Question: Smeagal Industries is considering a new division, making pixie dust in a handy resealable pouch. They intend to finance it with 50% equity, and 50%

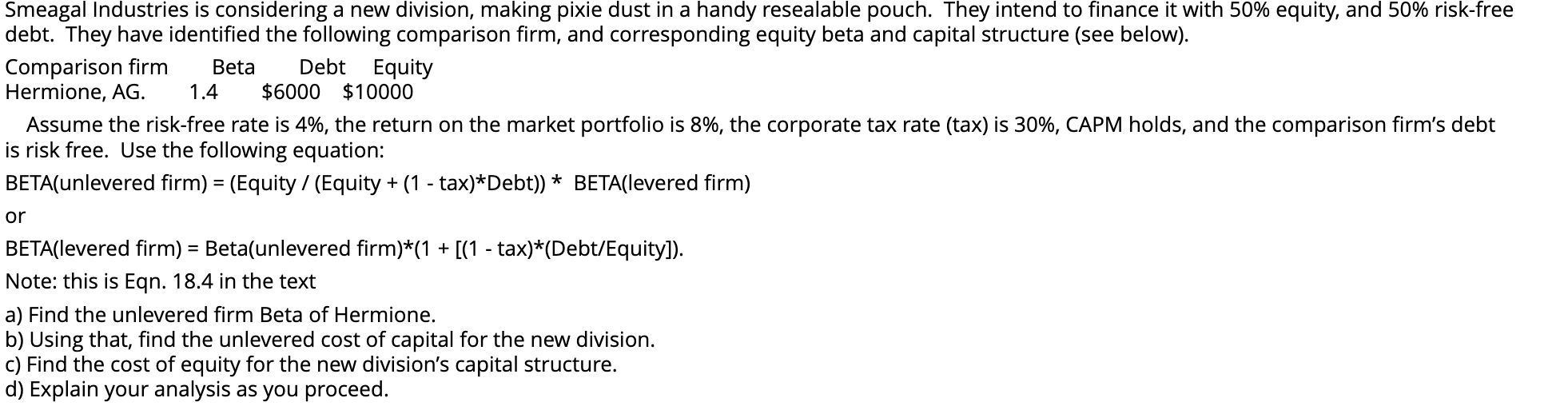

Smeagal Industries is considering a new division, making pixie dust in a handy resealable pouch. They intend to finance it with 50% equity, and 50% risk-free debt. They have identified the following comparison firm, and corresponding equity beta and capital structure (see below). Assume the risk-free rate is 4%, the return on the market portfolio is 8%, the corporate tax rate (tax) is 30%, CAPM holds, and the comparison firm's debt s risk free. Use the following equation: BETA(unlevered firm )=( Equity /( Equity +(1 tax ) Debt )) BETA(levered firm ) BETA(levered firm )=B Beta(unlevered firm )(1+[(1 tax )( Debt/Equity ]) Note: this is Eqn. 18.4 in the text a) Find the unlevered firm Beta of Hermione. o) Using that, find the unlevered cost of capital for the new division. c) Find the cost of equity for the new division's capital structure. d) Explain your analysis as you proceed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts