Question: Six mutually exclusive projects A, B, C, D, E, and F, are being considered by ABC Inc. They all have 20 years of project life

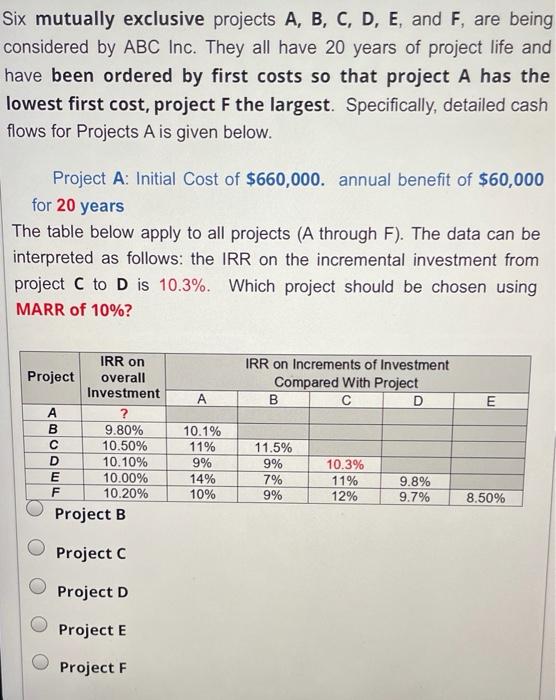

Six mutually exclusive projects A, B, C, D, E, and F, are being considered by ABC Inc. They all have 20 years of project life and have been ordered by first costs so that project A has the lowest first cost, project F the largest. Specifically, detailed cash flows for Projects A is given below. Project A: Initial Cost of $660,000. annual benefit of $60,000 for 20 years The table below apply to all projects (A through F). The data can be interpreted as follows: the IRR on the incremental investment from project C to D is 10.3%. Which project should be chosen using MARR of 10%? IRR on Increments of Investment Compared with Project B D A E IRR on Project overall Investment A ? 9.80% C 10.50% D 10.10% E 10.00% F 10.20% Project B MOLL 10.1% 11% 9% 14% 10% 11.5% 9% 7% 9% 10.3% 11% 12% 9.8% 9.7% 8.50% Project C Project D Project E Project F

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts