Question: slove wiht math on the side please! Required information [The following information applies to the questions displayed below.) Pete's Tennis Shop has the following transactions

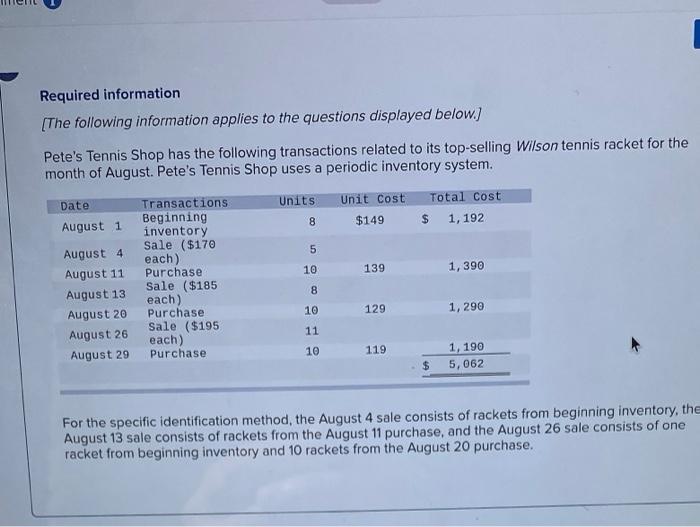

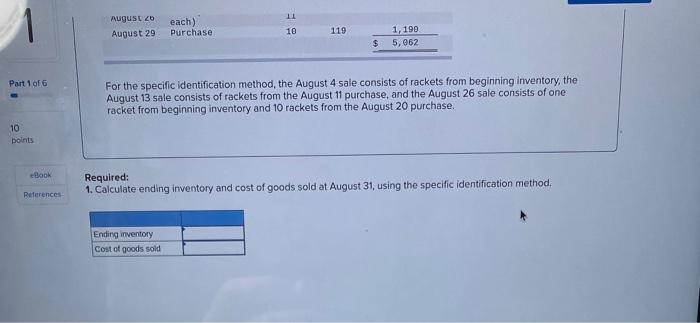

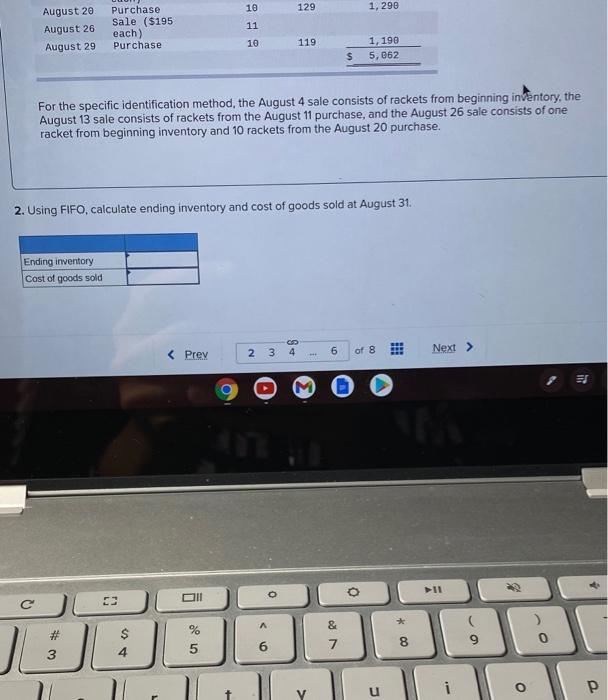

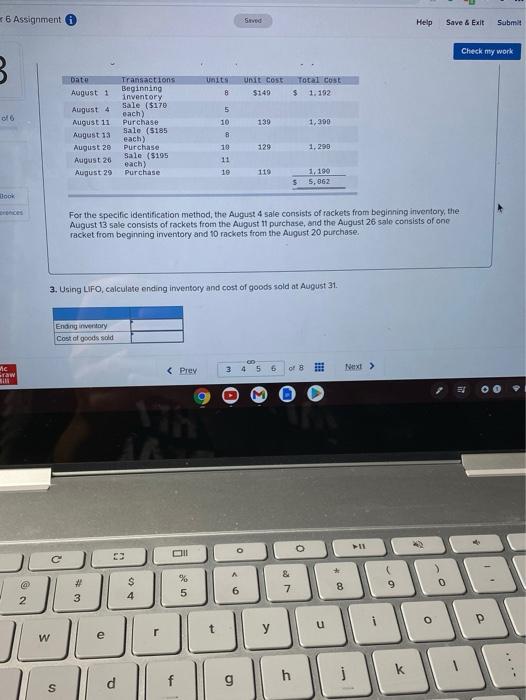

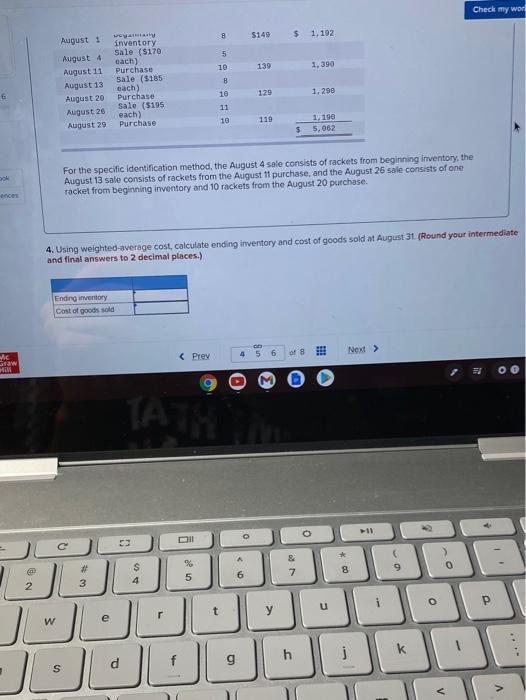

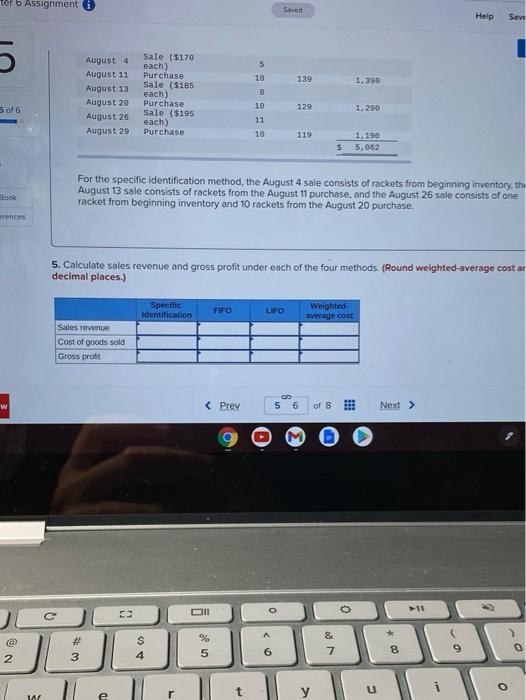

Required information [The following information applies to the questions displayed below.) Pete's Tennis Shop has the following transactions related to its top-selling Wilson tennis racket for the month of August. Pete's Tennis Shop uses a periodic inventory system. Units Unit Cost Date Total cost $ 1,192 8 $149 August 1 5 10 139 1, 390 Transactions Beginning inventory Sale ($170 each) Purchase Sale ($185 each) Purchase Sale ($195 each) Purchase August 4 August 11 August 13 August 20 August 26 August 29 8 10 129 1,290 11 10 119 1, 190 5,062 For the specific identification method, the August 4 sale consists of rackets from beginning inventory, the August 13 sale consists of rackets from the August 11 purchase, and the August 26 sale consists of one racket from beginning inventory and 10 rackets from the August 20 purchase. August 20 August 29 each) Purchase 10 119 1, 190 5,062 $ Part 1 of 6 For the specific identification method, the August 4 sale consists of rackets from beginning inventory, the August 13 sale consists of rackets from the August 11 purchase, and the August 26 sale consists of one racket from beginning inventory and 10 rackets from the August 20 purchase. 10 points BOOK Required: 1. Calculate ending inventory and cost of goods sold at August 31, using the specific identification method. References Ending inventory Cost of goods sold 10 129 1,290 Purchase Sale ($195 each) Purchase August 20 August 26 August 29 11 10 119 1, 190 5,062 $ For the specific identification method, the August 4 sale consists of rackets from beginning inventory, the August 13 sale consists of rackets from the August 11 purchase, and the August 26 sale consists of one racket from beginning inventory and 10 rackets from the August 20 purchase. 2. Using FIFO, calculate ending inventory and cost of goods sold at August 31. Ending inventory Cost of goods sold 2 3 4 6 ES . o O DI ca A & % # 3 $ 4 0 6 8 7 9 5 GEBOB . u O i t 6 Assignment Seved Help Save & Exit Submit Check my work 3 Transactions Beginning inventory Sale ($170 Units 8 unit COSE Total Cost $ 1. 192 $149 each) 5 10 139 Datu August 1 August 4 August 11 August 13 August 2e August 26 August 29 Purchase Sale (5185 1,300 B each) 129 1,298 Purchase Sale ($105 each) Purchase 10 11 1e 119 1,190 5,062 $ Book For the specific identification method, the August 4 sale consists of rackets from beginning inventory, the August 13 sale consists of rackets from the August 11 purchase, and the August 26 sale consists of one racket from beginning inventory and 10 rackets from the August 20 purchase. 3. Using LIFO, calculate ending inventory and cost of goods sold at August 31 Ending inventory Cost of goods sold O o 11 0 c ofs !! Me Graw Hill 7 TA . 11 O DI & 7 00+ $ 4 9 8 40 2 5 6 3 O P t u w I - ): " k g S v Ter b Assignment i Saved Help Save 5 10 139 1,390 August 4 August 11 August 13 August 20 August 26 August 29 Sale ($170 each) Purchase Sale ($185 each) Purchase Sale ($195 each) Purchase 8 5 of 6 10 129 1,290 11 10 119 1. 190 $ 5,062 For the specific identification method, the August 4 sale consists of rackets from beginning inventory.th August 13 sale consists of rackets from the August 11 purchase, and the August 26 sale consists of one racket from beginning inventory and 10 rackets from the August 20 purchase. Book erences 5. Calculate sales revenue and gross profit under each of the four methods. (Round weighted average costar decimal places.) Specific Identification FIFO LIFO Weighted average cost Sales revenue Cost of goods sold Gross profit w DI O 11 0 o i o @

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts