Question: So a bit confused as with variable and absorption costing - i have had a an attempt at this question and errors that arise would

So a bit confused as with variable and absorption costing - i have had a an attempt at this question and errors that arise would be extremely helpful to show where i have went wrong

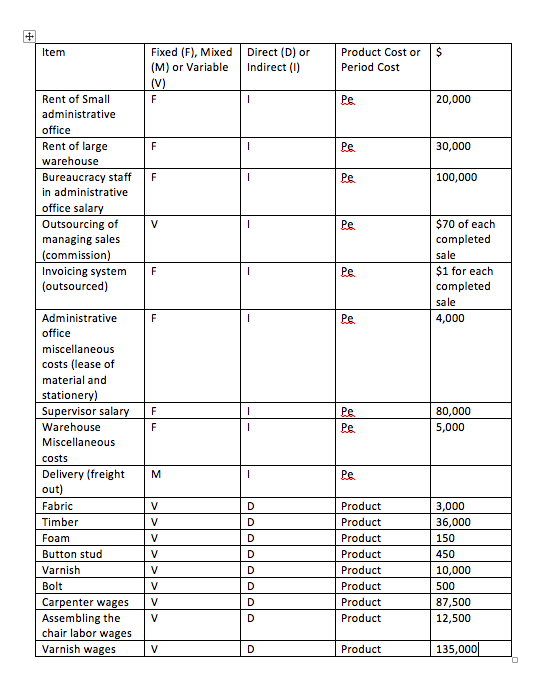

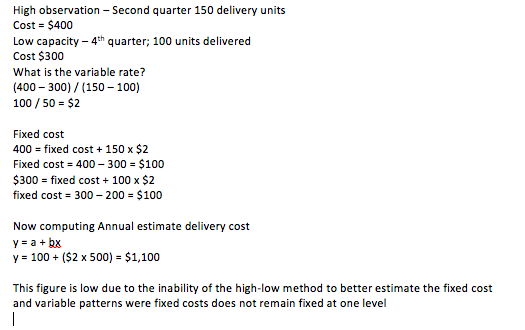

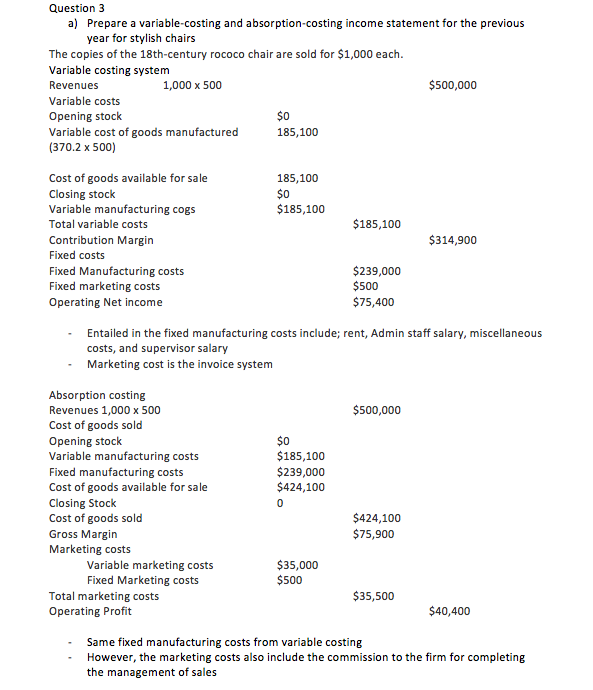

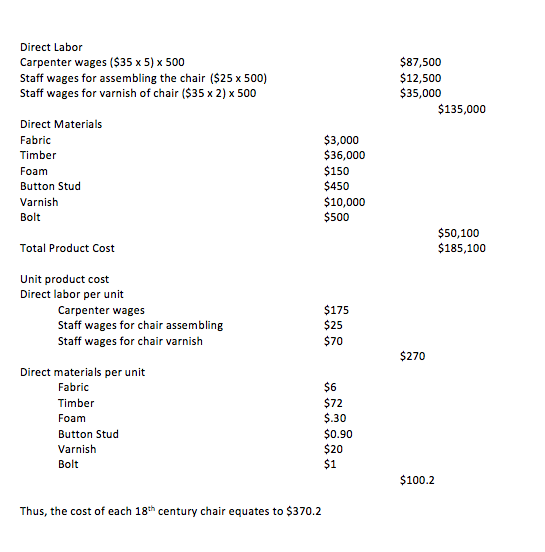

Item Fixed (F), Mixed Direct (D) or Product Cost or (M) or Variable Indirect (1) Period Cost (V) Rent of Small F Pe. 20,000 administrative office Rent of large F Pe. 30,000 warehouse Bureaucracy staff F Pe. 100,000 in administrative office salary Outsourcing of V $70 of each managing sales completed (commission) sale Invoicing system F Pe. $1 for each (outsourced) completed sale Administrative F Re. 4,000 office miscellaneous costs (lease of material and stationery) Supervisor salary F Pe. 80,000 Warehouse F Pe. 5,000 Miscellaneous costs Delivery (freight M I Pe. out) Fabric V D Product 3,000 Timber V D Product 36,000 Foam V D Product 150 Button stud V D Product 450 Varnish V D Product 10,000 Bol V D Product 500 Carpenter wages V D Product 87,500 Assembling the V D Product 12,500 chair labor wages Varnish wages V D Product 135,000High observation - Second quarter 150 delivery units Cost = $400 Low capacity - 4" quarter; 100 units delivered Cost $300 What is the variable rate? (400 - 300) / (150 -100) 100 / 50 = $2 Fixed cost 400 = fixed cost + 150 x $2 Fixed cost = 400 - 300 = $100 $300 = fixed cost + 100 x $2 fixed cost = 300 - 200 = $100 Now computing Annual estimate delivery cost y = a + by y = 100 + ($2 x 500) = $1,100 This figure is low due to the inability of the high-low method to better estimate the fixed cost and variable patterns were fixed costs does not remain fixed at one levelQuestion 3 a) Prepare a variable-costing and absorption-costing income statement for the previous year for stylish chairs The copies of the 18th-century rococo chair are sold for $1,000 each. Variable costing system Revenues 1,000 x 500 $500,000 Variable costs Opening stock $0 Variable cost of goods manufactured 185,100 (370.2 x 500) Cost of goods available for sale 185,100 Closing stock Variable manufacturing cogs $185,100 Total variable costs $185,100 Contribution Margin $314,900 Fixed costs Fixed Manufacturing costs $239,000 Fixed marketing costs $500 Operating Net income $75,400 Entailed in the fixed manufacturing costs include; rent, Admin staff salary, miscellaneous costs, and supervisor salary Marketing cost is the invoice system Absorption costing Revenues 1,000 x 500 $500,000 Cost of goods sold Opening stock $0 Variable manufacturing costs $185,100 Fixed manufacturing costs $239,000 Cost of goods available for sale $424,100 Closing Stock 0 Cost of goods sold $424,100 Gross Margin $75,900 Marketing costs Variable marketing costs $35,000 Fixed Marketing costs $500 Total marketing costs $35,500 Operating Profit $40,400 Same fixed manufacturing costs from variable costing However, the marketing costs also include the commission to the firm for completing the management of salesDirect Labor Carpenter wages ($35 x 5) x 500 $87,500 Staff wages for assembling the chair ($25 x 500) $12,500 Staff wages for varnish of chair ($35 x 2) x 500 $35,000 $135,000 Direct Materials Fabric $3,000 Timber $36,000 Foam $150 Button Stud $450 Varnish $10,000 Bolt $500 $50,100 Total Product Cost $185,100 Unit product cost Direct labor per unit Carpenter wages $175 Staff wages for chair assembling $25 Staff wages for chair varnish $70 $270 Direct materials per unit Fabric $6 Timber $72 Foam $.30 Button Stud $0.90 Varnish $20 Bolt $1 $100.2 Thus, the cost of each 18th century chair equates to $370.2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts