Question: sled: Exam III - Summer 2 0 2 4 Saved Required information [ The following information applies to the questions displayed below. ] The following

sled: Exam IIISummer

Saved

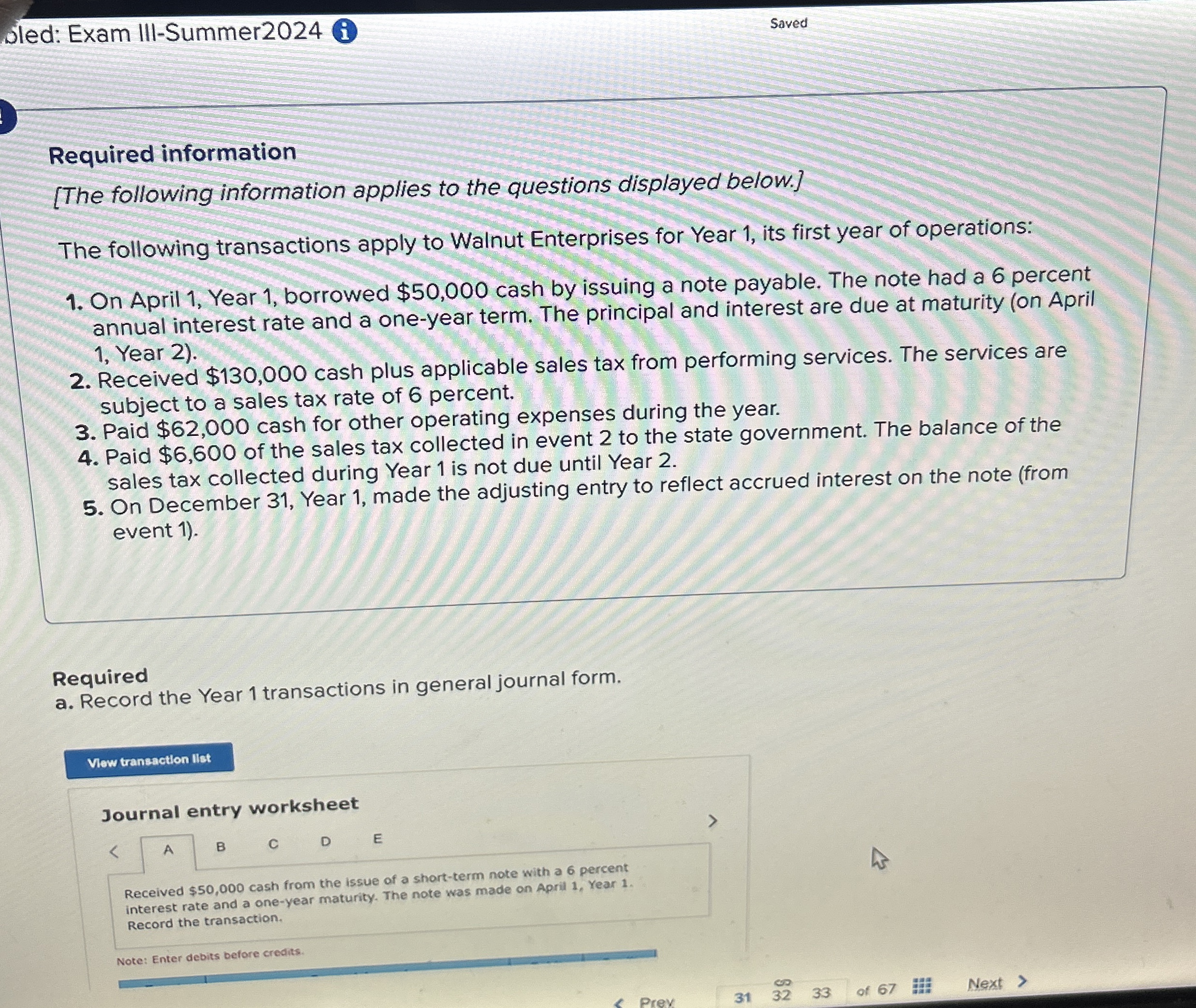

Required information

The following information applies to the questions displayed below.

The following transactions apply to Walnut Enterprises for Year its first year of operations:

On April Year borrowed $ cash by issuing a note payable. The note had a percent annual interest rate and a oneyear term. The principal and interest are due at maturity on April Year

Received $ cash plus applicable sales tax from performing services. The services are subject to a sales tax rate of percent.

Paid $ cash for other operating expenses during the year.

Paid $ of the sales tax collected in event to the state government. The balance of the sales tax collected during Year is not due until Year

On December Year made the adjusting entry to reflect accrued interest on the note from event

Required

a Record the Year transactions in general journal form.

Journal entry worksheet

A

B

C

D

E

Received $ cash fram the issue of a shortterm note with a percent

interest rate and a oneyear maturity. The note was made on April year

Record the transaction.

Note: Enter debits before credits.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock