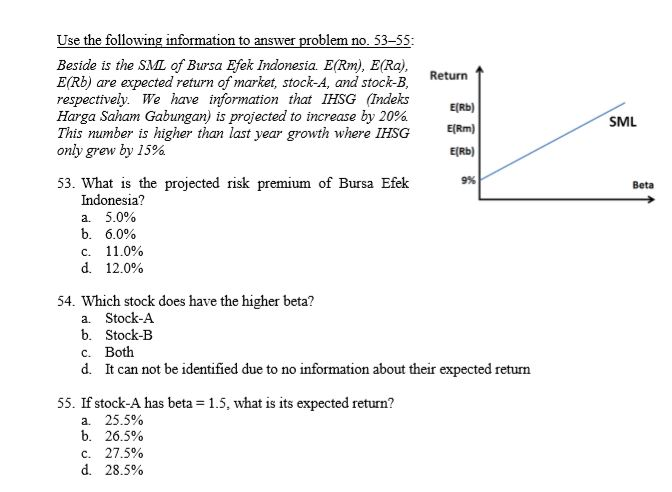

Question: SML 9% Beta Use the following information to answer problem no. 5355: Beside is the SML of Bursa Efek Indonesia. E(Rm), E(Ra), E(Rb) are expected

SML 9% Beta Use the following information to answer problem no. 5355: Beside is the SML of Bursa Efek Indonesia. E(Rm), E(Ra), E(Rb) are expected return of market, stock-A, and stock-B, Return respectively. We have information that IHSG (Indeks Harga Saham Gabungan) is projected to increase by 20%. E(RD) This number is higher than last year growth where IHSG E[Rm) only grew by 15% E(Rb) 53. What is the projected risk premium of Bursa Efek Indonesia? a. 5.0% b. 6.0% 11.0% d. 12.0% 54. Which stock does have the higher beta? a. Stock-A b. Stock-B C. Both d. It can not be identified due to no information about their expected return 55. If stock-A has beta = 1.5, what is its expected return? a. 25.5% b. 26.5% c. 27.5% d. 28.5% C. SML 9% Beta Use the following information to answer problem no. 5355: Beside is the SML of Bursa Efek Indonesia. E(Rm), E(Ra), E(Rb) are expected return of market, stock-A, and stock-B, Return respectively. We have information that IHSG (Indeks Harga Saham Gabungan) is projected to increase by 20%. E(RD) This number is higher than last year growth where IHSG E[Rm) only grew by 15% E(Rb) 53. What is the projected risk premium of Bursa Efek Indonesia? a. 5.0% b. 6.0% 11.0% d. 12.0% 54. Which stock does have the higher beta? a. Stock-A b. Stock-B C. Both d. It can not be identified due to no information about their expected return 55. If stock-A has beta = 1.5, what is its expected return? a. 25.5% b. 26.5% c. 27.5% d. 28.5% C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts