Question: Skect Star Maker ADJUSTING ENTRIES The unadiusted trial balance (step 4) of Sketch Star Makers Inc., prepared as of December 31. 2018 , includes the

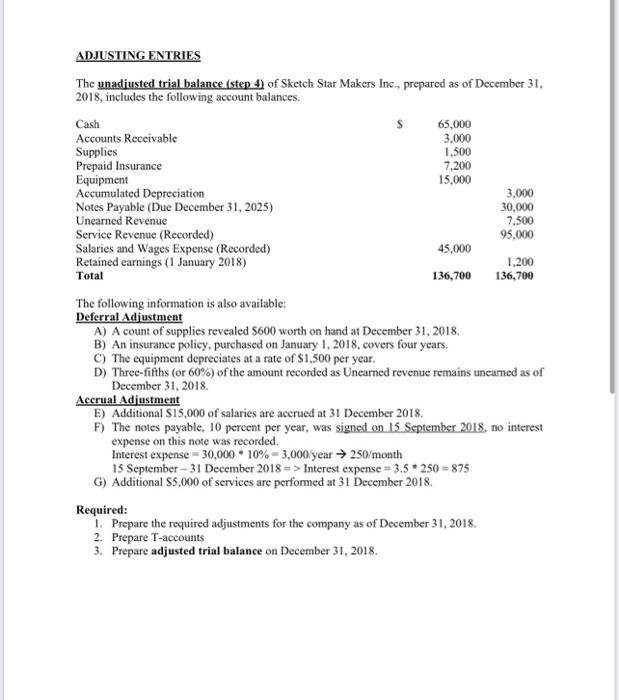

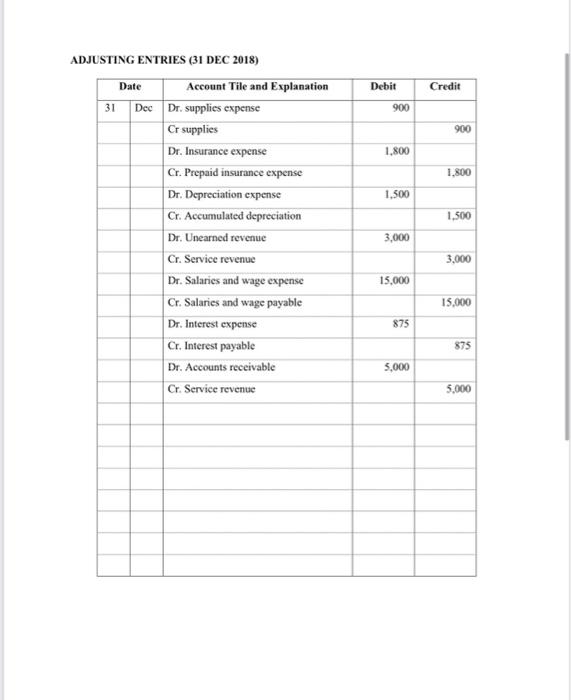

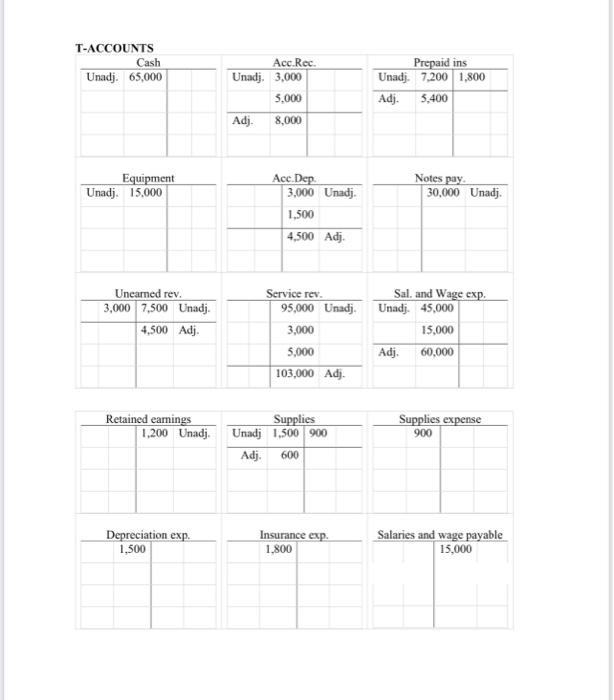

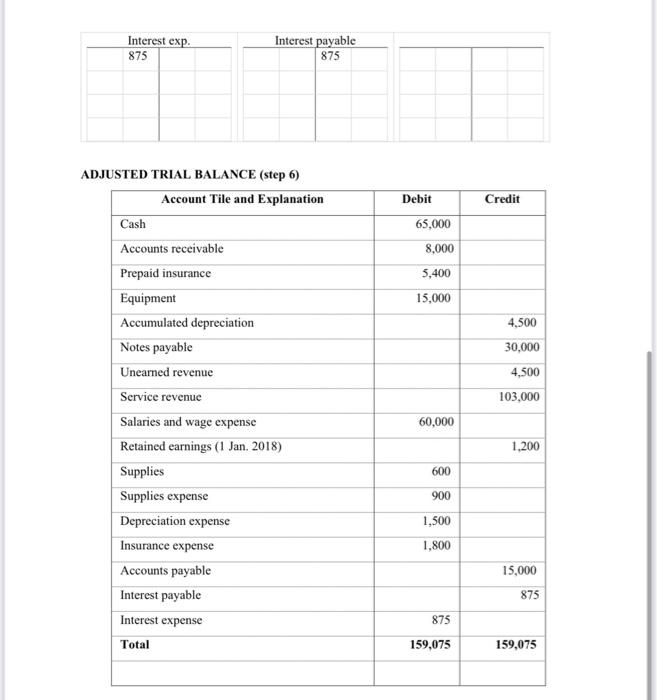

ADJUSTING ENTRIES The unadiusted trial balance (step 4) of Sketch Star Makers Inc., prepared as of December 31. 2018 , includes the following account balances. 000000 The following information is also available: Deferral Adjustment A) A count of supplies revealed $600 worth on hand at December 31,2018. B) An insurance policy, purchased on January 1, 2018, covers four years. C) The equipment depreciates at a rate of $1,500 per year. D) Three-fifths (or 60% ) of the amount recorded as Unearned revenue remains unearned as of December 31, 2018. Accrual Adiustment E) Additional $15,000 of salaries are acerued at 31 December 2018. F) The notes payable, 10 percent per year, was signed on 15 September 2018, no interest expense on this note was recorded. Interest expense =30,00010%=3,000 year 250/ month 15 September -31 December 2018> Interest expense =3.5250=875 G) Additional $5,000 of services are performed at 31 December 2018. Required: 1. Prepare the required adjustments for the company as of December 31,2018. 2. Prepare T-accounts 3. Prepare adjusted trial balance on December 31, 2018. ADJUSTING ENTRIES (31 DEC 2018) T-ACCOUNTS AD.IISTEN TRIAI RAI ANCE ieton G Prepare financial statements for Sketch Star Maker Sketch Star Maker Income statement For the year ended December 31, 2018 Sketch Star Maker Statement of retained earnings For the year ended December 31,2018 Sketch Star Maker Statement of financial position As of December 31, 2018 Current asset Current liability Noncurrent asset Owner's equity Prepare closing entries Noncurrent liability

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts