Question: Smart Touch Learning began operations on December 1. Record the business transactions for the month of December. Explanations are not required. Refer to the Chart

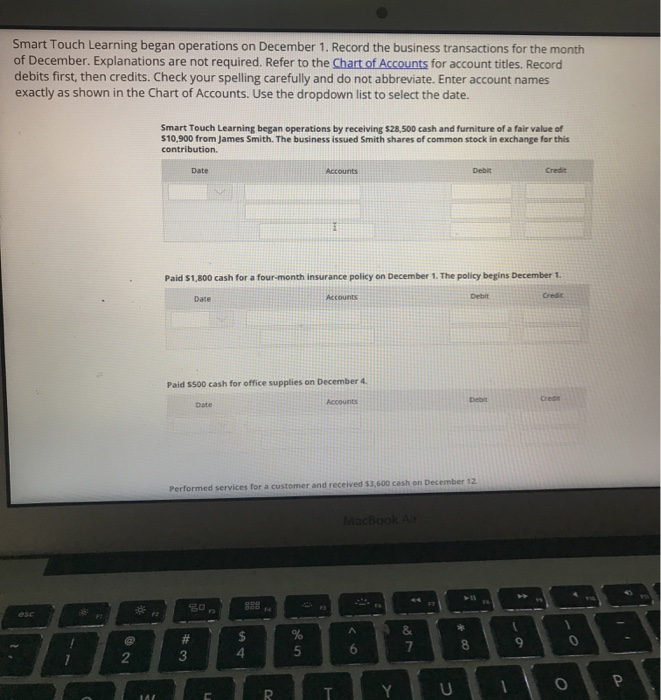

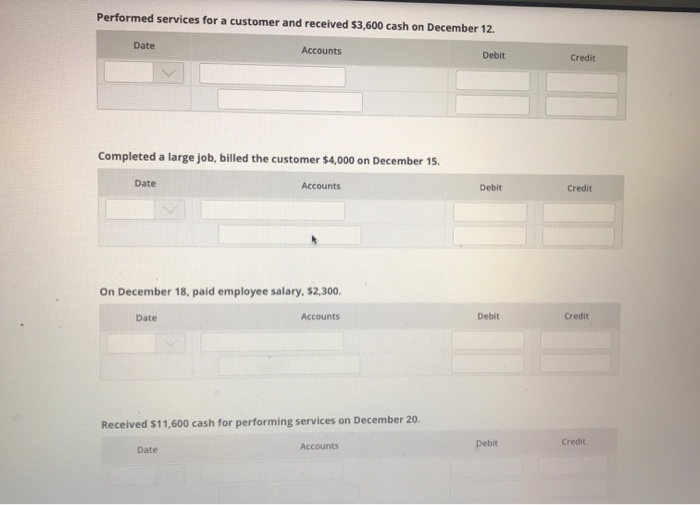

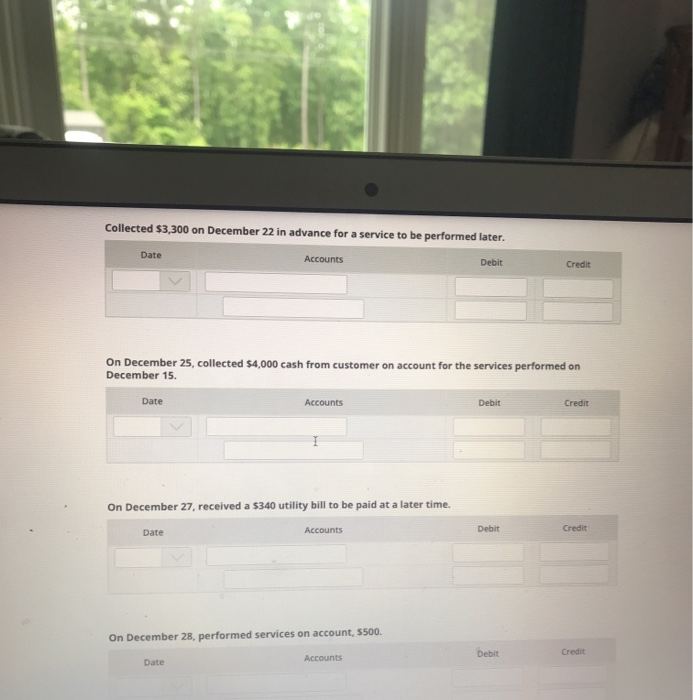

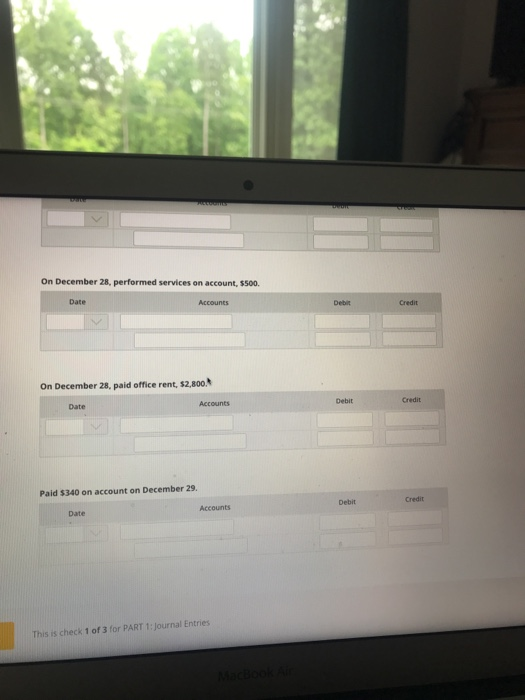

Smart Touch Learning began operations on December 1. Record the business transactions for the month of December. Explanations are not required. Refer to the Chart of Accounts for account titles. Record debits first, then credits. Check your spelling carefully and do not abbreviate. Enter account names exactly as shown in the Chart of Accounts. Use the dropdown list to select the date. Smart Touch Learning began operations by receiving $28,500 cash and furniture of a fair value of $10,900 from James Smith. The business issued Smith shares of common stock in exchange for this contribution. Date Accounts Debit Credit Paid $1,800 cash for a four-month insurance policy on December 1. The policy begins December 1. Date Accounts Debit Crede Paid 5500 cash for office supplies on December 4 Accounts De Date Crede Performed services for a customer and received $3,600 cash on December 12 MacBook ce 11 14 A % 5 & 7 8 9 2 4 0 U R. 141 C Performed services for a customer and received $3,600 cash on December 12. Date Accounts Debit Credit Completed a large job, billed the customer $4,000 on December 15. Date Accounts Debit Credit On December 18, paid employee salary, $2,300, Date Accounts Debit Credit Received $11,600 cash for performing services on December 20. Accounts Debit Date Credit Collected $3,300 on December 22 in advance for a service to be performed later. Date Accounts Debit Credit On December 25, collected $4,000 cash from customer on account for the services performed on December 15. Date Accounts Debit Credit On December 27, received a $340 utility bill to be paid at a later time. Date Accounts Debit Credit On December 28, performed services on account, $500. Debit Credit Date Accounts On December 28, performed services on account, 5500 Date Accounts Debat Credit On December 28, paid office rent, $2,800. Accounts Debit Date Credit Paid $340 on account on December 29. Debit Credit Accounts Date This is check 1 of 3 for PART 1: Journal Entries

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts