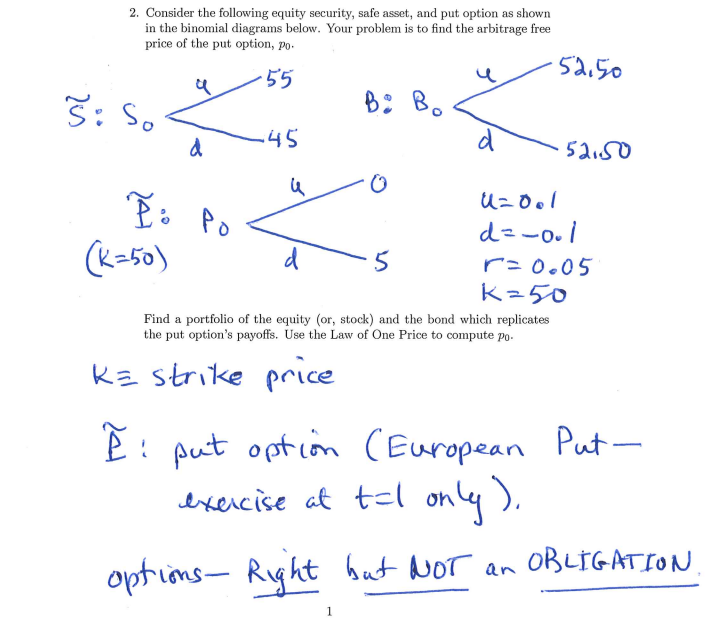

Question: : So 2. Consider the following equity security, safe asset, and put option as shown in the binomial diagrams below. Your problem is to find

: So 2. Consider the following equity security, safe asset, and put option as shown in the binomial diagrams below. Your problem is to find the arbitrage free price of the put option, Po. 52.50 55 B: B. d .45 d 52150 a Uzool d=-ool 5 r=0.05 k=50 Find a portfolio of the equity (or, stock) and the bond which replicates the put option's payoffs. Use the Law of One Price to compute po Po po (K=50) - k= strike price i put option (European Put- exercise at tal only) options- Right but NOT an OBLIGATION , 1 : So 2. Consider the following equity security, safe asset, and put option as shown in the binomial diagrams below. Your problem is to find the arbitrage free price of the put option, Po. 52.50 55 B: B. d .45 d 52150 a Uzool d=-ool 5 r=0.05 k=50 Find a portfolio of the equity (or, stock) and the bond which replicates the put option's payoffs. Use the Law of One Price to compute po Po po (K=50) - k= strike price i put option (European Put- exercise at tal only) options- Right but NOT an OBLIGATION , 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts