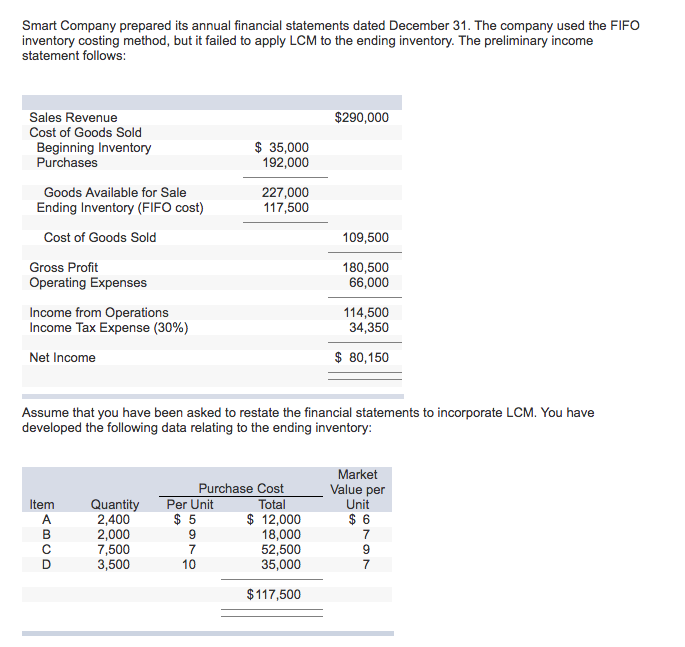

Question: Smart Company pre inventory costing method, but it failed to apply LCM to the ending inventory. The preliminary income statement follows: pared its annual financial

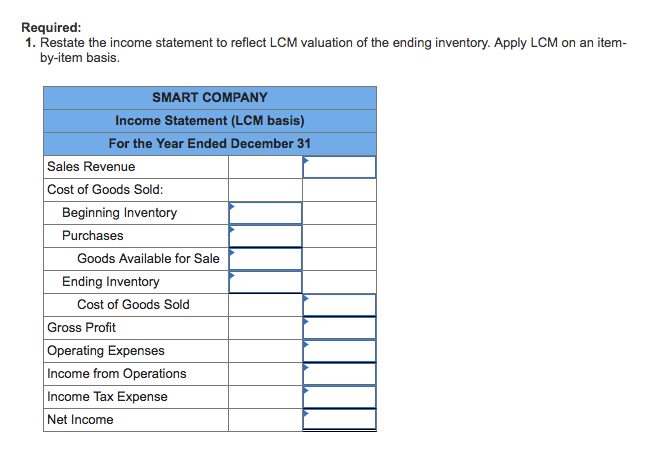

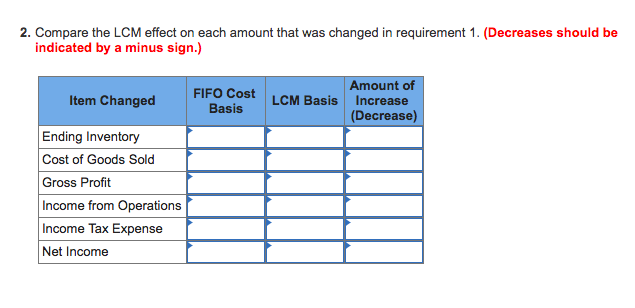

Smart Company pre inventory costing method, but it failed to apply LCM to the ending inventory. The preliminary income statement follows: pared its annual financial statements dated December 31. The company used the FIFO $290,000 Sales Revenue Cost of Goods Sold Beginning Inventory Purchases $35,000 192,000 Goods Available for Sale Ending Inventory (FIFO cost) 227,000 117,500 Cost of Goods Sold 109,500 Gross Profit Operating Expenses 180,500 66,000 Income from Operations Income Tax Expense (30%) 114,500 34,350 Net Income $ 80,150 Assume that you have been asked to restate the financial statements to incorporate LCM. You have developed the following data relating to the ending inventory: Market Value per Unit $ 6 Purchase Cost Total Item Quantity Per Unit 2,400 2,000 7,500 3,500 $12,000 18,000 52,500 35,000 $ 5 7 7 10 $117,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts