Question: SML, CAPM, Beta, Risk & Return Name: 1.) Nick Williams owns a 3-stock portfolio with a total investment value equal to $200,000. Stock Investment Beta

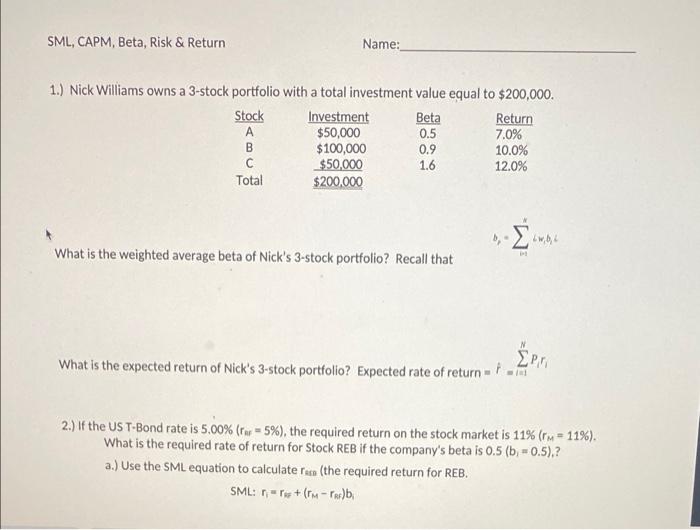

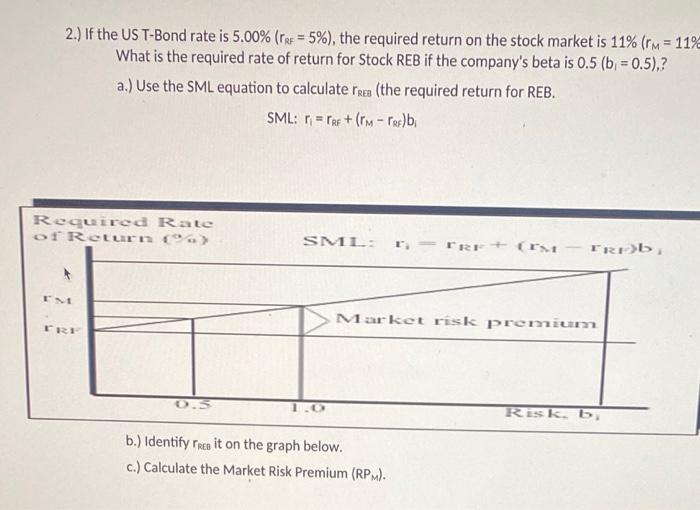

SML, CAPM, Beta, Risk & Return Name: 1.) Nick Williams owns a 3-stock portfolio with a total investment value equal to $200,000. Stock Investment Beta Return $50,000 0.5 7.0% $100,000 0.9 10.0% $50,000 1.6 12.0% Total $200,000 B ww, What is the weighted average beta of Nick's 3-stock portfolio? Recall that N What is the expected return of Nick's 3-stock portfolio? Expected rate of return=1 . 2.) If the US T-Bond rate is 5.00% (r = 5%), the required return on the stock market is 11% (r = 11%). What is the required rate of return for Stock REB if the company's beta is 0.5 (b) = 0.5),? a.) Use the SML equation to calculate re (the required return for REB. SML: + (-rab 2.) If the US T-Bond rate is 5.00% (rre = 5%), the required return on the stock market is 11% (r = 1193 What is the required rate of return for Stock REB if the company's beta is 0.5 (b) = 0.5).? a.) Use the SML equation to calculate rres (the required return for REB. SML: r = rre+ (rm- rb Required Rate of Return > SML: rrrr + (rst Trib Market risk premium TRE Rek. b b.) Identify rreg it on the graph below. c.) Calculate the Market Risk Premium (RPM). SML, CAPM, Beta, Risk & Return Name: e.) Is REB more or less risky than the stock market

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts