Question: Small Ltd signed a 3-year contract with Big Ltd for the use of a factory on 1 July 2020 with the option to purchase the

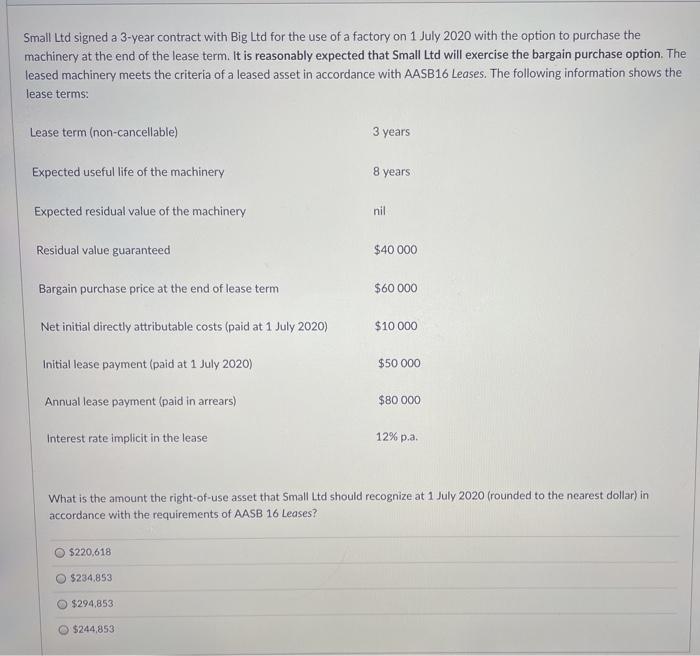

Small Ltd signed a 3-year contract with Big Ltd for the use of a factory on 1 July 2020 with the option to purchase the machinery at the end of the lease term. It is reasonably expected that Small Ltd will exercise the bargain purchase option. The leased machinery meets the criteria of a leased asset in accordance with AASB16 Leases. The following information shows the lease terms. Lease term (non-cancellable) 3 years Expected useful life of the machinery 8 years Expected residual value of the machinery nil Residual value guaranteed $40 000 Bargain purchase price at the end of lease term $60 000 Net initial directly attributable costs (paid at 1 July 2020) $10 000 Initial lease payment (paid at 1 July 2020) $50 000 Annual lease payment (paid in arrears) $80 000 Interest rate implicit in the lease 12% p.a. What is the amount the right-of-use asset that Small Ltd should recognize at 1 July 2020 (rounded to the nearest dollar) in accordance with the requirements of AASB 16 Leases? $220,618 $234,853 $294.853 $244,853

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts