Question: S&L Financial buys and sells securities which it classifies as available for sale. On December 27, 2021, S&L purchased Coca-Cola bonds at par for $887,000

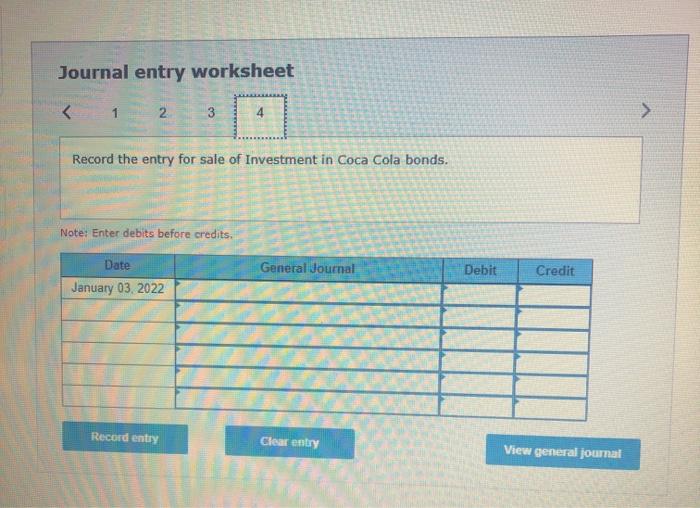

S&L Financial buys and sells securities which it classifies as available for sale. On December 27, 2021, S&L purchased Coca-Cola bonds at par for $887,000 and sold the bonds on January 3, 2022, for $896,000. At December 31, the bonds had a fair value of $879000, and S&L has the intent and ability to hold the investment until fair value recovers.

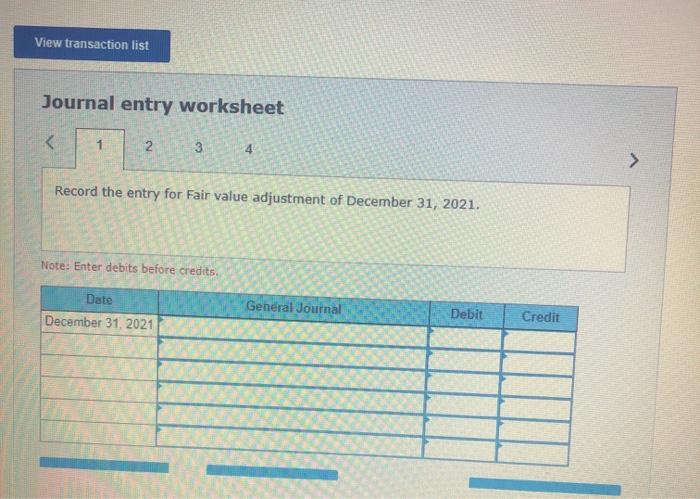

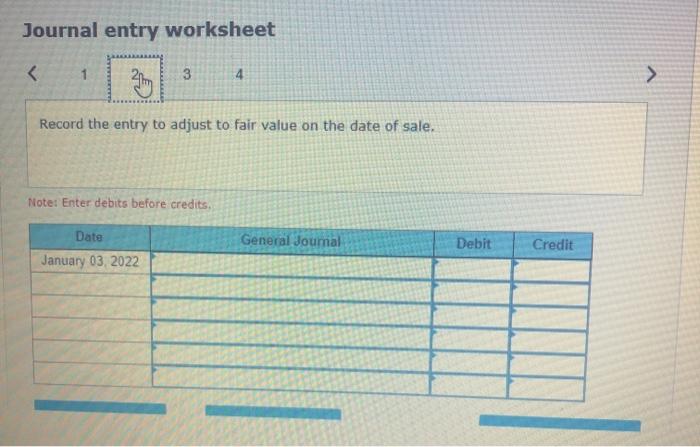

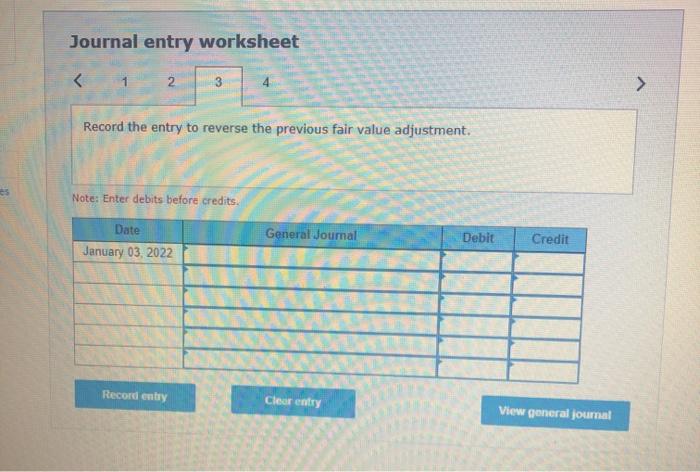

Prepare journal entries to record (a) any unrealized gains or losses occurring in 2021 and (b) the sale of the bonds in 2022, including recognition of any unrealized gains in 2022 prior to sale and reclassification of amounts out of OCL.

View transaction list Journal entry worksheet 4 Record the entry for Fair value adjustment of December 31, 2021. Note: Enter debits before credits. Date Geheral Journal Debit Credit December 31, 2021

Step by Step Solution

3.36 Rating (159 Votes )

There are 3 Steps involved in it

2021 December 31 Loss on investments unrealized OCI 8000 ... View full answer

Get step-by-step solutions from verified subject matter experts