Question: SMB stands for a factor portfolio based on size. It is computed as the portfolio returns of small size stocks minus portfolio returns of large

SMB stands for a factor portfolio based on size. It is computed as the portfolio returns of small size stocks minus portfolio returns of large cap stocks. Negative coefficient is expected since the TRBCX fund invests in large cap stocks and has a negative exposure to this factor. ?

SMB stands for a factor portfolio based on Book to Market Ratio. It is computed as the portfolio returns of value stocks (high book to market) minus portfolio returns of growth stocks (low book to market). Negative coefficient is expected since the TRBCX fund invests in growth stocks and has a negative exposure to this factor. ?

SMB stands for a factor portfolio based on size. It is computed as the portfolio returns of small size stocks minus portfolio returns of large cap stocks. Positive coefficient is expected since the TRBCX fund invests in large cap stocks and should have superior performance compared to investment in small cap stocks ?

SMB stands for a factor portfolio based on momentum strategy. Due to Efficient Market Hypothesis the coefficient is expected to be zero.?

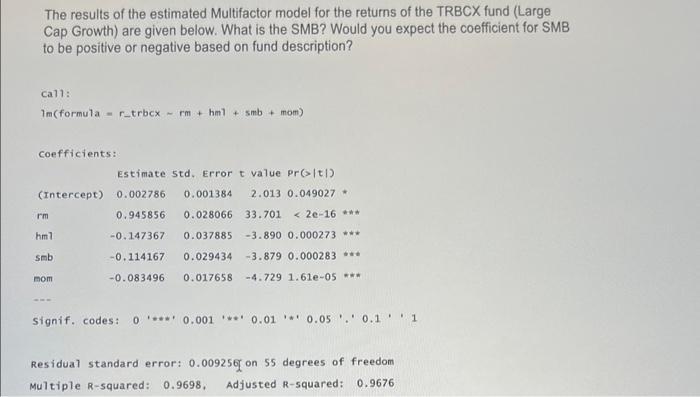

The results of the estimated Multifactor model for the returns of the TRBCX fund (Large Cap Growth) are given below. What is the SMB? Would you expect the coefficient for SMB to be positive or negative based on fund description? call: 1m (formular_trbcx - rm + 11 + smb + mom) Coefficients: Estimate Std. Error t value Prit|) (Intercept) 0.002786 0.001384 2.013 0.049027 * 0.945856 0.028066 33.701 < 2e-16 *** -0.147367 0.037885 -3.890 0.000273 *** -0.114167 0.029434 -3.879 0.000283 *** -0.083496 0.017658 -4.729 1.61e-05 *** rm hml smb mom signif. codes: 00.001 0.01 0.05 0.1 1. Residual standard error: 0.009256 on 55 degrees of freedom Multiple R-squared: 0.9698, Adjusted R-squared: 0.9676

Step by Step Solution

3.51 Rating (161 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts