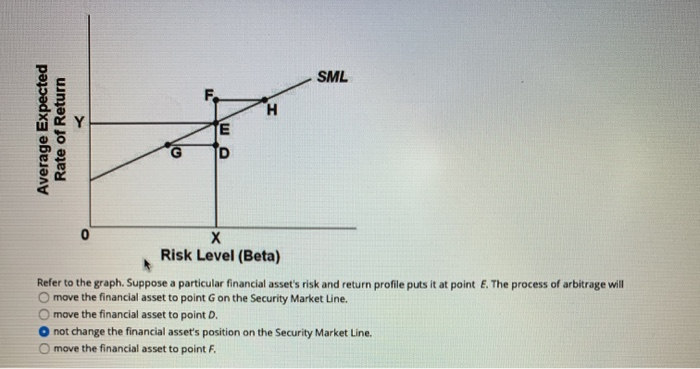

Question: SML Average Expected Rate of Return Risk Level (Beta) Refer to the graph. Suppose a particular financial asset's risk and return profile puts it at

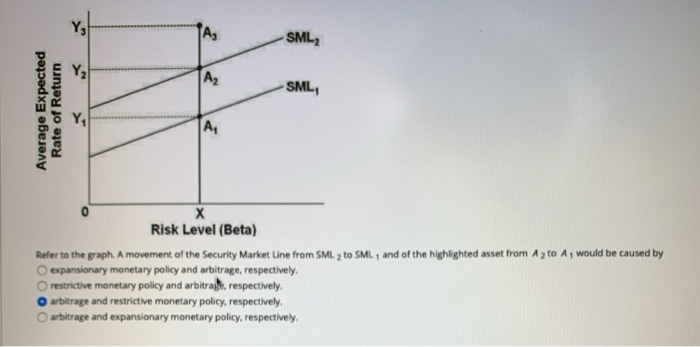

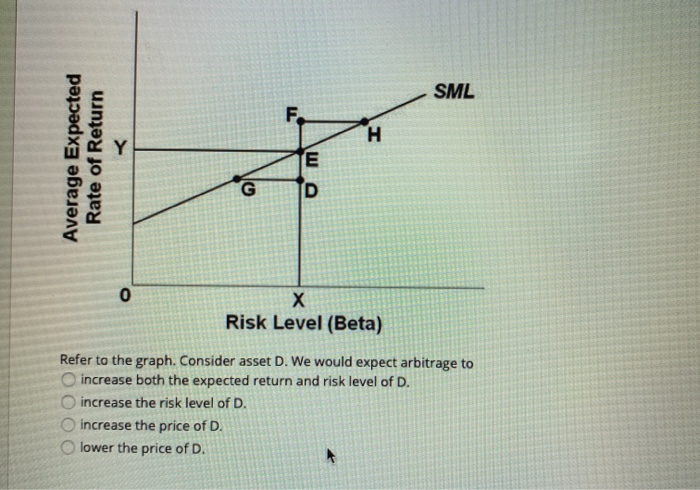

SML Average Expected Rate of Return Risk Level (Beta) Refer to the graph. Suppose a particular financial asset's risk and return profile puts it at point E. The process of arbitrage will O move the financial asset to point on the Security Market Line. move the financial asset to point D. o not change the financial asset's position on the Security Market Line. O move the financial asset to point F. SML SML, Average Expected Rate of Return Risk Level (Beta) Refer to the graph. A movement of the Security Market Line from SML to SML, and of the highlighted asset from A to Ay would be caused by O expansionary monetary policy and arbitrage, respectively, restrictive monetary policy and arbitrag, respectively arbitrage and restrictive monetary policy, respectively arbitrage and expansionary monetary policy, respectively, SML

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts