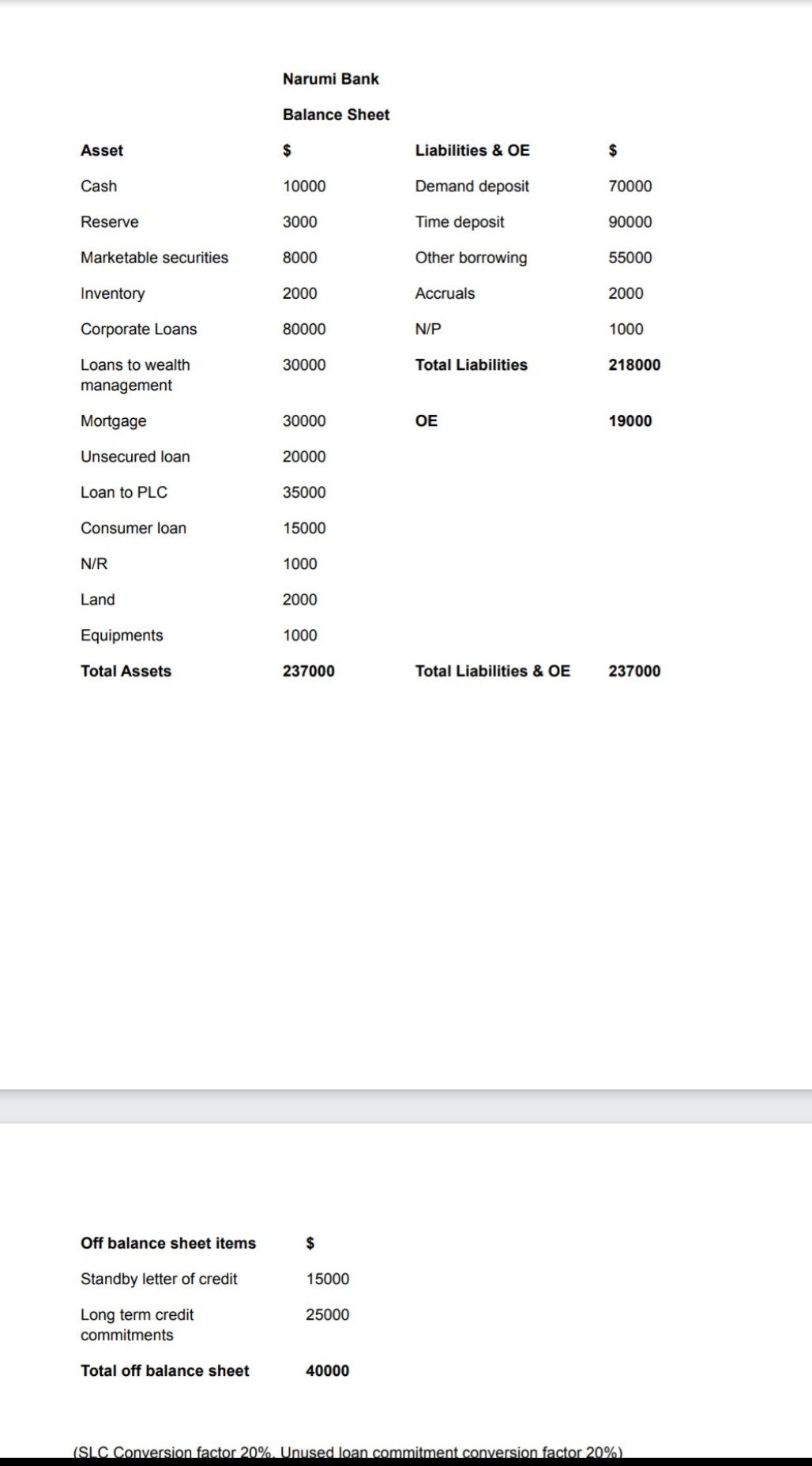

Question: (SLC Conversion factor 20%, Unused loan commitment conversion factor 20%)According to BASEL I,(Risk-weighting category: 0% for cash, reserve and marketable securities, 20% for Deposit at

(SLC Conversion factor 20%, Unused loan commitment conversion factor 20%)According to BASEL I,(Risk-weighting category: 0% for cash, reserve and marketable securities, 20% for Deposit at other banks and SLC, 50% for home loans, 100% for all loans, Unused commitment)You need to find out if the Narumi Bank is BASEL I compliant and at the same time their interest rate GAP status. If they are not BASEL I compliant, what do they need to do to ensure compliance? Also, if the government increases or decreases treasury bill yield, how will that affect the bank's NIM? You need to be very specific about your recommendations.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts