

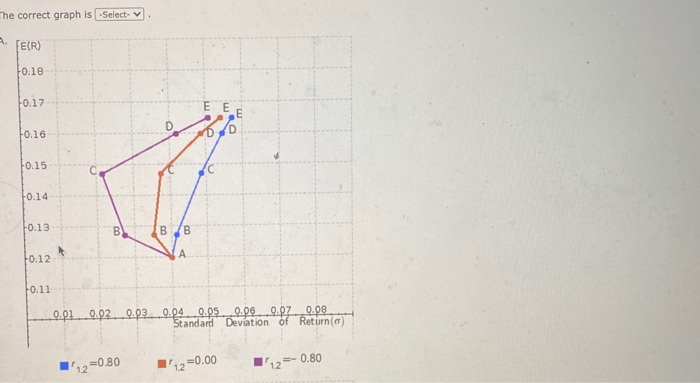

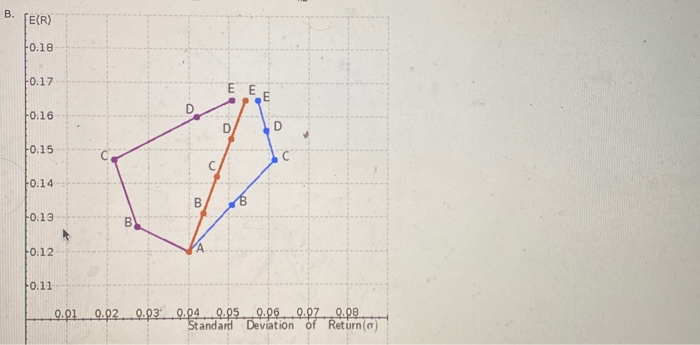

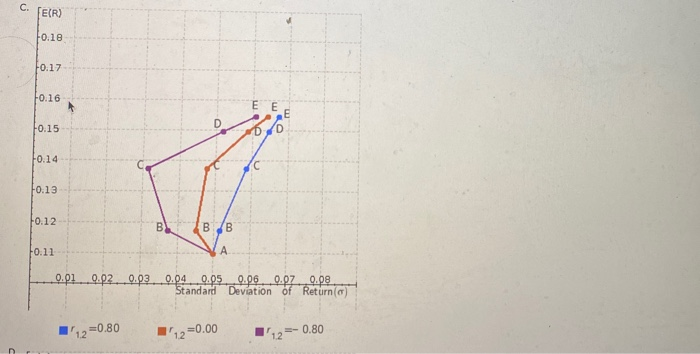

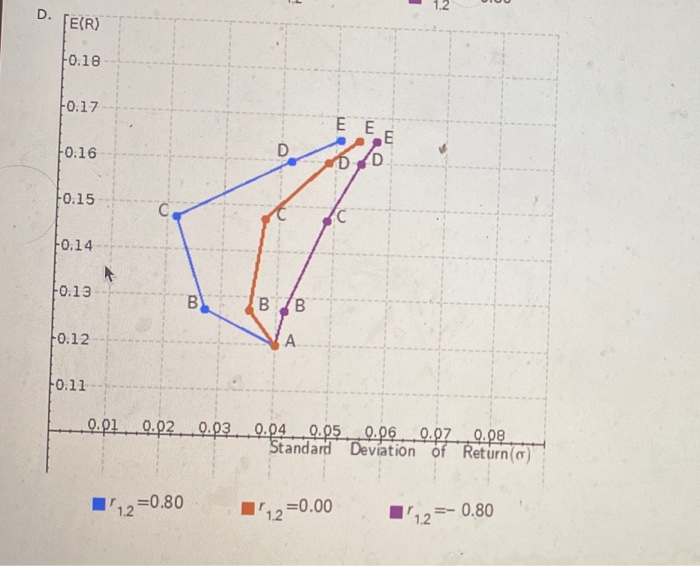

Siven: E(R) - 0.12 E(R2) = 0.17 E(0) = 0.04 E(0) - 0.06 Calculate the expected returns and expected standard deviations of a two-stock portfolio having a correlation coefficient of 0.80 under the conditions given below. Do not round intermediate calculations. Round your answers to four decimal places a. W; -1.00 Expected return of a two-stock portfolio: Expected standard deviation of a two-stock portfolio: b. w: -0.85 Expected return of a two-stock portfolio: Expected standard deviation of a two-stock portfolio: CW0.45 Expected return of a two-stock portfolio Expected standard deviation of a two-stock portfolio: d. W: - 0.20 Expected return of a two-stock portfolio: Expected standard deviation of a two-stock portfolio: e. W; - 0.10 Expected return of a two-stock portfolio: Expected standard deviation of a two-stock portfolio: Choose the correct risk-return graph for weights from parts (a) through (e) when = -0.80; 0.00; 0.80. The correct graph is -Select- The correct graph is -Select- FE(R) F0.18 F0.17 E D D F0.16 O 10.15 c F0.14 F0.13 BB A F0.12 10.11 0.01 0.02. 0.03 0.04 0.05 0.06 0.07 0.08 Standard Deviation of Return() 0.80 (12=0.80 "'12=0.00 12 B. E(R) F0.18 F0.17 E 10.16 D D F0.15 C 0.14 B B 0.13 B +0.12 F0.11 0.01 0.02 0.03 0.04 0.05 0.06 0.07 0.08 Standard Deviation of Return (m) C. FE(R) F0.18 +0.17 -0.16 E F0.15 B 0 -0.14 -0.13 F0.12 / 10.11 0.01 0.02. 0.03 0.04 0.05 0.06 0.07 0.08 Standard Deviation of Return (C) =0.80 12 0.80 14/12=0.00 1.2 1.2 D. FER) 10.18 10.17 E E E 10.16 D Do +0.15 +0.14 10.13 . B B F0.12 A Fo.11 0.01 0.02 0.03 0.04 0.05 0.06 0.07 0.08 Standard Deviation of Return (0) 112=0.80 112=0.00 1.2 - 0.80

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts