Question: Smart Stream Inc. uses the total cost method of applying the cost-plus approach to product pricing. The costs of producing and selling 7,500 units

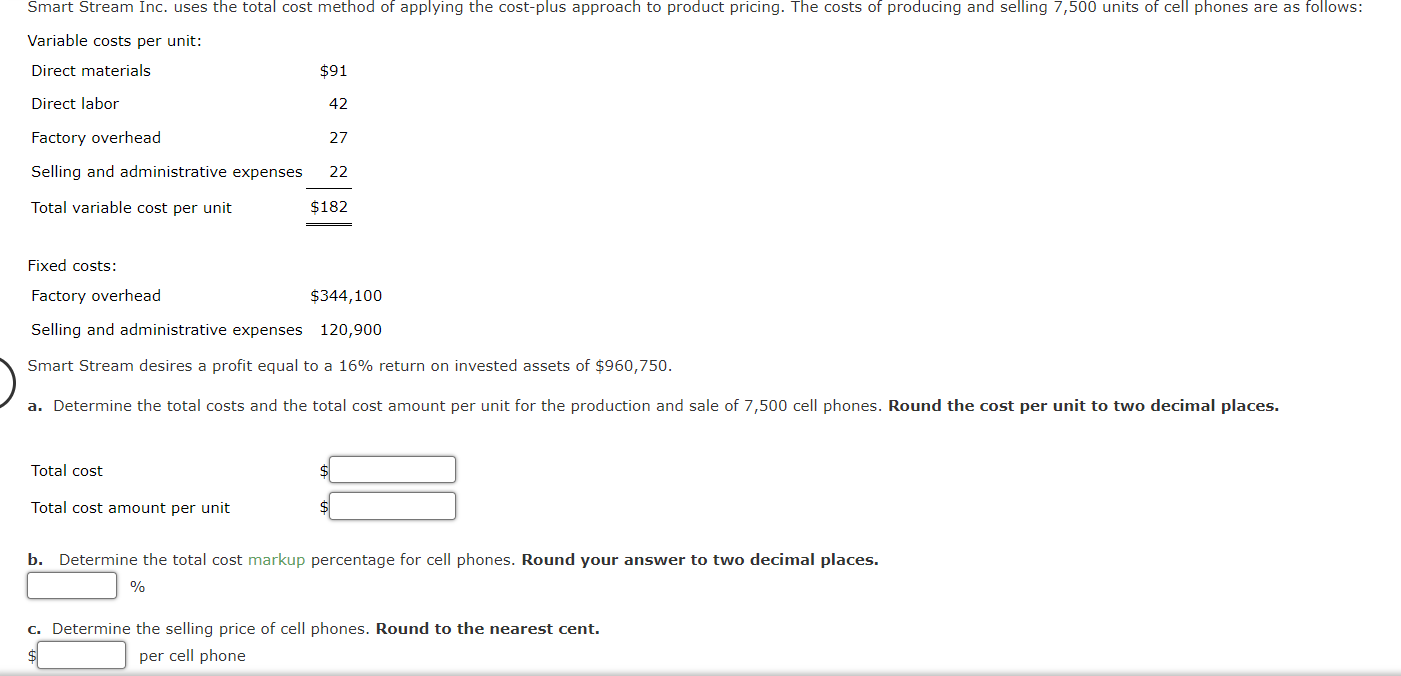

Smart Stream Inc. uses the total cost method of applying the cost-plus approach to product pricing. The costs of producing and selling 7,500 units of cell phones are as follows: Variable costs per unit: Direct materials Direct labor $91 42 Factory overhead 27 Selling and administrative expenses 22 Total variable cost per unit $182 Fixed costs: Factory overhead $344,100 Selling and administrative expenses 120,900 Smart Stream desires a profit equal to a 16% return on invested assets of $960,750. a. Determine the total costs and the total cost amount per unit for the production and sale of 7,500 cell phones. Round the cost per unit to two decimal places. Total cost Total cost amount per unit Smart Stream Inc. uses the total cost method of applying the cost-plus approach to product pricing. The costs of producing and selling 7,500 units of cell phones are as follows: Variable costs per unit: Direct materials $91 42 Direct labor Factory overhead Selling and administrative expenses Total variable cost per unit Fixed costs: Factory overhead 27 22 $182 $344,100 Selling and administrative expenses 120,900 Smart Stream desires a profit equal to a 16% return on invested assets of $960,750. a. Determine the total costs and the total cost amount per unit for the production and sale of 7,500 cell phones. Round the cost per unit to two decimal places. Total cost Total cost amount per unit b. Determine the total cost markup percentage for cell phones. Round your answer to two decimal places. % c. Determine the selling price of cell phones. Round to the nearest cent. per cell phone

Step by Step Solution

There are 3 Steps involved in it

1 Total Costs and Total Cost Amount per Unit Total Variable Costs per Unit 91 Direct Materials 42 Di... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

6642cf709f863_973954.pdf

180 KBs PDF File

6642cf709f863_973954.docx

120 KBs Word File