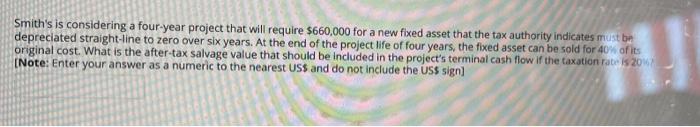

Question: Smith's is considering a four-year project that will require $660,000 for a new fixed asset that the tax authority indicates must be depreciated straight-line to

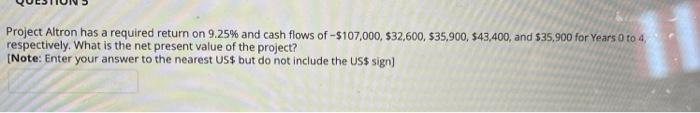

Smith's is considering a four-year project that will require $660,000 for a new fixed asset that the tax authority indicates must be depreciated straight-line to zero over six years. At the end of the project life of four years, the fixed asset can be sold for 40% of its original cost. What is the after-tax salvage value that should be included in the project's terminal cash flow if the taxation rate is 20% [Note: Enter your answer as a numeric to the nearest US$ and do not include the US$ sign] Project Altron has a required return on 9.25% and cash flows of -$107,000, $32,600, $35,900, $43,400, and $35,900 for Years 0 to 4, respectively. What is the net present value of the project? [Note: Enter your answer to the nearest US$ but do not include the US$ sign]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts