4. Sleekfon and Sturdyfon are two major cell phone manufacturers that have recently merged. Their current...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

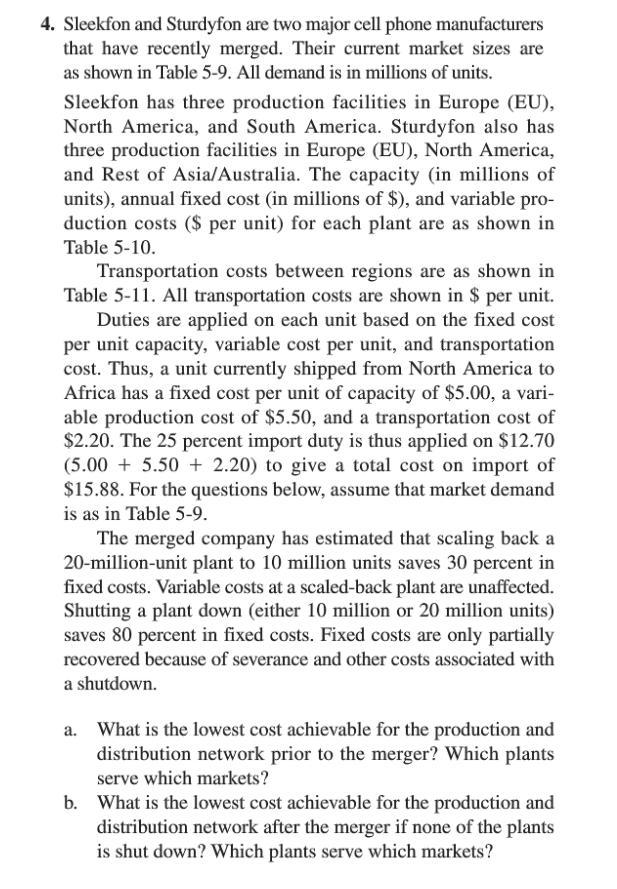

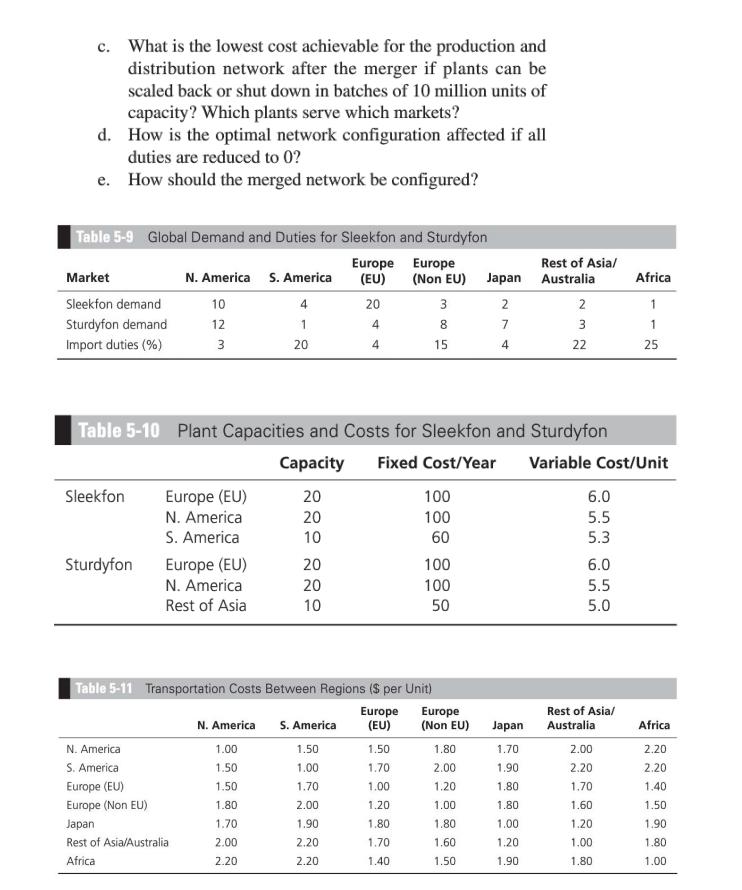

4. Sleekfon and Sturdyfon are two major cell phone manufacturers that have recently merged. Their current market sizes are as shown in Table 5-9. All demand is in millions of units. Sleekfon has three production facilities in Europe (EU), North America, and South America. Sturdyfon also has three production facilities in Europe (EU), North America, and Rest of Asia/Australia. The capacity (in millions of units), annual fixed cost (in millions of $), and variable pro- duction costs ($ per unit) for each plant are as shown in Table 5-10. Transportation costs between regions are as shown in Table 5-11. All transportation costs are shown in $ per unit. Duties are applied on each unit based on the fixed cost per unit capacity, variable cost per unit, and transportation cost. Thus, a unit currently shipped from North America to Africa has a fixed cost per unit of capacity of $5.00, a vari- able production cost of $5.50, and a transportation cost of $2.20. The 25 percent import duty is thus applied on $12.70 (5.00 + 5.50 + 2.20) to give a total cost on import of $15.88. For the questions below, assume that market demand is as in Table 5-9. The merged company has estimated that scaling back a 20-million-unit plant to 10 million units saves 30 percent in fixed costs. Variable costs at a scaled-back plant are unaffected. Shutting a plant down (either 10 million or 20 million units) saves 80 percent in fixed costs. Fixed costs are only partially recovered because of severance and other costs associated with a shutdown. What is the lowest cost achievable for the production and distribution network prior to the merger? Which plants serve which markets? b. What is the lowest cost achievable for the production and distribution network after the merger if none of the plants is shut down? Which plants serve which markets? c. What is the lowest cost achievable for the production and distribution network after the merger if plants can be scaled back or shut down in batches of 10 million units of capacity? Which plants serve which markets? d. How is the optimal network configuration affected if all duties are reduced to 0? e. How should the merged network be configured? Table 5-9 Global Demand and Duties for Sleekfon and Sturdyfon Europe Europe (EU) Rest of Asia/ Market N. America S. America (Non EU) Japan Australia Africa Sleekfon demand 10 4 20 3 2 2 1 Sturdyfon demand 12 1 4 8 7 3 1 Import duties (%) 3 20 4 15 4 22 25 Table 5-10 Plant Capacities and Costs for Sleekfon and Sturdyfon Capacity Fixed Cost/Year Variable Cost/Unit Sleekfon Europe (EU) 20 100 6.0 N. America 20 100 5.5 S. America 10 60 5.3 Sturdyfon Europe (EU) N. America 20 100 6.0 20 100 5.5 Rest of Asia 10 50 5.0 Table 5-11 Transportation Costs Between Regions ($ per Unit) Europe (EU) Europe (Non EU) Rest of Asia/ N. America S. America Japan Australia Africa N. America 1.00 1.50 1.50 1.80 1.70 2.00 2.20 S. America 1.50 1.00 1.70 2.00 1.90 2.20 2.20 Europe (EU) 1.50 1.70 1.00 1.20 1.80 1.70 1.40 Europe (Non EU) 1.80 2.00 1.20 1.00 1.80 1.60 1.50 Japan 1.70 1.90 1.80 1.80 1.00 1.20 1.90 Rest of Asia/Australia 2.00 2.20 1.70 1.60 1.20 1.00 1.80 Africa 2.20 2.20 1.40 1.50 1.90 1.80 1.00 4. Sleekfon and Sturdyfon are two major cell phone manufacturers that have recently merged. Their current market sizes are as shown in Table 5-9. All demand is in millions of units. Sleekfon has three production facilities in Europe (EU), North America, and South America. Sturdyfon also has three production facilities in Europe (EU), North America, and Rest of Asia/Australia. The capacity (in millions of units), annual fixed cost (in millions of $), and variable pro- duction costs ($ per unit) for each plant are as shown in Table 5-10. Transportation costs between regions are as shown in Table 5-11. All transportation costs are shown in $ per unit. Duties are applied on each unit based on the fixed cost per unit capacity, variable cost per unit, and transportation cost. Thus, a unit currently shipped from North America to Africa has a fixed cost per unit of capacity of $5.00, a vari- able production cost of $5.50, and a transportation cost of $2.20. The 25 percent import duty is thus applied on $12.70 (5.00 + 5.50 + 2.20) to give a total cost on import of $15.88. For the questions below, assume that market demand is as in Table 5-9. The merged company has estimated that scaling back a 20-million-unit plant to 10 million units saves 30 percent in fixed costs. Variable costs at a scaled-back plant are unaffected. Shutting a plant down (either 10 million or 20 million units) saves 80 percent in fixed costs. Fixed costs are only partially recovered because of severance and other costs associated with a shutdown. What is the lowest cost achievable for the production and distribution network prior to the merger? Which plants serve which markets? b. What is the lowest cost achievable for the production and distribution network after the merger if none of the plants is shut down? Which plants serve which markets? c. What is the lowest cost achievable for the production and distribution network after the merger if plants can be scaled back or shut down in batches of 10 million units of capacity? Which plants serve which markets? d. How is the optimal network configuration affected if all duties are reduced to 0? e. How should the merged network be configured? Table 5-9 Global Demand and Duties for Sleekfon and Sturdyfon Europe Europe (EU) Rest of Asia/ Market N. America S. America (Non EU) Japan Australia Africa Sleekfon demand 10 4 20 3 2 2 1 Sturdyfon demand 12 1 4 8 7 3 1 Import duties (%) 3 20 4 15 4 22 25 Table 5-10 Plant Capacities and Costs for Sleekfon and Sturdyfon Capacity Fixed Cost/Year Variable Cost/Unit Sleekfon Europe (EU) 20 100 6.0 N. America 20 100 5.5 S. America 10 60 5.3 Sturdyfon Europe (EU) N. America 20 100 6.0 20 100 5.5 Rest of Asia 10 50 5.0 Table 5-11 Transportation Costs Between Regions ($ per Unit) Europe (EU) Europe (Non EU) Rest of Asia/ N. America S. America Japan Australia Africa N. America 1.00 1.50 1.50 1.80 1.70 2.00 2.20 S. America 1.50 1.00 1.70 2.00 1.90 2.20 2.20 Europe (EU) 1.50 1.70 1.00 1.20 1.80 1.70 1.40 Europe (Non EU) 1.80 2.00 1.20 1.00 1.80 1.60 1.50 Japan 1.70 1.90 1.80 1.80 1.00 1.20 1.90 Rest of Asia/Australia 2.00 2.20 1.70 1.60 1.20 1.00 1.80 Africa 2.20 2.20 1.40 1.50 1.90 1.80 1.00

Expert Answer:

Answer rating: 100% (QA)

lwest st hievble fr rdutin nd distributin fr the first mny is 56438600 ... View the full answer

Related Book For

Applied Regression Analysis and Other Multivariable Methods

ISBN: 978-1285051086

5th edition

Authors: David G. Kleinbaum, Lawrence L. Kupper, Azhar Nizam, Eli S. Rosenberg

Posted Date:

Students also viewed these mathematics questions

-

The data shown in the following table are highway gasoline mileage performance and engine displacement for a sample of 20 cars. (a) Fit a simple linear model relating highway miles per gallon (y) to...

-

The financial information shown in the following table was presented for Massive Enterprises Ltd. for the year ending May 31, 20X1. Statement of Income Sales $1,700,000 Cost of sales 830,000 Gross...

-

Three large tanks contain brine, as shown in the following figure. Use the information in the figure to construct a mathematical model for the number of pounds of salt x 1 (t), x 2 (t), and x 3...

-

An electron experiences the greatest force as it travels 2.9 X 106 m/s in a magnetic field when it is moving north-ward. The force is upward and of magnitude 7.2 X 10-13N. What are the magnitude and...

-

How may bonds be purchased?

-

For the following exercises, determine whether the table could represent a function that is linear, exponential, or neither. If it appears to be exponential, find a function that passes through the...

-

Which entry strategy has the least risk and why?

-

Prepare entries for (a), (b), and (c) listed below using two methods. First, prepare the entries without making a reversing entry. Second, prepare the entries with the use of a reversing entry. Use...

-

Georgia, Inc. has collected the following data on one of its products. The actual cost of direct materials used is: Direct materials standard (2 lbs @ $3/lb) $6 per finished unit Total direct...

-

You are the executive assistant to the director of sales at B-Trendz, Inc., a trendy retail store that has locations in only ten states. The company is considering branching into the online retail...

-

Question 1 0/2 pts O 10 2 4 0 Det Suppose the true proportion of voters in the county who support a restaurant tax is 0.35. Consider the sampling distribution for the proportion of supporters with...

-

Your friend Amber has approached you seeking advice concerning two investment opportunities that she is presently considering. Her classmate Simone has asked her for a loan of $5,000 to help...

-

Please read the following carefully. For each question on the exam, you should assume that: 1. unless expressly stated to the contrary, all events occurred in ?the current taxable year;? 2. all...

-

The pulse rates of 152 randomly selected adult males vary from a low of 37 bpm to a high of 117 bpm. Find the minimum sample size required to estimate the mean pulse rate of adult males. Assume that...

-

Can I get clear explanation how to work these. Thanking you in advance. 1. A rod 12.0 cm long is uniformly charged and has a total charge of -23.0 uC. Determine the magnitude and direction of the...

-

Poll Results in the Media USA Today provided results from a survey of 1144 Americans who were asked if they approve of Brett Kavanaugh as the choice for Supreme Court justice. 51% of the respondents...

-

a) What is the shutdown point? What is the break-even point? b) What is the short run equilibrium price in this market? c) What amount of profit (or loss) is being made by each firm at the short-run...

-

For the data in Exercise 17-19, use the FIFO method to summarize total costs to account for, and assign these costs to units completed and transferred out, and to units in ending work in process....

-

A company evaluated three new production-line technologies, one involving high automation, the second involving moderate automation, and the third involving low automation. All three technologies...

-

Consider the following computer results, which describe regression analyses involving two independent variables X1 and X2 and a dependent variable Y. Assume that your goal is to assess the...

-

An experiment was conducted to determine the extent to which the growth rate of a certain fungus could be affected by filling test tubes containing the same medium at the same temperature with...

-

2. If you were the top manager at Hormel, name two organizational systems you would establish to encourage organization member creativity.

-

would ensure Hormels future success. Be sure to explain how each idea would contribute to that success.

-

3. List three creative ideas based on your TQM expertise that, if implemented,

Study smarter with the SolutionInn App