Question: Skywalker inc. is proposing a nights offering. Presenty there are 256,000 shares outstanding at 590 each. There wil be 64,000 new shares oliered at $52

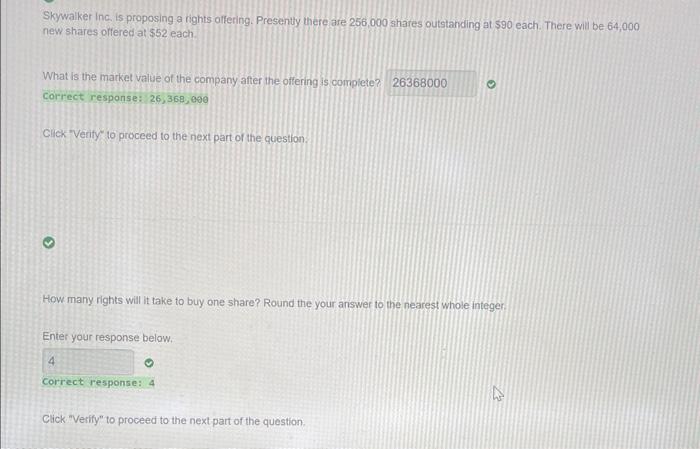

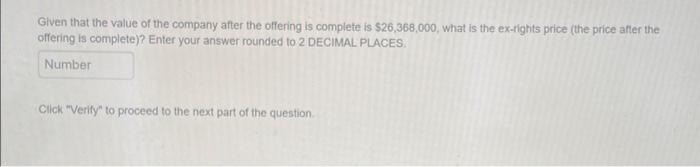

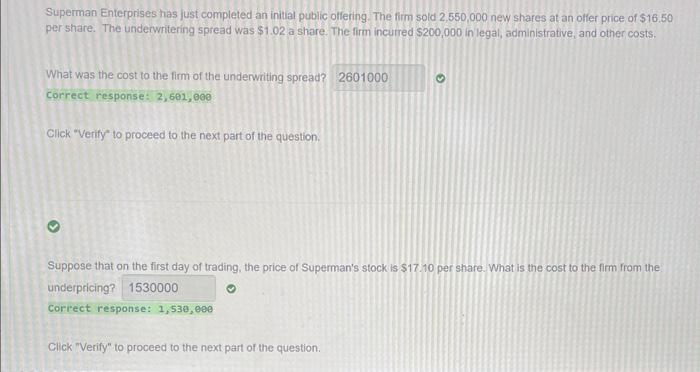

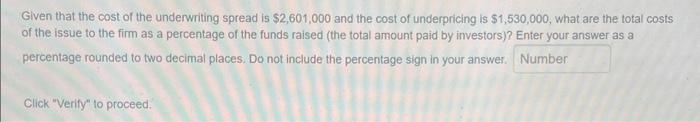

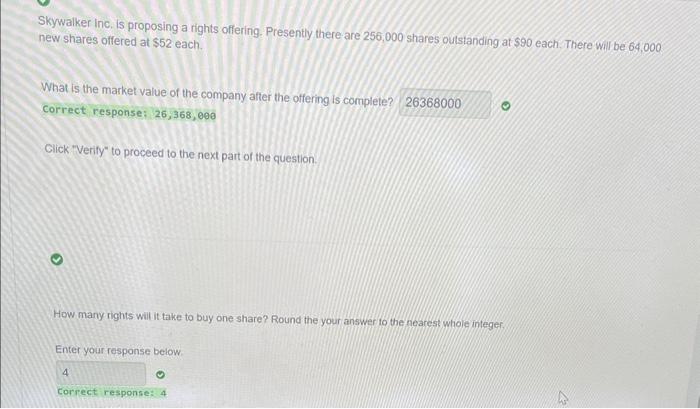

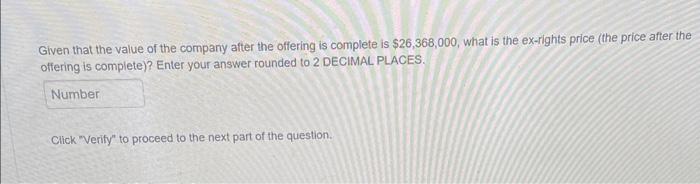

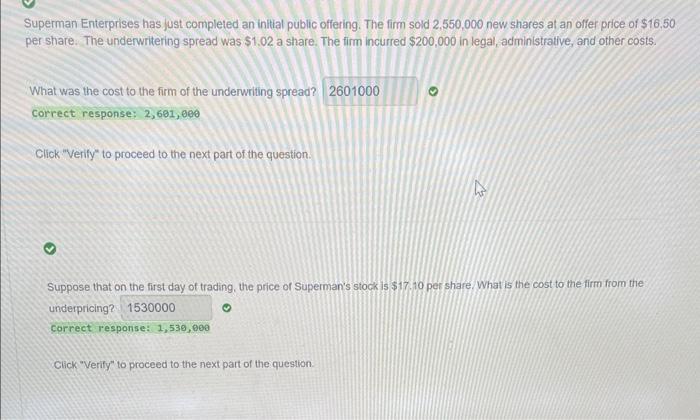

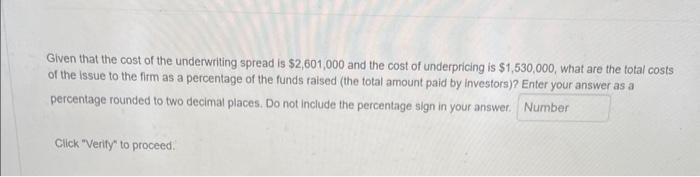

Skywalker inc. is proposing a nights offering. Presenty there are 256,000 shares outstanding at 590 each. There wil be 64,000 new shares oliered at $52 each. What is the market value of the company after the offering is compiete? correct response: 26,368,000 Cilck Verify to proceed to the next part of the question. How many rights will it take to buy one share? Round the your answer to the nearest whole integen Enter your response below. correct response: 4 Click "Verify" to proceed to the next part of the question. Given that the value of the company after the offering is complete is $26,368,000, what is the ex-rights price (the price after the offering is complete)? Enter your answer rounded to 2 DECIMAL PLACES. Click "Verify" to proceed to the next part of the question. Superman Enterprises has just completed an initial public olfering. The firm sold 2,550,000 new shares at an olfer price of $16.50 per share. The underwritering spread was $1.02 a share. The firm incurred $200,000 in legal, administrative, and other costs. What was the cost to the firm of the underwriting spread? correct response: 2,601,000 Click "Verify" to proceed to the next part of the question. Suppose that on the first day of trading, the price of Superman's stock is $17:10 per share. What is the cost to the firm from the underpricing? Correct response: 1,533,000 Click "Verify" to proceed to the next part of the question. Glven that the cost of the underwriting spread is $2,601,000 and the cost of underpricing is $1,530,000, what are the total costs of the issue to the firm as a percentage of the funds raised (the total amount paid by investors)? Enter your answer as a percentage rounded to two decimal places. Do not include the percentage sign in your answer. Click "Verify" to proceed. Skywalker inc, is proposing a rights offering. Presently there are 256,000 shares outstanding at $90 each, There wil be 64,000 new shares offered at $52 each. What is the market value of the company after the offering is complete? correct response: 26,368,006 Click "Verify" to proceed to the next part of the question. How many rights wil it take to buy one share? Round the your answer to the nearest whoie integer. Enter your response below Correct response: 4 Given that the value of the company after the offering is complete is $26,368,000, what is the ex-rights price (the price after the offering is complete)? Enter your answer rounded to 2 DECIMAL PLACES. Click "Verify" to proceed to the next part of the question. Superman Enterprises has just completed an initial public offering. The firm sold 2,550,000 new shares at an offer price of $16,50 per share. The underwritering spread was $1.02 a share. The firm incurred $200,000 in legal, administrative, and other costs. What was the cost to the firm of the underwriting spread? correct response: 2,601,000 Click "Verify" to proceed to the next part of the question. Suppose that on the first day of trading, the price of Superman's stock Is $17.10 per share, What is the cost to the firm from the underpricing? correct response: 1,530,000 Click "Verify" to proceed to the next part of the question. Given that the cost of the underwriting spread is $2,601,000 and the cost of underpricing is $1,530,000, what are the total costs of the issue to the firm as a percentage of the funds raised (the total amount paid by investors)? Enter your answer as a percentage rounded to two decimal places. Do not include the percentage sign in your answer. Click "Verity" to proceed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts