Question: Slide 9 I need D, E, F, G, H, I ,J ANSWERS Question 3. The quarterly investors call is approaching and you were asked to

Slide 9 I need D, E, F, G, H, I ,J ANSWERS

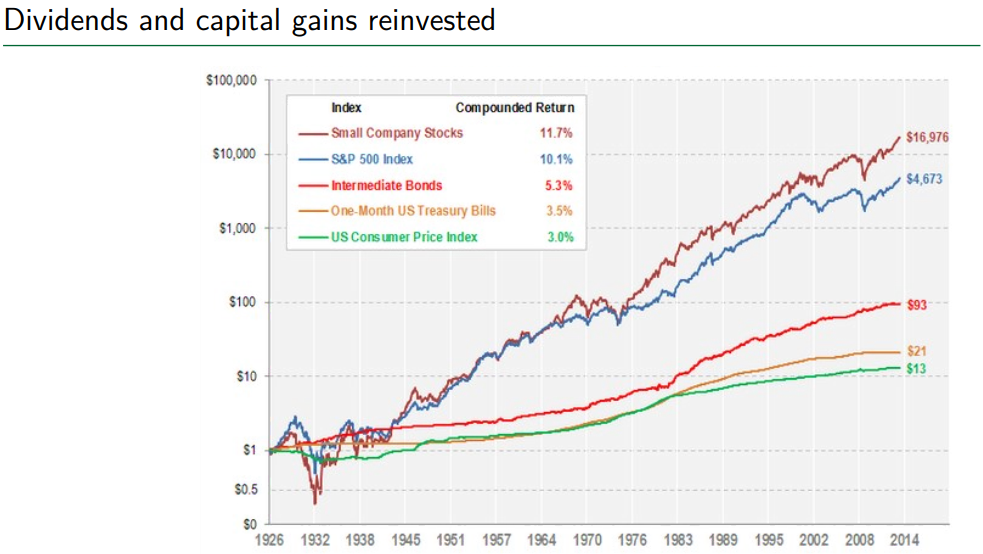

Question 3. The quarterly investors call is approaching and you were asked to comment on the EPS and projected EPS based on the growth forecast of 10%. (a) Compute the EPS for the Current Fiscal Year (b) What is the projected EPS with the same assumptions as in Question 1? You are a bit skeptical of the projected 10% growth in sales and decided to look at a much less aggressive long-run growth scenario of 3.5% growth in sales. (c) What is the projected EPS for a 3.5% growth in sales? If the dividend payout ratio remains the same, how much is paid per share? As some external financing will be needed to accommodate any growth, you started looking into raising debt and/or equity. Since your company would be mostly described as a small- cap US company, you looked at market data to help you determine your costs of equity and debt. (d) Using the information on slide 9 on the deck from Week 4 - Part I, what should be the risk premium for appropriate market for your company? Assume the risk free is given by Imo Treasury Bills. (e) Looking at historical stock market data, you determined that your beta is roughly 1.4 with respect to the market benchmark you used above to compute the risk premium. What should your cost of equity be? (f) In order to get a little more comfortable with the number com above, you decided to look at the cost of equity using the dividend growth corresponding to the 3.5% sales growth scenario from (c). If you decide to use the average dividend growth value from last 8 years, what is the cost of equity using this approach? Do you think this is a reliable number? If so, why not? In order to determine your cost of debt, you decided to look at your long term debt, which is structured as a single 20yr bond with semi-annual coupons, a coupon rate of 10%, and is currently trading at 83%. (g) What is your cost of debt? (h) What is your after-tax cost of debt? Your CEO is interested in knowing what is the minimum return the company should generate to make sure investors are satisfied, but is not sure which number to focus on. (i) What measure should you propose and how would you explain it to your CEO? 6) What is the value for the proposed measure? Dividends and capital gains reinvested $100,000 Index Compounded Return Small Company Stocks 11.7% $16,976 $10,000 S&P 500 Index 10.1% your 5.3% $4,673 Intermediate Bonds -One-Month US Treasury Bills US Consumer Price Index Zoom 3.5% $1,000 3.0% $100 $93 $21 $13 $10 $1 $0.5 SO 1926 1932 1938 1945 1951 1957 1964 1970 1976 1983 1989 1995 2002 2008 2014 Question 3. The quarterly investors call is approaching and you were asked to comment on the EPS and projected EPS based on the growth forecast of 10%. (a) Compute the EPS for the Current Fiscal Year (b) What is the projected EPS with the same assumptions as in Question 1? You are a bit skeptical of the projected 10% growth in sales and decided to look at a much less aggressive long-run growth scenario of 3.5% growth in sales. (c) What is the projected EPS for a 3.5% growth in sales? If the dividend payout ratio remains the same, how much is paid per share? As some external financing will be needed to accommodate any growth, you started looking into raising debt and/or equity. Since your company would be mostly described as a small- cap US company, you looked at market data to help you determine your costs of equity and debt. (d) Using the information on slide 9 on the deck from Week 4 - Part I, what should be the risk premium for appropriate market for your company? Assume the risk free is given by Imo Treasury Bills. (e) Looking at historical stock market data, you determined that your beta is roughly 1.4 with respect to the market benchmark you used above to compute the risk premium. What should your cost of equity be? (f) In order to get a little more comfortable with the number com above, you decided to look at the cost of equity using the dividend growth corresponding to the 3.5% sales growth scenario from (c). If you decide to use the average dividend growth value from last 8 years, what is the cost of equity using this approach? Do you think this is a reliable number? If so, why not? In order to determine your cost of debt, you decided to look at your long term debt, which is structured as a single 20yr bond with semi-annual coupons, a coupon rate of 10%, and is currently trading at 83%. (g) What is your cost of debt? (h) What is your after-tax cost of debt? Your CEO is interested in knowing what is the minimum return the company should generate to make sure investors are satisfied, but is not sure which number to focus on. (i) What measure should you propose and how would you explain it to your CEO? 6) What is the value for the proposed measure? Dividends and capital gains reinvested $100,000 Index Compounded Return Small Company Stocks 11.7% $16,976 $10,000 S&P 500 Index 10.1% your 5.3% $4,673 Intermediate Bonds -One-Month US Treasury Bills US Consumer Price Index Zoom 3.5% $1,000 3.0% $100 $93 $21 $13 $10 $1 $0.5 SO 1926 1932 1938 1945 1951 1957 1964 1970 1976 1983 1989 1995 2002 2008 2014

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts