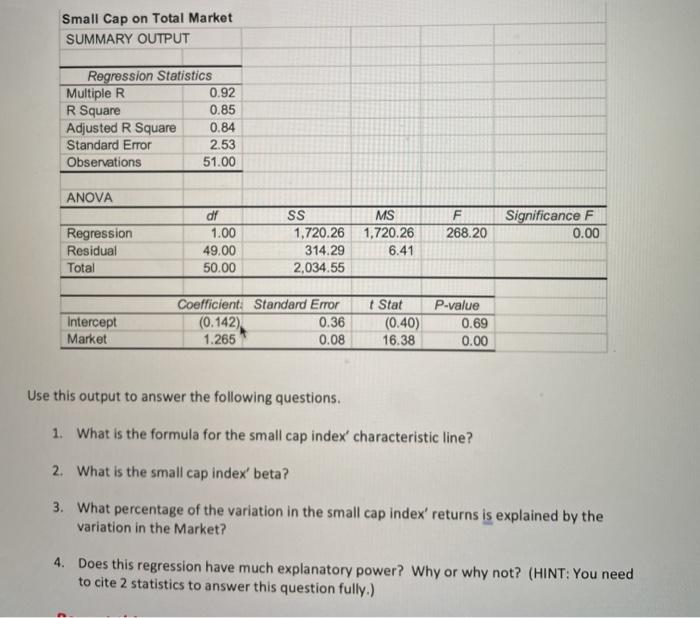

Question: Small Cap on Total Market SUMMARY OUTPUT Regression Statistics Multiple R 0.92 R Square 0.85 Adjusted R Square 0.84 Standard Error 2.53 Observations 51.00 ANOVA

Small Cap on Total Market SUMMARY OUTPUT Regression Statistics Multiple R 0.92 R Square 0.85 Adjusted R Square 0.84 Standard Error 2.53 Observations 51.00 ANOVA F 268.20 Significance F 0.00 Regression Residual Total df 1.00 49.00 50.00 MS 1,720.26 6.41 SS 1,720.26 314.29 2,034.55 Intercept Market Coefficient: Standard Error (0.142) 0.36 1.265 0.08 t Stat (0.40) 16.38 P-value 0.69 0.00 Use this output to answer the following questions. 1. What is the formula for the small cap index' characteristic line? 2. What is the small cap index' beta? 3. What percentage of the variation in the small cap index' returns is explained by the variation in the Market? 4. Does this regression have much explanatory power? Why or why not? (HINT: You need to cite 2 statistics to answer this question fully.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts